Moody’s expects property/casualty commercial insurance rate hikes to continue for the balance of the year, making 2013 the third straight full year of rising rates for commercial lines carriers, according to a special comment published recently.

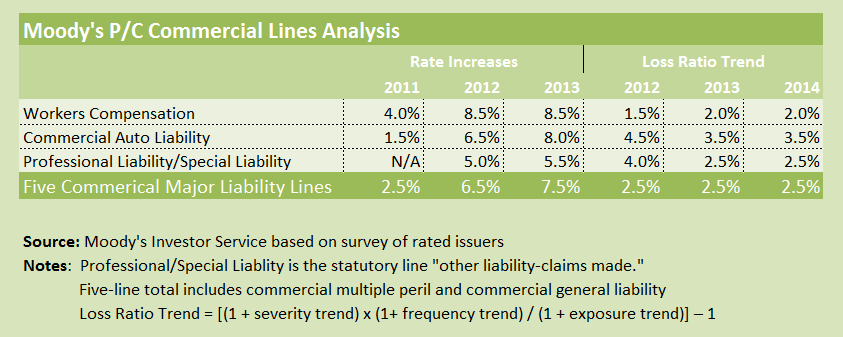

Referring to survey data collected from rated issuers for the workers compensation, commercial general liability, professional liability, commercial auto and commercial multiple peril lines, Moody’s reported that commercial insurers are expecting average rate increases of roughly 7.5 percent for policies written in 2013, up from 6.5 percent for 2012 and 2.5 percent in 2011.

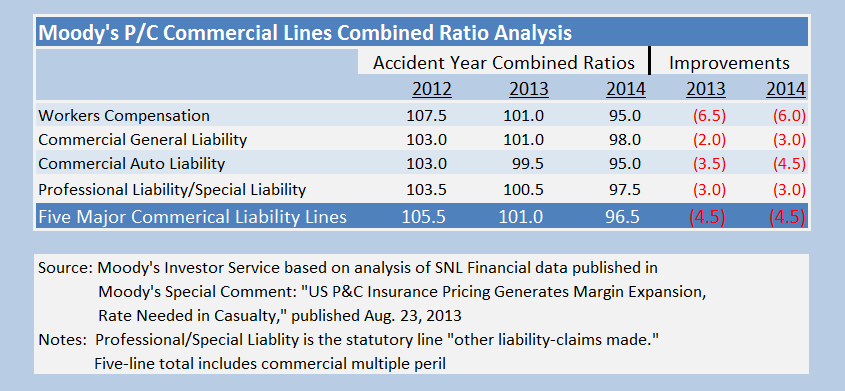

Given the current level of price increases, which are outpacing loss ratio trends, Moody’s forecasts that underwriting margins will also continue to improve, with the industry aggregate commercial lines combined ratio falling to 101 for 2013 and down to 96.5 for 2014. Both figures are substantially better than the 105.5 Moody’s calculated for 2012 based on SNL Financial data.

According to the report authored by Moody’s analyst Jasper Cooper, surveyed companies expect accident-year loss ratio trends to continue at about 2.5 percent in 2013 and 2014—a level similar to 2012.

According to the report authored by Moody’s analyst Jasper Cooper, surveyed companies expect accident-year loss ratio trends to continue at about 2.5 percent in 2013 and 2014—a level similar to 2012.

(Note: Moody’s defines loss ratio trend using the following calculation: [(1 + severity trend) x (1 + frequency trend) / (1 + exposure trend)] – 1. “It can be thought of as the difference between the inflation rate of claims being paid and the inflation rate of the premium exposure base,” the report states.)

Workers Comp Analysis

Particularly striking among Moody’s line-by-line analyses of the combined ratio impacts of price changes relative to loss ratio trends is the degree of improvement indicated for the workers comp line. For workers comp, Moody’s estimates an accident-year 2013 combined ratio coming in just a point above break-even, at 101, compared to 107.5 for 2012 and 118 as recently as 2010. For 2014, Moody’s is projecting an accident-year combined ratio of 95 for the line.

While combined ratios are improving, Moody’s reveals that a number of workers comp carriers are signaling “a moderate decline in risk appetite” for 2013. The Moody’s report suggests that this reduced appetite will push further pricing improvements in 2014 but notes that the appetite decline is not as pronounced as it was during the early part of the last decade.

Operating returns-on-surplus for workers comp are still low relative to target returns, and further rate increases are needed given the line’s sensitivity to low new-money rates and lower reserve releases on older accident years, Moody’s says.

Moody’s estimates that a 101 combined ratio for workers comp for accident-year 2013 would result in a pre-tax operating return-on-surplus of about 8.5 percent (assuming a 3 percent investment yield), while a 95 combined ratio for accident-year 2014 would result in a pre-tax operating return-on-surplus of about 12 percent.

What If Pricing Falls, Investment Rates Change

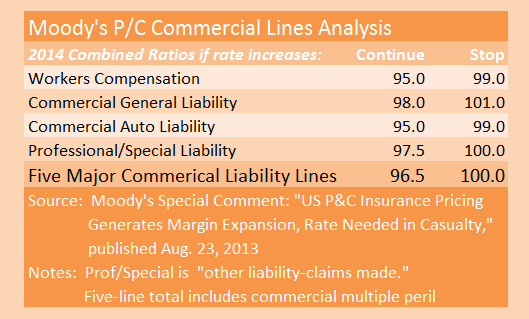

The report, which includes a similar analysis for each of the five major commercial insurance lines, also provides indications of where combined ratios and returns-on-surplus will fall at different prospective investment yield levels and if insurance pricing improvements don’t persist into 2014.

- For workers comp, for example, Moody’s believes that impact of each percentage-point increase in investment yield on operating returns is equivalent to about a 5.5-point decrease in the combined ratio for this line.

- In addition, a 12 percent return-on-surplus—predicted for 2014 assuming a 3 percent investment yield—would jump to 15 percent if the yield is 4 percent and fall to 10 percent for a yield of 2.5 percent.

- Further, if price increases were to stop in 2014, the accident-year 2014 combined ratio for workers comp could come in at 99 rather than the 95 that Moody’s is forecasting under a scenario of continued price improvements.

- For all the commercial lines that Moody’s analyzed taken together, each percentage-point increase in investment yield has the same impact on operating returns as a 5-point decrease in the combined ratio, the report says.

- If price increases fade, then Moody’s analysts predict a break-even 100 aggregate commercial lines accident-year combined ratio for 2014, instead of the 96.5 they predict in a continued favorable pricing environment.

As for 2013, in general, the combined ratio forecasts contained in Moody’s most recent report are better than those that Moody’s analysts predicted in a similar report last year (Commercial Lines Pricing Improving, But More Rate Is Needed, published Sept. 3, 2012).

As for 2013, in general, the combined ratio forecasts contained in Moody’s most recent report are better than those that Moody’s analysts predicted in a similar report last year (Commercial Lines Pricing Improving, But More Rate Is Needed, published Sept. 3, 2012).

In the prior report, Moody’s projected 2013 accident-year combined ratios of 104 for commercial lines overall and for the workers comp line, instead of the 101 predicted now.

Combined ratios for 2012 also came in lower than predicted, with workers comp falling 2.5 points below a previously predicted 110, and the commercial lines total falling 2 points shy of the 107.5 that Moody’s was predicting at this time last year.

Nearly 26.2M Workers Are Expected to Miss Work on Super Bowl Monday

Nearly 26.2M Workers Are Expected to Miss Work on Super Bowl Monday  Winter Storm Fern to Cost $4B to $6.7B in Insured Losses: KCC, Verisk

Winter Storm Fern to Cost $4B to $6.7B in Insured Losses: KCC, Verisk  Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford

Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford  Insurance Groundhogs Warming Up to Market Changes

Insurance Groundhogs Warming Up to Market Changes