U.S. property/casualty insurers absorbed net insured catastrophe losses of more than $32 billion last year, but still managed to post $33.5 billion in net income in the aggregate—in part because catastrophe losses were lower than in 2011.

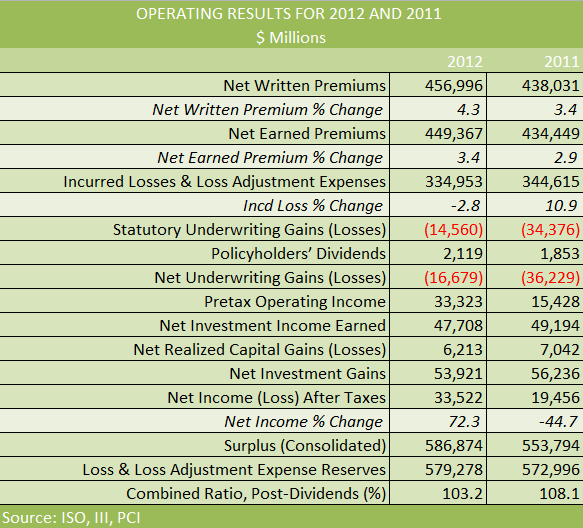

Analysts commenting on the year-end financial results published jointly by ISO, the Property Casualty Insurers Association of America and the Insurance Information Institute, also said the growth in net written premiums (or 4.3 percent in 2012, compared to 3.4 percent in 2011) and a lower level of non-catastrophe losses in 2012 helped boost the bottom line from the $19.5 billion total reported for 2011.

The overall rate of return was still anemic compared to long-term historical averages, according to Michael R. Murray, ISO assistant vice president for financial analysis, who reported that the results for 2012 represent a 5.9 percent overall rate of return.

This is 3 points short of the 8.9 percent average rate of return for the 54 years from the start of ISO’s annual data in 1959 to 2012, Murray said in a statement.

Murray added that with given current levels of investment yields, financial leverage, and tax rates, ISO estimates that the overall industry combined ratio—which came in at 103.2 for 2012—would have to improve by an additional 4.6 points (to 98.6) for insurers to earn their long-term average rate of return.”

According to the ISO/PCI report, the P/C industry’s 5.9 percent rate of return for 2012 was the net result of negative rates of return for mortgage and financial guaranty (M&FG) insurers and single-digit rates of return for other insurers.

ISO estimates that M&FG insurers’ rate of return on average surplus improved to negative 9.3 percent for 2012 from negative 48 percent for 2011. Excluding M&FG insurers, the industry’s rate of return rose to 6.2 percent in 2012 from 4.7 percent in 2011.

“Once again, mortgage and financial guaranty insurers suffered disproportionate losses on underwriting,” said Murray. “Though mortgage and financial guaranty insurers’ combined ratio dropped 67.3 percentage points to 164.9 percent for 2012 from 232.3 percent for 2011, their combined ratio for 2012 was 62.6 percentage points worse than the 102.4 percent combined ratio for the industry excluding mortgage and financial guaranty insurers.”

Losses Decline

The industry report noted that for the industry overall, a 2.8 percent decline in net incurred losses and loss adjustment expenses, was a key contributor to a 4.9-point improvement in the combined ratio—to 103.2 in 2012 from 108.1 in 2011.

The loss and loss expense decline was largely driven by a drop in catastrophe losses, with ISO estimating that private insurers’ net losses from catastrophes fell $5.9 billion—to $32.1 billion in 2012 from $38 billion in 2011.

Non-cat losses and loss adjustment expenses also dropped, falling $3.7 billion, or 1.2 percent, to $302.9 billion in 2012 from $306.6 billion in 2011.

U.S. insurers’ $32.1 billion in net losses and loss expenses from catastrophes in 2012 is primarily attributable to catastrophes that struck the United States. The report notes that U.S. insurers’ net losses from catastrophes overseas dropped to near nil in 2012 from between $4.5 billion and $6.5 billion in 2011.

Within the United States, according to ISO’s Property Claim Services (PCS) unit, based on the information available as of April 23, 2013, 2012 catastrophes caused $35 billion in direct insured property losses (before reinsurance recoveries) for all insurers (including residual market insurers, foreign insurers, and reinsurers, but excluding the National Flood Insurance Program and ocean marine losses)—up $1.3 billion compared with the $33.6 billion in direct insured losses caused by catastrophes striking the United States in 2011 and $11 billion more than the $23.9 billion average for direct catastrophe losses during the past ten years.

Underwriting results for 2012 benefited from $10.2 billion in favorable prior-year loss and loss expense reserve development. The $10.2 billion in favorable reserve development in 2012 follows $11 billion of favorable development in 2011.

In a written commentary released in conjunction with the ISO/PCI report, Robert Hartwig, president of the Insurance Information Institute noted that “stronger top line growth is also now a consistent and meaningful contributor to improved profitability.”

Noting that the jump in net written premiums—4.3 percent in 2012—was nearly a full point above the 3.4 percent gain recorded in 2011, Hartwig noted that the 2012 figure represents “the strongest growth so far recorded in the post-crisis era.” It also exceeded the 4.0 percent nominal rate of growth in the overall economy last year.

“Indeed, net written premiums in 2012 expanded at their fastest pace in nearly a decade,” he said.

“Persistently low interest rates, of course, remain a challenge for the industry, with net investment income slipping by $2.3 billion or 4.1 percent in 2012,” Hartwig added.

Source: ISO, PCI, III

How Americans Are Using AI at Work: Gallup Poll

How Americans Are Using AI at Work: Gallup Poll  Nearly 26.2M Workers Are Expected to Miss Work on Super Bowl Monday

Nearly 26.2M Workers Are Expected to Miss Work on Super Bowl Monday  What Analysts Are Saying About the 2026 P/C Insurance Market

What Analysts Are Saying About the 2026 P/C Insurance Market  Modern Underwriting Technology: Decisive Steps to Successful Implementation

Modern Underwriting Technology: Decisive Steps to Successful Implementation