First quarter results for U.S. property/casualty insurers show they made a profit on underwriting for the first time since late 2009.

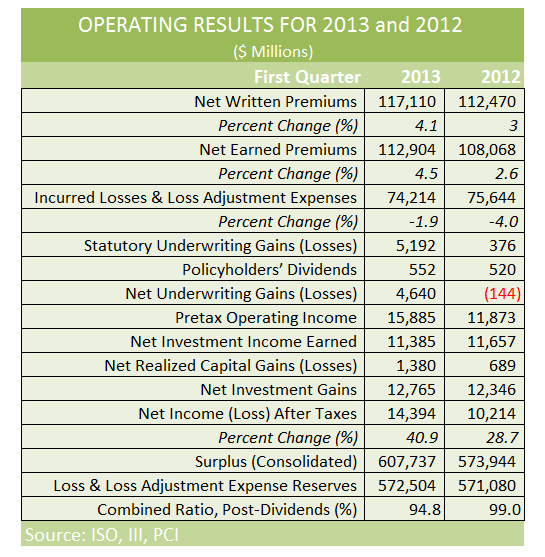

Private U.S. property/casualty insurers’ net income after taxes rose to $14.4 billion in first-quarter 2013 from $10.2 billion in first-quarter 2012, with insurers’ annualized rate of return on average policyholders’ surplus climbing to 9.6 percent from 7.2 percent, according to analytics firm ISO and the Property Casualty Insurers Association of America (PCI).

The increases in insurers’ net income and overall rate of return were driven by a $4.8 billion swing to $4.6 billion in net gains on underwriting in first-quarter 2013 from $0.1 billion in net losses on underwriting in first-quarter 2012.

Insurers’ profits on underwriting, the first since fourth-quarter 2009, reflect a combination of premium growth, increases in reserve releases and a decline in weather-related catastrophe losses.

ISO and PCI said that insurers’ overall results for first-quarter 2013 also benefited from special developments that bolstered investment results. Net investment gains rose $0.4 billion to $12.8 billion in first-quarter 2013 from $12.3 billion in first-quarter 2012 as write-downs on impaired investments dropped. Excluding the decline in write-downs, net investment gains fell $0.2 billion.

ISO and PCI said that insurers’ overall results for first-quarter 2013 also benefited from special developments that bolstered investment results. Net investment gains rose $0.4 billion to $12.8 billion in first-quarter 2013 from $12.3 billion in first-quarter 2012 as write-downs on impaired investments dropped. Excluding the decline in write-downs, net investment gains fell $0.2 billion.

Pretax operating income—the sum of net gains or losses on underwriting, net investment income, and miscellaneous other income—grew to $15.9 billion in first-quarter 2013 from $11.9 billion in first-quarter 2012.

Policyholders’ surplus—insurers’ net worth measured according to Statutory Accounting Principles—increased $20.9 billion to a record-high $607.7 billion at March 31, 2013, from $586.9 billion at December 31, 2012.

The figures are consolidated estimates for all private property/casualty insurers based on reports accounting for at least 96 percent of all business written by private U.S. property/casualty insurers, according to ISO and PCI.

“With government, academic, and commercial forecasters all warning that this year’s hurricane season will be unusually bad, the insurance industry’s record-high $607.7 billion in policyholders’ surplus as of March 31 means that elected officials, regulators, and policyholders can all be confident that insurers have the financial resources necessary to fulfill their obligations—just as insurers did after Katrina, all through the financial crisis of 2008, and are now assisting our nation’s recovery from Sandy,” said Robert Gordon, PCI’s senior vice president for policy development and research.

Gordon said that the $20.9 billion increase in policyholders’ surplus in first-quarter 2013 “underscores that insurers are strong, well capitalized, and well prepared to pay future claims.”

Michael R. Murray, assistant vice president for financial analysis at ISO, said the net gain on underwriting for the first quarter of this year is especially welcome given long-term declines in interest rates.

Underwriting Results

Insurers swung to $4.6 billion in net gains on underwriting in first-quarter 2013 from $0.1 billion in net losses on underwriting in first-quarter 2012 as premiums rose and loss and loss adjustment expenses (LLAE) declined.

Net written premiums increased $4.6 billion, or 4.1 percent, to $117.1 billion in first-quarter 2013 from $112.5 billion in first-quarter 2012 as net earned premiums rose $4.8 billion, or 4.5 percent, to $112.9 billion from $108.1 billion.

Net LLAE dropped $1.4 billion, or 1.9 percent, to $74.2 billion in first-quarter 2013 from $75.6 billion in first-quarter 2012.

The decrease in overall LLAE reflects favorable reserve development and associated reserve releases. Insurers released $5.6 billion from reserves in first-quarter 2013, with reserve releases rising from $3.9 billion in first-quarter 2012.

The decrease in overall LLAE also reflects a decline in catastrophe losses. ISO estimates that private insurers’ net LLAE from catastrophes fell $1.1 billion to $2.3 billion in first-quarter 2013 from $3.4 billion in first-quarter 2012. Those amounts exclude LLAE that emerged after insurers closed their books for each period but do include late-emerging LLAE from events in prior periods. Non-catastrophe net LLAE fell $0.3 billion, or 0.5 percent, to $71.9 billion in first-quarter 2013 from $72.2 billion in first-quarter 2012, and the combined ratio for first-quarter 2013 would have been 95.8 percent if not for the decline in catastrophe losses.

According to ISO’s Property Claim Services (PCS) unit, catastrophes striking the United States in first-quarter 2013 caused $2.6 billion in direct insured losses (before reinsurance recoveries) for all insurers (including residual market insurers, foreign insurers, and foreign reinsurers, but excluding the National Flood Insurance Program and ocean marine losses), down $1 billion compared with the $3.6 billion in first-quarter 2012.

Reflecting the growth in premiums and the decline in LLAE, the combined ratio improved by 4.1 percentage points to 94.8 percent in first-quarter 2013 from 99 percent in first-quarter 2012.

Growth in overall net written premiums accelerated to 4.1 percent in first-quarter 2013 from 3 percent in first-quarter 2012. But growth didn’t accelerate for all sectors of the insurance industry. Murray said that excluding mortgage and financial guaranty insurers, premium growth for insurers writing predominantly commercial lines slowed to 3.2 percent in first-quarter 2013 from 4.3 percent in first-quarter 2012. Conversely, premium growth for insurers writing a more balanced mix of commercial and personal lines climbed to 3.7 percent in first-quarter 2013 from 3.2 percent in first-quarter 2012 as premium growth for insurers writing predominantly personal lines accelerated to 5 percent from 2.5 percent.

“Underwriting results improved for all major sectors of the industry, with results for commercial insurers improving far more than those of other insurers,” said Gordon. “Excluding mortgage and financial guaranty insurers, commercial lines insurers’ combined ratio dropped 6.2 percentage points to 91.1 percent in first-quarter 2013 as balanced insurers’ combined ratio receded 0.7 percentage points to 97.5 percent and personal lines insurers’ combined ratio fell 0.9 percentage points to 96.2 percent.”

Investment Results

Insurers’ net investment income—primarily dividends from stocks and interest on bonds — fell 2.3 percent to $11.4 billion in first-quarter 2013 from $11.7 billion in first-quarter 2012, but insurers’ realized capital gains on investments rose $0.7 billion to $1.4 billion in the first three months of 2013 from $0.7 billion a year earlier. Combining net investment income and realized capital gains, net investment gains increased $0.4 billion, or 3.4 percent, to $12.8 billion for first-quarter 2013 from $12.3 billion for first-quarter 2012.

Combining the $1.4 billion in realized capital gains in first-quarter 2013 with $13.1 billion in unrealized capital gains during the period, insurers posted $14.5 billion in overall capital gains for first-quarter 2013—up $0.1 billion from the $14.4 billion in overall capital gains on investments for first-quarter 2012.

“The decline in insurers’ investment income reflects declines in market yields, with the annualized yield on insurers’ investments falling to 3.3 percent in first-quarter 2013 from 3.5 percent in first-quarter 2012, as the 12-month moving average yield on ten-year U.S. Treasury notes dropped to 1.8 percent from 2.4 percent,” said Gordon. “Insurers’ average holdings of cash and invested assets—the assets on which insurers earn investment income—actually rose 3.9 percent in first-quarter 2013 compared with their level a year earlier. Prospectively, we may see some further weakness in investment income as insurers reinvest funds from older, higher-yielding bonds at the rates now available.”

Source: ISO, PCI

Lessons From 25 Years Leading Accident & Health at Crum & Forster

Lessons From 25 Years Leading Accident & Health at Crum & Forster  Experts Say It’s Difficult to Tie AI to Layoffs

Experts Say It’s Difficult to Tie AI to Layoffs  Nearly 26.2M Workers Are Expected to Miss Work on Super Bowl Monday

Nearly 26.2M Workers Are Expected to Miss Work on Super Bowl Monday  Chubb CEO Greenberg on Personal Insurance Affordability and Data Centers

Chubb CEO Greenberg on Personal Insurance Affordability and Data Centers