The property/casualty insurance industry’s loss reserve position improved in 2012, according to analysts at Conning, who estimate an overall redundancy of 3.3 percent of carried reserves in spite of more than $10.5 billion in reserve takedowns.

The $10.5 billion total level of reserve releases for calendar-year 2012 (relating to prior accident years) includes $1.1 billion of strengthening for guaranty lines, Conning reports. Excluding the financial and mortgage guaranty boost, the total industry takedown is estimated to be $11.6 billion, Conning says, noting that releases were “on par” with 2011.

Commenting on this newfound energy from reserve releases available to continually boost P/C carrier earnings even after the reserve well appears to be dry, Conning Managing Director Stephan Christiansen compares the phenomenon to the oil and gas industry’s discovery of fracking.

“The insurance industry appears to have found the ability to extend earnings support from loss reserve releases beyond where we would have expected this part of the reserve cycle to have been tapped out,” he says in a statement about Conning’s latest reserve analysis.

According to the report titled, “2012 Property-Casualty Loss Reserves: Getting Stronger, or has the Industry Discovered Fracking,” the combination of stronger premium growth and continued slow claims development patterns “suggest that the industry can sustain the current level of releases and not have to reverse direction.”

In fact, “it is possible the reserve picture is on the way to improvement,” the report concludes.

“Reserves appear stronger than a year ago, reversing a trend of declining redundancies since 2009,” adds Steven Webersen, director of research at Conning.

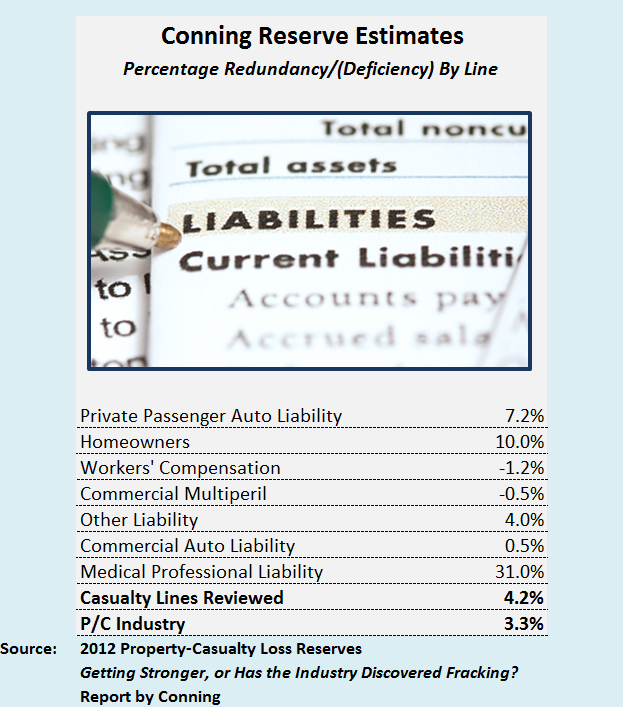

For the reserve study, Conning analyzed seven core casualty lines, finding an overall redundancy of roughly 4.2 percent of carried reserves as of year-end 2012, compared to 2.6 percent for year-end 2011

Commenting on some of the lines individually, the Conning report says that the 7.2 percent redundancy for personal auto is about the same as last year, and that reserves for the line have historically been slightly redundant. This is not the case with the other personal line studied—homeowners—which showed a deficiency as recently as 2009, but now looks to have a 10 percent redundancy.

Commenting on some of the lines individually, the Conning report says that the 7.2 percent redundancy for personal auto is about the same as last year, and that reserves for the line have historically been slightly redundant. This is not the case with the other personal line studied—homeowners—which showed a deficiency as recently as 2009, but now looks to have a 10 percent redundancy.

On the commercial side, two lines showed deficiencies for year-end 2012—workers’ compensation and commercial multiple peril—although the levels of deficiency were much lower than a year earlier.

The workers’ comp position, a 1.2 percent deficiency for 2012, compares to a 6 percent deficiency for 2011.

CMP came in slightly deficient for 2012—improved from an estimated deficiency of 3.7 percent a year earlier.

Of the other commercial lines studied, other liability and commercial auto were the only two showing worsening trends—with lower levels of redundancy estimates for 2012 than 2011. Conning notes that the worsening for other liability appeared to come from the claims-made segment, which is now slightly deficient, while occurrence reserves were estimated to be more redundant in 2012.

The Conning reserve study is based on analysis of Schedule P of the annual statement using data provided by A.M. Best. Schedule P includes 10 years of historical data with analysis of paid losses and reported loss development for the casualty and liability lines.

Reinsurance, property, financial, and combined specialty lines are not included in the study.

The Conning study also does not attempt to estimate ultimate asbestos and environmental losses, but comments on survival ratios (three-year payment to reserve ratios) on a net and direct basis, noting that only the environmental net ratio moved down slightly (from 6.5 in 2011 to 6.1 in 2012), while the others were essentially unchanged.

Source: Conning

20,000 AI Users at Travelers Prep for Innovation 2.0; Claims Call Centers Cut

20,000 AI Users at Travelers Prep for Innovation 2.0; Claims Call Centers Cut  Winter Storm Fern to Cost $4B to $6.7B in Insured Losses: KCC, Verisk

Winter Storm Fern to Cost $4B to $6.7B in Insured Losses: KCC, Verisk  Retired NASCAR Driver Greg Biffle Wasn’t Piloting Plane Before Deadly Crash

Retired NASCAR Driver Greg Biffle Wasn’t Piloting Plane Before Deadly Crash  Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid

Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid