The Reinsurance Association of America said a group of 19 U.S.-based property/casualty reinsurers reported higher net written premiums and net income for 2012 compared to 2011.

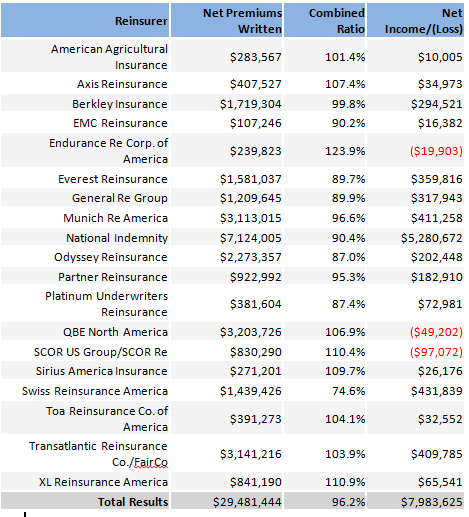

The RAA said Thursday that a survey of statutory underwriting results showed these 19 reinsurers wrote $29.5 billion of net premiums for 2012, up 11.7 percent compared to $26.4 billion for 2011.

The combined ratio for the group was 96.2 for 2012, improving from a 107.2 combined ratio reported for 2011. The combined ratio was attributable to a 66.1 loss ratio and an expense ratio of 30.1. The overall net income for the reinsurers was nearly $8 billion last year, up nearly 20 percent from $6.7 billion in 2011.

The following chart shows statutory results of the 19 reinsurers for the 12 months ended on Dec. 31, 2012, from a survey by the Reinsurance Association of America. (All dollar figures are in thousands.)

This article was originally published on Insurance Journal’s website by IJ’s East Coast Editor Young Ha

Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid

Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid  Nearly 26.2M Workers Are Expected to Miss Work on Super Bowl Monday

Nearly 26.2M Workers Are Expected to Miss Work on Super Bowl Monday  Insurance Groundhogs Warming Up to Market Changes

Insurance Groundhogs Warming Up to Market Changes  RLI Inks 30th Straight Full-Year Underwriting Profit

RLI Inks 30th Straight Full-Year Underwriting Profit