Growth was clearly a theme running through fourth-quarter 2024 conference calls, although the message coming from companies was necessarily more nuanced where growth in homeowners (HO) insurance is concerned.

Executive Summary

Carrier executives are talking about growing personal auto insurance again, and many see packaging auto with homeowners as the smoothest path. But where should they grow homeowners policies?

Assured Research’s William Wilt offers one analysis, intersecting data on housing unit shortages by state with risks to buildings across the 18 perils modeled by FEMA.

The conclusion: Wildfire risk can’t be avoided.

This article was originally published by Assured Research as part of a Feb. 25, 2025 research briefing. It is being republished here with the author’s permission.

The latest briefing also includes an analysis for commercial insurers on the hunt for growing business in the small and middle-market sectors, and discussions of accelerating liability insurance loss severity trends and the sustainability of workers compensation profits, among other topics.

Being bullish on HO is still the exception rather than the rule among insurance executives, although several outlined plans to grow in states outside their current geographic footprint—and all recognize that the road to growing auto insurance is smoother when it can be packaged with HO (umbrella too…but good luck with that). Of course, the news is also filled with stories of insurers that have left (or might leave) states with high risks and regulatory challenges like California.

It was with these dynamics in mind that we thought it could be interesting to examine, first, where the housing unit shortages are thought to be most acute. And next, armed with that information, we intersected housing unit shortages by state with risks to buildings across the 18 perils modeled by FEMA in their National Risk Index (NRI, both aggregated and by peril).

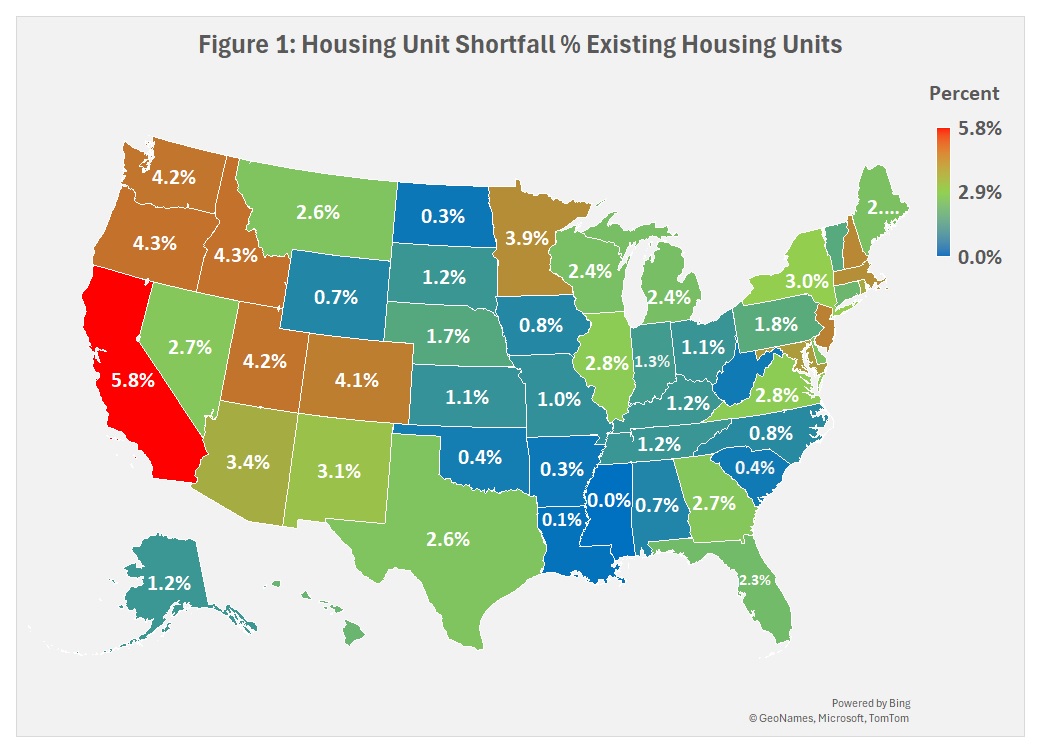

The housing unit shortfall is most acute in the West, followed by the Northeast, and least acute in the Midwest and South—all clearly with some variability within region.

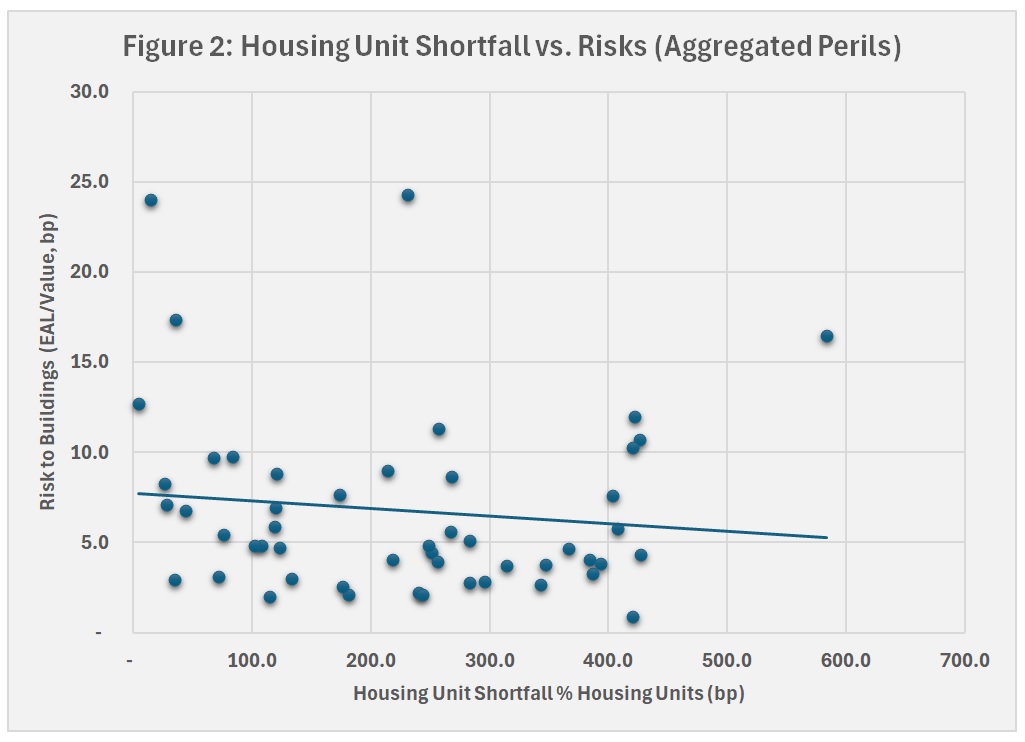

To intersect this data with risks to buildings (both in the aggregate and by peril), we used the “Expected Annual Loss” field from the NRI and expressed it in relation to building values by state. The accompany Figure 2 shows that there isn’t much relationship between aggregated risk from perils captured by the NRI and housing shortfalls.

We take this as generally good news for HO writers, with one interpretation being that a national portfolio that were to grow where the housing shortfall was most acute wouldn’t incrementally add states with outsized catastrophe risks.

Upon closer inspection, however, that observation requires refinement. Even a casual observation of Figure 1 reveals, as noted, that states in the West suffer from higher-than-national average levels of housing shortages. And in the Midwest, the numbers are consistently below average.

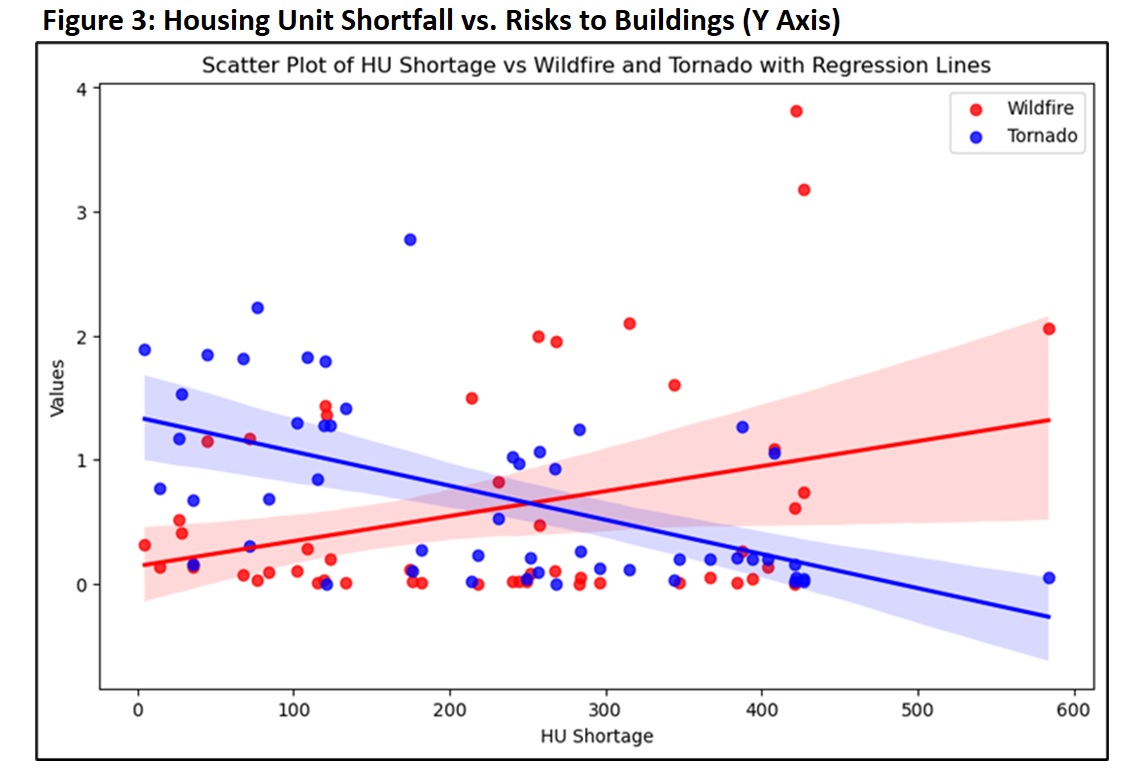

If your insurance mind, like ours, immediately went to wildfire and tornado risks, you’d be right.

In Figure 3, we plot the relationship between the expected annual loss from both perils (in relation to the state’s building values) against the housing unit shortall. The shaded areas represent 95 percent confidence intervals, and it’s easy to see that states with higher housing unit shortages tend to be overexposed to risk from wildfire, whereas the opposite is true for tornado risk.

We examined this relationship across several other perils and can report a positive relationship (as with wildfires) to coastal flooding but a slightly negative relationship (as with tornadoes) to hurricanes and riverine flood.

Obviously, insurers can choose the markets in which they want to compete, but with the nation’s housing inventory only increasing by about 1 percent per annum this century, slightly faster growth seems likely to occur in the states with the largest housing inventory shortfalls. Still, if that is the case, it will be tough for insurers to avoid wildfire risk; a bit easier to temper their exposure to severe convective storms.

Insurance Groundhogs Warming Up to Market Changes

Insurance Groundhogs Warming Up to Market Changes  What Analysts Are Saying About the 2026 P/C Insurance Market

What Analysts Are Saying About the 2026 P/C Insurance Market  Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford

Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford  Retired NASCAR Driver Greg Biffle Wasn’t Piloting Plane Before Deadly Crash

Retired NASCAR Driver Greg Biffle Wasn’t Piloting Plane Before Deadly Crash