A new report this week from the Union of Concerned Scientists, a watchdog group, warns that sea level rise and worsening storm surge are increasing both the risks of flooding in coastal communities and the potential for large costs borne by U.S. taxpayers.

The group’s report, titled “Overwhelming Risk: Rethinking Flood Insurance in a World of Rising Seas,” calls for further reforms to flood and wind insurance programs to discourage risky development and help reduce risk and taxpayer costs.

The report argues the Biggert-Waters Flood Insurance Reform Act doesn’t go far enough to remedy the problem.

Rachel Cleetus, a senior climate economist at the Union of Concerned Scientists and author of the report, says the problem is two-fold.

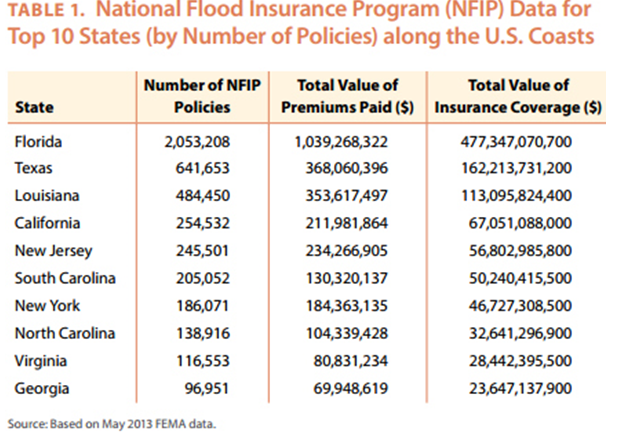

Chart courtesy of Union of Concerned Scientists (www.ucsusa.org)

“The coasts are becoming more populated and built-up, so we have more people and more valuable property in harm’s way,” Cleetus says.

“At the same time, climate change is contributing to sea level rise, generating more intense hurricanes, and causing bigger, more damaging storm surge.”

The result, she argues, is that coastal residents and business owners are at increased risk and taxpayers nationwide are looking at spending more money to help with post-storm rebuilding efforts.

The solution is also two-fold, according to the report. “We need to build resilience along our coasts, including through reforms to insurance programs, and we need to protect the long-term future of our coast by reducing carbon emissions to help slow global warming and sea level rise,” the report’s author says.

The report also criticizes the National Flood Insurance Program’s (NFIP) “perverse” incentives, including artificially low insurance rates and other subsidies.”

The report argues that “a particularly wasteful aspect” of the NFIP program is that it continues to pay out claims on properties in high risk areas that have been repeatedly flooded, with virtually no penalties.

The report says the data from the Federal Emergency Management Agency (FEMA) shows “egregious instances” of repetitive-loss claims along the Gulf coasts of Texas, Louisiana, Mississippi and Alabama, and along many parts of the Atlantic coast, including Florida, North Carolina, New York and Massachusetts.

The report also says the NFIP data shows that although repetitive-loss properties account for just 1.3 percent of overall policies, they have been responsible for 25 percent of all NFIP payments (almost $9 billion) since 1978, and are expected to account for 15 to 20 percent of future NFIP losses.

“Right now, with a few exceptions, we’re doing things exactly like we were before we knew climate change would be giving the coastline a more brutal battering in coming years,” said Cleetus.

“People are continuing to move to the already crowded coasts and we’re often rebuilding flooded properties in the same places and same ways they were built before being hit by storms. Taxpayers are paying for this risky behavior by subsidizing coastal property insurance and funding large payouts for disaster relief when major storms, like Hurricane Sandy, hit.”

A series of major storms dating back to Katrina have left the NFIP more than $20 billion in the red, a number that is likely to reach close to $30 billion after all the claims from Sandy have been settled, according to the report.

Report: Biggert-Waters Act Doesn’t Go Far Enough

The Union of Concerned Scientists says Congress “took a stab at bringing the NFIP into solvency” when it passed the Biggert-Waters Flood Insurance Reform Act last year. The law requires annual increases in insurance rates to gradually bring rates in line with actual risk.

“Because the changes are so overdue, those increases can be large and difficult for some homeowners to handle,” Cleetus says. “Low-income or fixed-income property owners should be assisted through federally-funded insurance vouchers or rebates, which their states could make available.”

The report says these groups are also often the hardest hit by major storms, so it is important to ensure they have adequate insurance coverage and other kinds of disaster assistance.

Biggert-Waters also will phase out subsidies for severe repetitive-loss properties and for some properties that have long benefitted from low “grandfathered” insurance rates.

Grandfathering provisions have allowed properties built to previous standards, or in areas that didn’t have flood maps when originally insured, to maintain their low insurance rates, the report’s author says. “The changes brought about by the law will help, but don’t go far enough.”

Many coastal property owners living in high flood risk areas will see changes in their insurance rates based on the Biggert-Waters Act and new FEMA flood risk maps that are being issued for a number of states, including coastal New Jersey, New York and Louisiana. In some cases these are the first flood risk map updates since 1980.

“It’s good FEMA has updated some of its maps to show how much sea levels have risen and how storm surge, coastal erosion and other factors have changed flood risks since their last maps were issued,” Cleetus says.

“But the new maps do nothing to help communities plan for sea level rise that will occur over the next several decades because they don’t take future projections into account. That’s a huge shortcoming,” she says.

“The Biggert-Waters Act opens the possibility that this could be remedied through a new mapping effort, but that will take time and money that Congress will need to authorize.”

The report also recommends some other practical steps governments can take to help residents and communities be better prepared, including mandating that homeowners disclose flood risks prior to home sales; establishing programs to help low-income residents buy insurance or relocate; and requiring property owners to take protective measures, such as elevating buildings, when areas are rebuilt with taxpayer dollars.

Reforms Needed for Many State-Subsidized Wind Insurance Programs

The report argues that many state-subsidized wind insurance programs also need to be reformed because, like the NFIP, they set artificially low rates that don’t reflect risk and as a result are creating huge financial exposure for state taxpayers.

A study from the Insurance Information Institute shows that nationwide, the value of insurance coverage in these plans grew 1,500 percent from $54.7 billion in 1990 to $884.7 billion in 2011, the Union of Concerned Scientists says.

While several states are taking steps to reduce their financial exposure, they still have a long way to go, the report argues.

The report says that, for example, were a bad storm to hit, the amount of money Florida might have to pay out in claims could bankrupt the state.

A number of other states, including Massachusetts, Louisiana, Alabama, Mississippi, North Carolina, South Carolina, and Texas also offer state-backed insurance plans.

The report says that some states, including Florida and Alabama, are trying to put their insurance programs on more financially sound footing by buying reinsurance and/or issuing catastrophe bonds as a way to transfer some of the risk to the broader capital market.

(Reporter Young Ha is the East Coast editor of Insurance Journal.)

Allianz Built an AI Agent to Train Claims Professionals in Virtual Reality

Allianz Built an AI Agent to Train Claims Professionals in Virtual Reality  Nearly 26.2M Workers Are Expected to Miss Work on Super Bowl Monday

Nearly 26.2M Workers Are Expected to Miss Work on Super Bowl Monday  Retired NASCAR Driver Greg Biffle Wasn’t Piloting Plane Before Deadly Crash

Retired NASCAR Driver Greg Biffle Wasn’t Piloting Plane Before Deadly Crash  RLI Inks 30th Straight Full-Year Underwriting Profit

RLI Inks 30th Straight Full-Year Underwriting Profit