European insurers are approaching the new year from a position of strength, having benefited from supportive interest rates and pricing cycles over the past two years.

However, 2025 is expected to present more challenges, with falling yields and moderating premium rates against a backdrop of moderate economic growth, lower interest rates, and rising geopolitical risks.

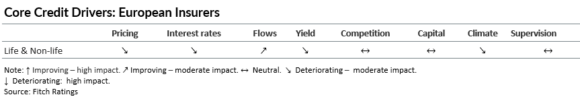

Despite these challenges, Fitch Ratings anticipates resilient operating conditions for European insurers. Core credit drivers have varying trends, but overall, they offset each other, presenting a balanced picture. Therefore, the sector is expected to maintain its strong credit fundamentals in 2025.

Strong 2024 Results

European insurance companies are poised to post robust results in 2024. Underwriting margins have significantly benefited from high interest rates in the life insurance sector and elevated pricing levels in the non-life sector across Europe. Higher returns on investments have further bolstered earnings, enabling insurers to maintain or even enhance their capital adequacy.

Fitch’s country-specific analysis of results and recent market trends, however, highlights the nuances in local market dynamics.

In the non-life sector, premiums have generally risen to offset high claims inflation and reinsurance costs. Price increases in Italy and the UK, where adjustments in personal lines began earlier, were more moderate compared to Germany. Natural catastrophe losses in 2024 varied by country, with Central Europe experiencing substantial flood-related losses. This underscores the increased earnings volatility due to higher reinsurance retention since 2023.

In the UK, life insurers are thriving from the growing demand for profitable pension risk transfers—a trend now emerging in the Netherlands but not yet elsewhere. In Italy, flows to traditional savings products are improving, albeit less markedly in France, due to the reduced appeal of alternative non-insurance offerings. Conversely, Germany continues to see weak flows from single premium business.

‘Neutral’ 2025 Outlook for European Insurance

Fitch’s outlook for the European insurance sector remains “neutral” for 2025. This forward-looking assessment indicates that Fitch expects the underlying operational and business conditions to remain mostly unchanged compared to the previous year.

Several factors drive this assessment. Non-life insurers’ underlying margins should remain fairly stable in 2025. Lower claims inflation is expected to be balanced by moderating premium rates, while price increases should keep pace with loss cost trends. Prudent reserving will help manage earnings volatility from unexpected loss events.

In the UK, life insurers are thriving from the growing demand for profitable pension risk transfers—a trend now emerging in the Netherlands but not yet elsewhere. In Italy, flows to traditional savings products are improving, albeit less markedly in France, due to the reduced appeal of alternative non-insurance offerings. Conversely, Germany continues to see weak flows from single premium business.

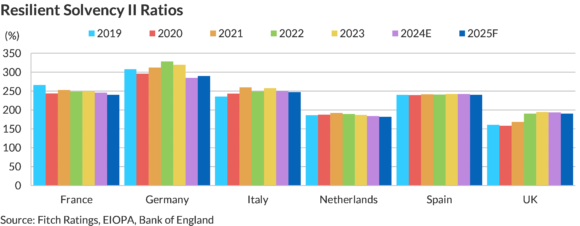

We forecast that capitalization across the European insurance industry will stay very strong, supported by sound profitability and measures taken in recent years to reduce the duration gap and hence, sensitivity to falling interest rates. We therefore expect a mild deterioration in solvency ratios in most European countries, assuming that earnings generation will be strong enough to mitigate a slightly negative effect from falling interest rate and stable capital deployment / repatriation.

Lastly, balance sheets are sufficiently liquid to cover rising cash outflows without incurring significant investment losses.

The outlooks for individual countries and underlying sectors are also “neutral,” with two exceptions. The German non-life sector outlook is “improving” owing to strong pricing momentum that should enhance profitability. At the same time, the Italian life sector outlook is “improving” due to expected recovery in net flows from lower lapse rates and higher new business volumes.

Margin Expansion Constrained in Non-Life

Fitch believes most European non-life insurers will be able to raise tariffs in 2025 to offset claims inflation and high reinsurance costs, but not enough to significantly grow underwriting margins. Instead, insurers are likely to focus on improving the quality of their books and cutting expenses, while continuing to benefit from past tariff increases. The discounting of claims reserves under IFRS 17 will provide less of a boost but will not undermine underwriting profitability.

European non-life insurers face increased earnings volatility due to higher retention of climate risk, as reinsurers remain cautious on secondary peril exposure. The ability to price, size, and reinsure climate-related risks will differentiate underwriting earnings among primary insurers.

State-owned entities in Spain (El Consorcio de Compensacion de Seguros) and France (Caisse Centrale de Réassurance) absorb much of the natural catastrophe losses, partly shielding primary insurers from these risks. Germany lacks such a scheme and Italy is developing a scheme for mandatory insurance for small and medium-sized enterprises.

Spain’s Record-Breaking Floods Push Insured Losses Above €4 Billion ($4.2 Billion)

Fitch views government-backed insurance schemes like those in Spain and France as credit positive for insurers, and the role of such schemes will increase with the frequency and severity of natural disasters. Climate change will drive higher demand for property coverage.

Robust Life Premium Growth

Reinvestment yields are expected to remain above average portfolio running yields, supporting technical margins on general accounts’ reserves: the long duration of life investment portfolios (7-9 years) and Fitch’s forecast for robust premium growth and low lapse rates mean that cash flows are (re)invested at higher yields than the recurring asset yield, supporting earnings growth.

However, we anticipate that most insurers will have captured the majority of benefits from rising yields by the end of 2025. The ongoing shift to and demand for capital-light, unit-linked products will continue to support steady fee income although rising market volatility could dampen demand for unit-linked products.

We forecast robust growth in new business sales as life insurance products remain attractive due to elevated yields or, in Italy’s case, falling government bond yields enhancing the value of traditional life insurance products. Structural drivers, such as increased demand for defined contribution pensions in the UK and the Netherlands, and retirement products in France and Italy, will further boost growth in 2025 and beyond.

Downside Investment Risks Magnified

Rising default rates or falling asset values could erode capital buffers and earnings in extreme scenarios, although some losses can be shared with life policyholders in most European countries. Allocations to alternative asset classes such as real estate, private loans, mortgages, infrastructure, and private debt increased substantially over the past decade, in an effort to reduce balance sheet sensitivity to interest rates and equity markets.

The risk from growing exposure to riskier assets is mitigated by the long-term, illiquid nature of the liabilities these assets back (for example, annuity or pension risk transfer business in the UK or the Netherlands) or the ability to share some losses with life participating products’ policyholders. While benign credit conditions should support life insurers’ concentration in real estate, private loans, and mortgages, infrastructure and private debt pose potential risks.

Regulatory Oversight Strengthens Resiliency, Boosts Expenses

Fitch expects conduct risk to remain on regulators’ agendas, particularly in the UK, where investigations in motor-related lines and funded reinsurance are ongoing. In Europe, the forthcoming enforcement of the Insurance Recovery and Resolution Directive in 2026 will establish a uniform cross-border regulation for large insurers under stress. Solvency II, despite its benefits, does not eliminate the risk of insurance companies experiencing financial distress. The directive mandates large insurers to develop pre-emptive recovery plans but it does not legislate for the build-up of bail in-able bonds.

While increased regulatory oversight should strengthen the sector’s resilience, compliance costs are expected to remain high. Most European insurers have transitioned to IFRS 17, bringing stability through increased transparency and comparability, which supports investor confidence.

Overall, while 2025 presents new risks and challenges, notably falling yields and moderating premium growth, the European insurance sector is well-positioned to navigate them, maintaining strong credit fundamentals, notably stable earnings and capital adequacy.

Rating Outlooks Predominately Stable

Around 85 percent of Fitch-rated European insurance groups have stable outlooks. This reflects Fitch’s expectations for financial metrics to remain broadly stable and within Fitch’s rating sensitivities for most European insurers. Higher earnings and stronger capital positions resulted in more upgrades than downgrades in 2024, with IFRS 17 accounting providing more insight on insurers’ capital strength.

This article was previously published by Insurance Journal.

Preparing for an AI Native Future

Preparing for an AI Native Future  Nearly 26.2M Workers Are Expected to Miss Work on Super Bowl Monday

Nearly 26.2M Workers Are Expected to Miss Work on Super Bowl Monday  Winter Storm Fern to Cost $4B to $6.7B in Insured Losses: KCC, Verisk

Winter Storm Fern to Cost $4B to $6.7B in Insured Losses: KCC, Verisk  Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford

Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford