There is no doubt the auto insurance industry is in a state of flux. Rising repair costs, poor driving behavior and advancing auto technology has disrupted the market, and there are no signs it will change anytime soon.

Executive Summary

Concerning trends in commercial auto make it urgent for insurers to embrace technology that will decrease accidents and make insurance pricing more commensurate with evolving risk, the head of Waymo’s Risk and Insurance practice told Carrier Management. Here, Tilia Gode and several other experts weigh in on the benefits and challenges ahead for auto insurers looking out at a landscape that includes, autonomous vehicles, OEMs distributing insurance and wider use of telematics data.Last year, a report by Ernst & Young indicated the disruption is expected to last a decade and will challenge legacy models as customer appetites and mobility trends evolve, and as telematics alter the auto insurance landscape.

The authors of the report, Martin Spit, principal EY-Parthenon, Ernst & Young LLP US and EY Americas Insurance Strategy and Transactions Leader, and Sulait Das, senior director, Americas Financial Services Strategy, EY-Parthenon, Ernst & Young LLP, wrote that by 2035, the changes will shrink the market by 31 percent, inviting new competition while changing how insurance is distributed, underwritten and serviced.

Competition will come “from non-carriers, including auto original equipment manufacturers (OEMs), eager to leverage vehicle telematics data and their access to car-buying customers to capture new revenue streams,” the EY authors added.

“The emergence of technologies like autonomous vehicles is ushering in a new era of data-driven insights for the insurance industry,” said Tilia Gode, Waymo’s head of Risk and Insurance.

Carrier with the ability to adapt to autonomous and artificial intelligence-enhanced vehicles and telematics data collection will remain competitive as the market reinvents itself. But many remain unprepared, Das and Spit explained, indicating that legacy distribution networks and policy administration systems could bog down “the ability to incorporate mobility trends, EV- and AV-based risk, repairability and safety projections, and telematics data into their underwriting engines.”

Small and midsize carriers may struggle to retain market share, leading to more consolidations, they added.

“Incumbent carriers, InsurTech firms and other mobility ecosystem participants could capitalize on the disruption with strategic investments to add scale, capabilities or market share,” Das and Spit added. To embrace this auto insurance revolution, they recommend carriers take a proactive approach building distribution partnerships.

Autonomous Vehicles and Artificial Intelligence

There are six levels of autonomous vehicles, according to the Society of Automotive Engineers.

- Level 0 – no driving automation

- Level 1 – driver assistance

- Level 2 – partial driving automation

- Level 3 – conditional driving automation

- Level 4 – high driving automation

- Level 5 – full driving automation

A majority of vehicles on the road already have AI-powered advanced driving systems like automatic braking and lane departure warnings.

“I look at it as a continuum that started with things like cruise control up to things we have today like the adaptive cruise control, emergency braking front and rear, the cameras, the sensors, and theoretically you could get to full self-driving someday,” said Bob Passmore, vice president of auto and claims policy for the American Property Casualty Insurance Association (APCIA).

As more AI-enhanced vehicles and AVs take the road, it’s expected that carriers will see a reduction in losses.

Das and Spit indicate that as Level 3 and 4 AVs become commercialized, accident rates will decline by 2 percent. Personal auto loss ratios will also drop, and direct premiums written will decline by 9 percent, they say.

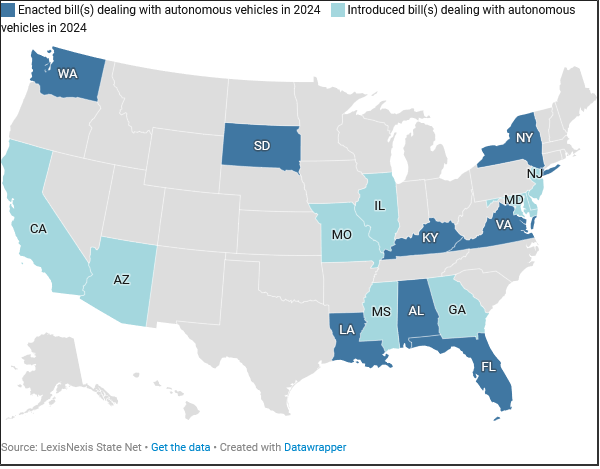

As vehicles progress through the various stages, state lawmakers are making changes, too. More than 70 AV-related legislation bills have been introduced in 17 states. Most of the bills focus on insurance requirements, with nine having been enacted, according to a September 2024 LexisNexis report. The emerging laws, however, may not only impact how AVs are insured but also, in the case of an accident, how fault is determined.

The shift in risk from driver to technology hampers the ability to answer who is at fault and the question becomes increasingly difficult to answer when there are more parties—such as the manufacturer, software developer, programmers, satellite mapping companies and even state government—to consider.

“Autonomous vehicles are no longer a futuristic idea; they are already here.”

“Autonomous vehicles are no longer a futuristic idea; they are already here.”

Tilia Gode, Waymo

Insurance policies may be adjusted to address auto manufacturer and software developer liability, LexisNexis noted.

In the future, state versus federal regulation may come into play.

“Regulatory fragmentation presents a challenge,” said Waymo’s Gode. “The regulatory landscape for both autonomous vehicle operation and insurance is incredibly complex and varies significantly from region to region.”

Insurance for Waymo One, the fully autonomous ride-hailing service, operates much like it does for human-driven commercial fleets, Gode explained.

Waymo’s insurance provides coverage for the Waymo Driver and passengers, she said. “But looking ahead, we envision a future where this data, combined with our commitment to safety, allows us to significantly decrease accidents and make insurance pricing much more accurate and commensurable with the risk itself.”

“Autonomous vehicles are no longer a futuristic idea; they are already here,” added Gode.

A wait-and-see approach is no longer a viable strategy, the Waymo head of Risk and Insurance said. “Insurers need to proactively deepen their knowledge of this technology or risk missing the boat. The concerning trends in commercial auto make this even more urgent. Autonomous vehicles offer a potential solution, but only if insurers are ready to embrace the technology and collaborate to ensure its success,” said Gode.

“Things like automatic emergency braking and lane keeping assistance…can help keep you out of crashes. But if there is a crash or if the car is damaged, it becomes a lot more expensive to repair.”

“Things like automatic emergency braking and lane keeping assistance…can help keep you out of crashes. But if there is a crash or if the car is damaged, it becomes a lot more expensive to repair.”

Bob Passmore, American Property Casualty Insurance Association

Developed over a 15-year time period, Waymo’s technology now provides over 100,000 rides per week to the public across San Francisco, Phoenix and Los Angeles, she said.

“While the potential benefits of autonomous vehicles are immense, there are a few drawbacks from an insurance perspective that need to be addressed, she added.

As an actuary, she sees two key challenges.

“First, traditional actuarial models, which are largely based on human driving behavior and historical accident patterns, don’t directly apply to autonomous vehicles,” Gode explained.

As such, the actuary indicated new methodologies to accurately assess risk and determine appropriate pricing for this emerging technology need to be developed.

The second challenge, she said, is that despite evidence highlighting the risk reduction connected to autonomous vehicle technology, the insurance industry has been slow to respond given its typically conservative nature.

Gode said Waymo is sharing insights to help insurers “develop robust and accurate insurance models that reflect the novel risk profile of autonomous driving technology.”

“We believe that collaboration and transparency are crucial for the successful integration of autonomous vehicles into the broader transportation ecosystem,” she added.

Overwhelmed by Data

Telematics data continues to represent another disrupter, moving auto insurers in the direction of using individual driver’s habits to impact their insurance costs.

“Traditionally, insurers relied on demographic data, historical accident statistics and vehicle types to determine rates. Telematics allows insurers to collect real-time data on individual driving behaviors and apply the data to both personal and commercial auto policies,” wrote Christopher DiDonato, vice president, Property Casualty at insurance broker Holmes Murphy, in a blog post last month. “This shift toward usage-based insurance (UBI) is making auto insurance more reflective of actual driving behavior,” he added.

The benefits of telematics are many, according to David Moran, vice president of TPA Services for professional and technology firm Davies. Everything from real-time crash data reporting to fraud prevention to driver behavior and assessment.

This wealth of information, Gode said, “holds immense potential for making automobile insurance a more predictable risk.”

Still, she warned the data explosion could cloud carriers’ judgment.

“It’s crucial to remember the fundamentals of ratemaking and be selective about what data we use. Not all data is created equal. The industry needs to avoid a ‘data land grab’ and thoughtfully identify the most relevant data points for assessing risk and predicting claims,” said Gode. “Traditional claims data, or in the case of Waymo, the lack thereof, should still play a fundamental role in understanding risk exposure.”

Other issues include data privacy and protection and fragmented data issues, Moran explained.

Determining when data collection becomes an invasion of privacy is a concern for fleet managers where trackers continue recording data after work hours are complete.

Technical glitches or issues where data collection between a vehicle and the user platform is interrupted are of equal importance when interpreting data garnered through telematics.

While carriers grapple with the changes needed to remain competitive in the market, privacy surrounding customer data is a primary concern.

Fleet telematics adds an additional layer of complexity for carriers weighing who is responsible for making the decision, as well as when to make that call, that a driver may be operating a vehicle in an unsafe manner. That’s because one or the other—insurance carrier or fleet manager—could be held accountable for not making the decision sooner.

The Nuances of Claims Handling Will Change

The ability to monitor vehicles and data in the future will undoubtedly inform policy and claims decisions. Where once human behavior was considered the cause of nearly 94 percent of accidents, drivers can now blame their car’s technology.

While beneficial at providing much data in the event of a crash, the advanced technology requires additional experts and even experienced ADAS attorneys to extract, understand and handle litigation involving the advanced technology.

“Insurers absolutely need to be proactive in understanding and adapting to emerging vehicle technology,” said Gode.

The unfortunate nature of litigation and the growth of third-party litigation funding means carriers, especially those insuring fleets, will need to be on top of their game when it comes to managing claims.

The detailed data captured via telematics, AV and ADAS vehicles will help record events, said Gode, “ensuring transparency in claims adjudication, minimizing fraud and reducing litigation.”

“The data we see so far underscores the transformative potential of autonomous vehicles and highlights the need for the insurance industry to help support this technology to create a safer and more efficient future for transportation,” Gode explained.

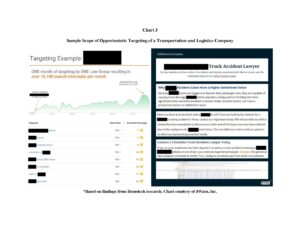

While rising litigation costs affect both personal and commercial auto lines, there is evidence that fleet operations are being targeted aggressively by plaintiffs’ counsel. Third-party investment funding by private equity firms that have no direct involvement in litigated claims has spurred a whole new tech-enabled claims litigation platform. (See related article, “Fleets Targeted in High-Tech Claims Scheme.”) That trend could worsen as advanced technology in cars offers the investment firms an opportunity for a bigger payout thanks to the involvement of OEM manufacturers and software developers.

Right now, Passmore believes the greater claims impact of technology on stems from higher repair costs of increasingly advance vehicle systems. “Those kinds of features are becoming more and more common in vehicles. Things like automatic emergency braking and lane keeping assistance…can help keep you out of crashes. But if there is a crash or if the car is damaged, it becomes a lot more expensive to repair.”

Beyond the repair costs associated with advanced auto technology, insurers will see more costs ahead, according to Passmore. The specialized nature of the technology and data means that finding the right experts to evaluate losses will lead to higher expenses. The required analysis could also result in a delay, leading to a lower claims closure rate and longer open reserves.

Despite this, experts say the technology and data will lead to the creation of new coverages and opportunities for carriers willing to embrace a new auto insurance market.

***

Claims was the focus of Carrier Management’s final print issue, including articles on social inflation, litigation funding, Generative AI, the future of auto insurance and more.

Claims was the focus of Carrier Management’s final print issue, including articles on social inflation, litigation funding, Generative AI, the future of auto insurance and more.

- Having It Both Ways

- Generative AI: A Double Agent Serving Good and Evil in the World of Claims

- Claims Satisfaction Leaders Reveal Secrets to Success

Those articles are featured in CM’s fourth-quarter magazine, “Unite and Conquer: Industry Battles Social Inflation.” (Download a PDF for free access to all articles in the magazine or become a Carrier Management member to unlock every feature article we publish.)

What Analysts Are Saying About the 2026 P/C Insurance Market

What Analysts Are Saying About the 2026 P/C Insurance Market  Experts Say It’s Difficult to Tie AI to Layoffs

Experts Say It’s Difficult to Tie AI to Layoffs  Nearly 26.2M Workers Are Expected to Miss Work on Super Bowl Monday

Nearly 26.2M Workers Are Expected to Miss Work on Super Bowl Monday  RLI Inks 30th Straight Full-Year Underwriting Profit

RLI Inks 30th Straight Full-Year Underwriting Profit