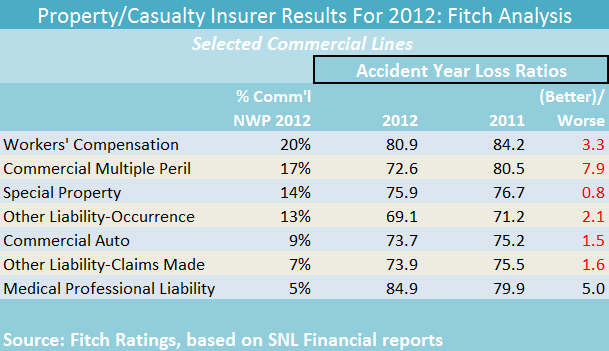

Accident-year loss ratios for all major commercial insurance lines except medical professional liability insurance improved in 2012, but none of them produced an accident-year underwriting profit last year, according to a report published earlier this month by Fitch Ratings.

In a report titled, “Commercial Lines Market Update” report, Fitch analysts describe the stable outlook for the commercial lines sector and provide a line-by-line analysis of the seven largest commercial lines, representing more than 80 percent of the industry’s commercial lines premium volume.

For the largest line of the group—workers’ compensation—the accident-year loss ratio improved 3.3 points to 80.9 in 2012 from 84.2 in 2011. But whiles rates are rising sharply in workers’ comp, premium growth is challenged to keep pace with loss severity, the report said, pointing to higher medical costs as a severity driver.

The smallest commercial line studied by Fitch—medical professional liability—had a 5.0-point deterioration in its accident-year loss ratio in 2012, which rose to 84.9. Fitch notes, however, that there is a potential for accident-year incurred losses in the medical professional line to develop more favorably than other commercial lines segments as loss experience matures.

“This line entered the soft-market phase later than other lines, and is affected by the strong capital and reserve position of [monoline] specialists,” the Fitch report says, noting that medical professional specialists reported better accident-year underwriting margins than the broader commercial lines market from 2004−2010.

A large portion of market share in this line is held by monoline specialists, which substantially expanded their capital bases in the previous hard market and have limited underwriting opportunities outside of the medical professional liability segment. “As such, price competition is currently more intense in medical professional liability, and a market turn does not appear imminent” in this line, Fitch says.

Outlook Stable; Market Turn Takes Hold

For commercial lines outside of the medical professional area, “a market turn is taking hold,” the Fitch report says, highlighting a second year of material premium growth in 2012 and an analysis of recent histories of loss ratios for the major lines indicating that the loss ratios peaked in accident-year 2011.

For all commercial lines taken together, the 2012 accident-year loss ratio was 74.3, representing a 2 point improvement from 2011. (The 74.3 loss ratio for 2012 and all the by-line accident year loss ratios in the report include loss adjustment expenses.) Although that aggregate loss ratio remains 17 points above the previous cyclical best of 2006, Fitch says its outlook for commercial lines is stable, pointing to strong capital levels maintained by most of the commercial insurers in Fitch’s rating universe.

Those capital levels “provide an ability to withstand considerable adversity, including recent above-average catastrophe losses and an extended period of subpar core underwriting results.”

Fitch’s by-line analysis reveals that of the seven major commercial lines, only other-liability occurrence is likely to approach a breakeven combined ratio result for accident-year 2012 when expense ratio data become fully available. Still, all seven lines will likely produce an accident-year underwriting loss, Fitch says.

Examining the last five years of accident-year loss ratios for each line, Fitch notes that the ratios for the other liability-occurrence and claims-made segments have exhibited the least variability. The report suggests that this is explained, in part, by relatively stable litigation and tort claim costs. In addition, for the claims-made segment, losses related to the 2008 credit crisis are proving to be less than initially feared, Fitch says.

Turning to commercial auto liability, which had a 73.7 accident-year loss ratio for 2012, Fitch says that the line’s results have been hindered by slower premium growth relative to other segments, and adversely affected on the loss side by higher costs of bodily injury claims.

The report reviews pricing trends for the major commercial lines based on various market surveys and rating monitors (such as Towers Watson’s Commercial Lines Insurance Pricing Survey and The Council’s quarterly pricing survey), and loss reserve trends in the aggregate and by individual line of business.

In the aggregate, Fitch estimates that prior-year reserve takedowns (the recognition of favorable loss development for prior accident years) improved overall calendar-year 2012 commercial lines underwriting results by 1.6 points. The comparable figure for 2011 was 3.6 points, Fitch says, noting that the 2012 reduction in favorable reserve development is partially explained by unfavorable development in commercial auto and other liability−occurrence lines.

In 2012, reserve boosts for prior accident years added 3.2 points to the commercial auto calendar-year loss ratio and 3.3 points to the other liability-occurrence loss ratio, Fitch says, adding that the other liability development came from old asbestos and environmental claims.

Overall, commercial lines experienced favorable prior-year loss reserve development for the seventh consecutive year in 2012, but reported favorable development is slowing, Fitch concludes.

The workers’ compensation segment developed unfavorably for the fourth consecutive year in 2012 and is likely to continue showing reserve deficiencies going forward, Fitch says.

Insurance Groundhogs Warming Up to Market Changes

Insurance Groundhogs Warming Up to Market Changes  Nearly 26.2M Workers Are Expected to Miss Work on Super Bowl Monday

Nearly 26.2M Workers Are Expected to Miss Work on Super Bowl Monday  Berkshire-owned Utility Urges Oregon Appeals Court to Limit Wildfire Damages

Berkshire-owned Utility Urges Oregon Appeals Court to Limit Wildfire Damages  20,000 AI Users at Travelers Prep for Innovation 2.0; Claims Call Centers Cut

20,000 AI Users at Travelers Prep for Innovation 2.0; Claims Call Centers Cut