A relative newcomer to the personal lines space—Lemonade—marked a milestone this week, announcing that it surpassed $1 billion of in force premiums, a measure of annualized premiums that the InsurTech tracks on a regular basis.

But the number of renters, pet and auto policies underlying what Lemonade reported to be a 150 percent compound annual premium growth rate over its 8.5 years of existence, still represent just a fraction of those written by longstanding industry giants.

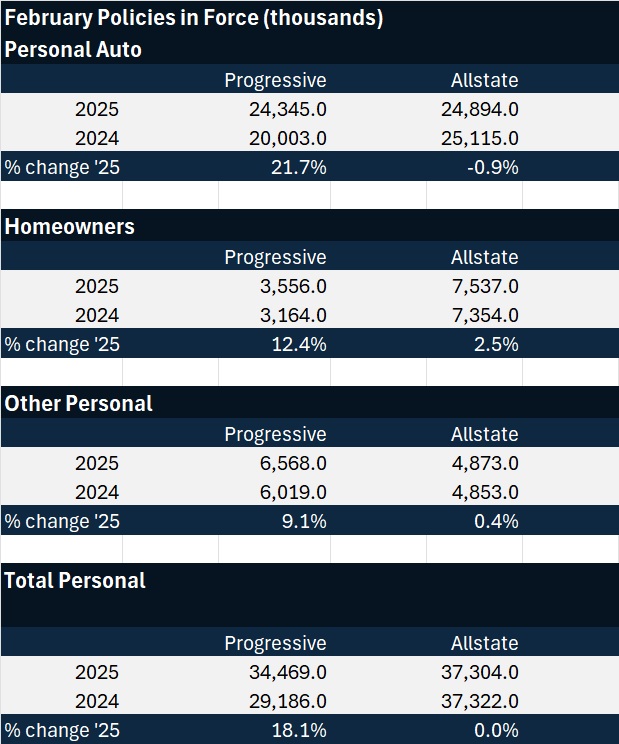

A year-end 2024 shareholder report indicates that Lemonade had 2.3 million customers at the end of December. While the policy counts are unavailable and are likely higher than customer counts for a company that has made the sales of multiple different policies to each customer a core component of its go-forward strategy, it’s still far away from the 34.5 and 37.3 million policies in force that Progressive and Allstate reported as of the end of February.

Executives of all three companies recently gave updates on their growth strategies for 2025, and while the turnaround in personal auto has been the dominant focus of analysts assessing last year’s record earnings for the industry overall, only Progressive’s leaders indicated a full-throttle push for new customers in that line for the coming year. Allstate executives highlighted a focus on retention—keeping the auto customers it already has on the books—and the company’s successful track record in the homeowners business. With its renters book repaired and pet policies continuing to soar, Lemonade is moving cautiously on car insurance as it works to build upon and perfect the model it acquired when it bought Metromile in 2022.

Some takeaways from recent earnings conference calls of all three are summarized in these related articles:

Below is a chart comparing February policy count increases reported by Progressive and Allstate last week.

Featured image: AI-generated image using Adobe Firefly

Insurance Groundhogs Warming Up to Market Changes

Insurance Groundhogs Warming Up to Market Changes  Nearly 26.2M Workers Are Expected to Miss Work on Super Bowl Monday

Nearly 26.2M Workers Are Expected to Miss Work on Super Bowl Monday  Modern Underwriting Technology: Decisive Steps to Successful Implementation

Modern Underwriting Technology: Decisive Steps to Successful Implementation  Berkshire-owned Utility Urges Oregon Appeals Court to Limit Wildfire Damages

Berkshire-owned Utility Urges Oregon Appeals Court to Limit Wildfire Damages