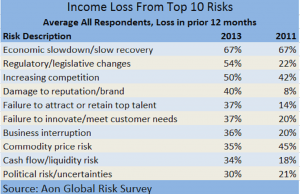

Risk decision makers from 1,400 companies around the globe report that the 10 biggest risks facing their companies wiped away 42 percent of their income, on average, during the last 12 months, a new survey reveals.

The figure, reported in the Aon Global Risk Management Survey, is 14 percentage points higher than the comparable income-loss estimate from the last study published in 2011, the survey report says.

In 2011, the reported loss of income from the top-10 risks was 28 percent. The higher income loss in 2013 may indicate a decline in risk readiness, according to Aon Risk Solutions.

The report reveals that insurers did not do much better than other types of firms—reporting a 41 percent loss of income from the top-10 risks in the 2013 survey, compared to 24 percent in 2011. (For the purposes of the study, insurers are grouped with investment and finance firms.)

Still, the insurers did better than professional services firms, which reported the worst result of any industry group—an income loss of 48 percent from the top-10 risks in the last 12 months. Pharmaceutical showed the biggest decline in readiness between the two survey years—with a 42 percent loss of income reported in 2013, compared to 11 percent in 2011.

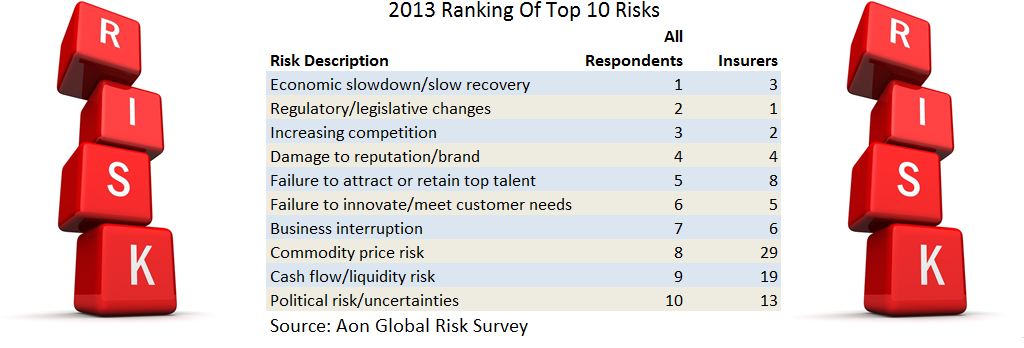

Just what are the 10 biggest risks that caused these losses?

A central focus of the report is the ranking compiled from surveying the 1,415 risk leaders—risk managers, CROs, CFOs, treasurers and other risk professionals—from all types of companies in various geographies. Across all geographies and industries, the ranking is as follows:

- Economic slowdown/slow recovery

- Regulatory/legislative changes

- Increasing competition

- Damage to reputation/brand

- Failure to attract or retain top talent

- Failure to innovate/meet customer needs

- Business interruption

- Commodity price risk

- Cash flow/liquidity risk

- Political risk/uncertainties

Aon reveals that the greatest income loss (67 percent) came from the top-ranked risk—the economic slowdown.

Losses from damage to reputation (ranked No. 4) and regulatory/ legislative changes (ranked No. 2) registered the greatest increases in income losses between the 2011 and 2013 surveys, each rising 32 percentage points

The survey report also reveals that insurance company risk officers were less concerned about some of these top-10 issues than their counterparts in other industries—ranking the economic slowdown third, for example, while putting regulatory risks in the top spot.

The survey report also reveals that insurance company risk officers were less concerned about some of these top-10 issues than their counterparts in other industries—ranking the economic slowdown third, for example, while putting regulatory risks in the top spot.

The chart below shows how insurers ranked the remaining eight issues on Aon’s overall top-10 list.

Looking ahead to 2016, risk managers overall have the same risk picks for the top-three as they do for 2013—economic slowdown/slow recovery as No. 1, regulatory/legislative changes as No. 2 and increasing competition as No. 3. Insurers, however, put the economy first for 2016, regulation second, and then move political risk up to No. 3 in 2016 from a rank of No. 13 in 2013.

Looking ahead to 2016, risk managers overall have the same risk picks for the top-three as they do for 2013—economic slowdown/slow recovery as No. 1, regulatory/legislative changes as No. 2 and increasing competition as No. 3. Insurers, however, put the economy first for 2016, regulation second, and then move political risk up to No. 3 in 2016 from a rank of No. 13 in 2013.

In addition to reporting on income-loss figures, Aon Risk Solutions asked respondents directly to assess their “risk readiness” to respond to the top-10 risk issues, defining “risk readiness” to mean that the company has a comprehensive plan to address risks or has undertaken a formal review of the risks.

On average, reported readiness for the top-10 risks dropped a material 7 percent—to 59 percent in the 2013 survey from 66 percent in 2011, Aon said. For insurers, the skid was similar—falling to 60 percent in 2013 from 68 percent in 2011.

“One possible explanation of the decline in risk readiness could be that the prolonged economic recovery has strained organizations’ resources, thus hampering the abilities to mitigate many of these risks,” said Stephen Cross, chairman of Aon Global Risk Consulting, in a statement. “Our survey revealed that, despite diverse geographies, companies across the globe shared surprisingly similar views on the risks we are facing today—whether or not they feel prepared.”

In a short video analysis of the report on the Aon Risk Solutions website, Theresa Bourdon, group managing director of Aon Risk Consulting, highlighted some risks which didn’t make the top-10 list:

- Social media, which ranked at No. 40;

- Computer crime/ hacking/ viruses, which ranked at No. 18;

- Terrorism, which ranked at No. 46

- Pension scheme funding, at No. 47.

“From our perspective, we thought they should be higher,” Bourdon said, encouraging companies to pay more attention to these underrated risks.

Methodology

Aon Risk Solutions first introduced the Aon Global Risk Management Survey report in 2007. The 2013 report reflects a survey of 1,415 organizations from 70 countries in all regions of the world, which was conducted in 10 languages in the fourth quarter of 2012. The survey is still open to participants.

The report was created to help risk decision makers stay abreast of emerging issues and learn how their industry and regional peers are managing risks and capturing opportunities. The web-based biannual survey addressed both qualitative and quantitative risk issues. Risk managers, CROs, CFOs, treasurers and others provided feedback and insight on their insurance and risk management choices, interests and concerns. All responses for individual organizations are kept confidential; only the consolidated data were incorporated into the report’s findings.

Allianz Built an AI Agent to Train Claims Professionals in Virtual Reality

Allianz Built an AI Agent to Train Claims Professionals in Virtual Reality  20,000 AI Users at Travelers Prep for Innovation 2.0; Claims Call Centers Cut

20,000 AI Users at Travelers Prep for Innovation 2.0; Claims Call Centers Cut  Nearly 26.2M Workers Are Expected to Miss Work on Super Bowl Monday

Nearly 26.2M Workers Are Expected to Miss Work on Super Bowl Monday  Insurance Groundhogs Warming Up to Market Changes

Insurance Groundhogs Warming Up to Market Changes