Over the past few decades, the insurance industry has focused on the digital transformation of its operations to keep pace with rapid technological developments. Technology innovation has had a parallel effect on insurance fraud for property and casualty claims, which has become more sophisticated and increasingly harder to detect. The survey Verisk conducted at the 2024 Insurance Fraud Management (IFM) Conference revealed valuable insights into insurance professionals’ concerns, and highlighted rising digital fraud as a top concern—and how they plan to address the challenge.

Executive Summary

“Claims investigators must now add ‘verifying the authenticity of digital evidence’ to their task list and develop the skills and technology to do so,” writes Verisk’s Shane Riedman.This article is the third in his series examining the pressing issues confronting SIU decision-makers and the transformative potential of emerging technologies.

The Rise of Digital Media Fraud

Image and document manipulation have become some of the top weapons in the fraudster’s arsenal. With readily available software and techniques powered by AI, bad actors can now alter photos and documents with alarming ease. Deepfakes—hyper-realistic video and audio manipulations—further complicate fraud detection.

In one case reported in California, a claimant downloaded images of injuries from a hospital website and submitted them as evidence of her claim—to several different carriers. Elsewhere, criminals have used photo-editing software to manipulate documents and images to fabricate or inflate damages or even create fake claims altogether.

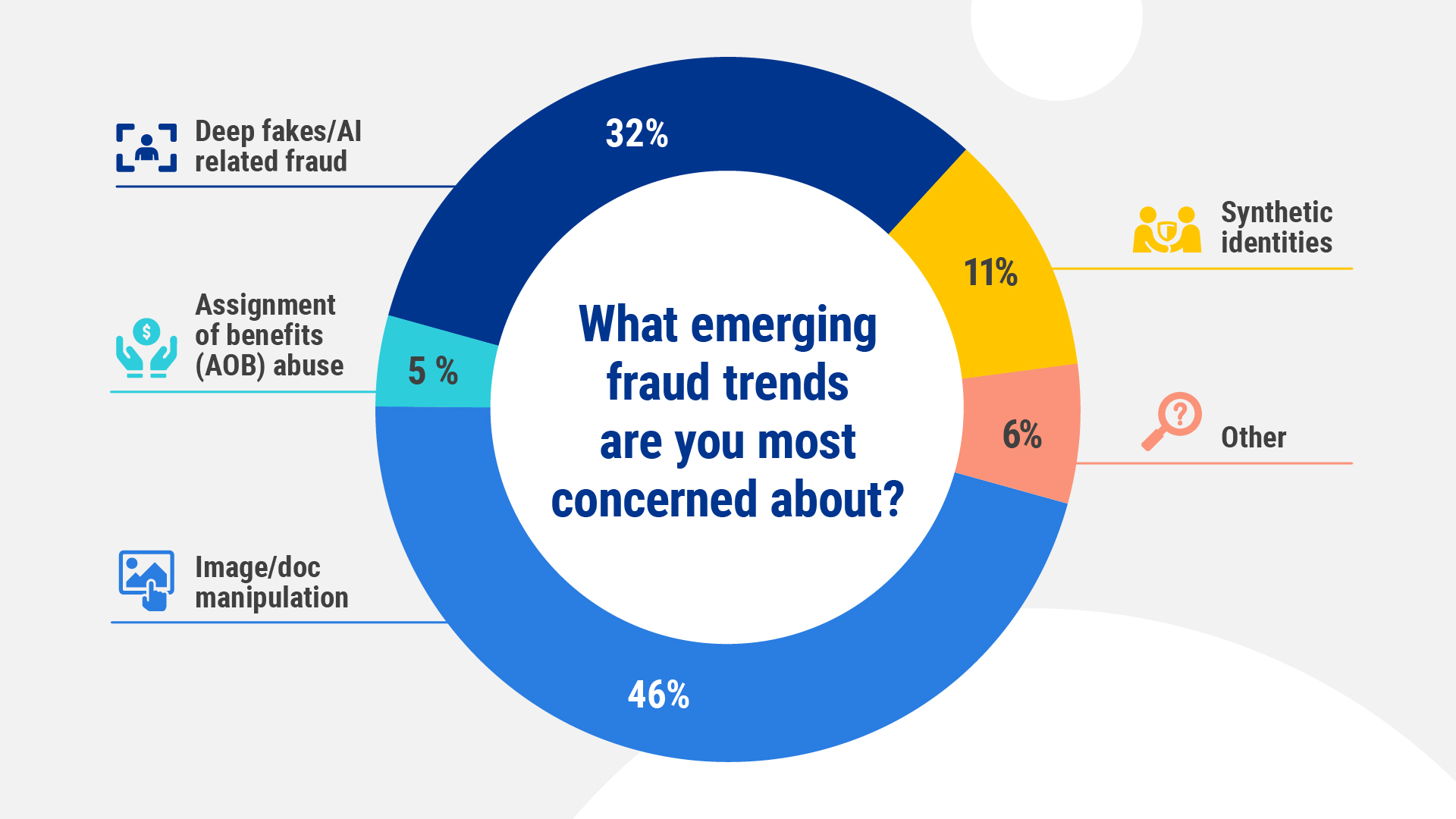

SIU leaders are not blind to the challenges of digital media fraud. When asked to pick the emerging challenge that worried them most:

- 46 percent of respondents cited image and document manipulation as their main concern.

- 32 percent pointed to deepfakes and AI-related fraud as their primary worry.

Combined, these items account for 78 percent of the top emerging fraud concerns in the industry.

The increasing prevalence and complexity of digital fraud create large-scale challenges for insurers. Claims investigators must now add “verifying the authenticity of digital evidence” to their task list and develop the skills and technology to do so. The challenge is further compounded by the rapid pace of technological advancement, which often outstrips insurers’ ability to adapt.

The Tools to Combat Digital Media Fraud

To combat these emerging threats, insurers will need technologies as robust and adaptable as the fraudsters’ tactics to augment claims and SIU departments’ capabilities. Technologies such as AI and predictive analytics can help identify patterns and anomalies that may indicate fraud. Digital tools that detect manipulated images and documents have become essential to many insurers.

Such tools can include:

- Pixel manipulation detection, using machine learning and AI to identify different pixel patterns in manipulated portions of images.

- PDF manipulation check to find overlapping text edits in altered PDFs.

- Internet duplication checks, which search the Internet for existing images and documents.

- Metadata check, comparing image and document metadata to ensure data aligns with details within the claim

The Race to Stay Ahead of Digital Media Fraud

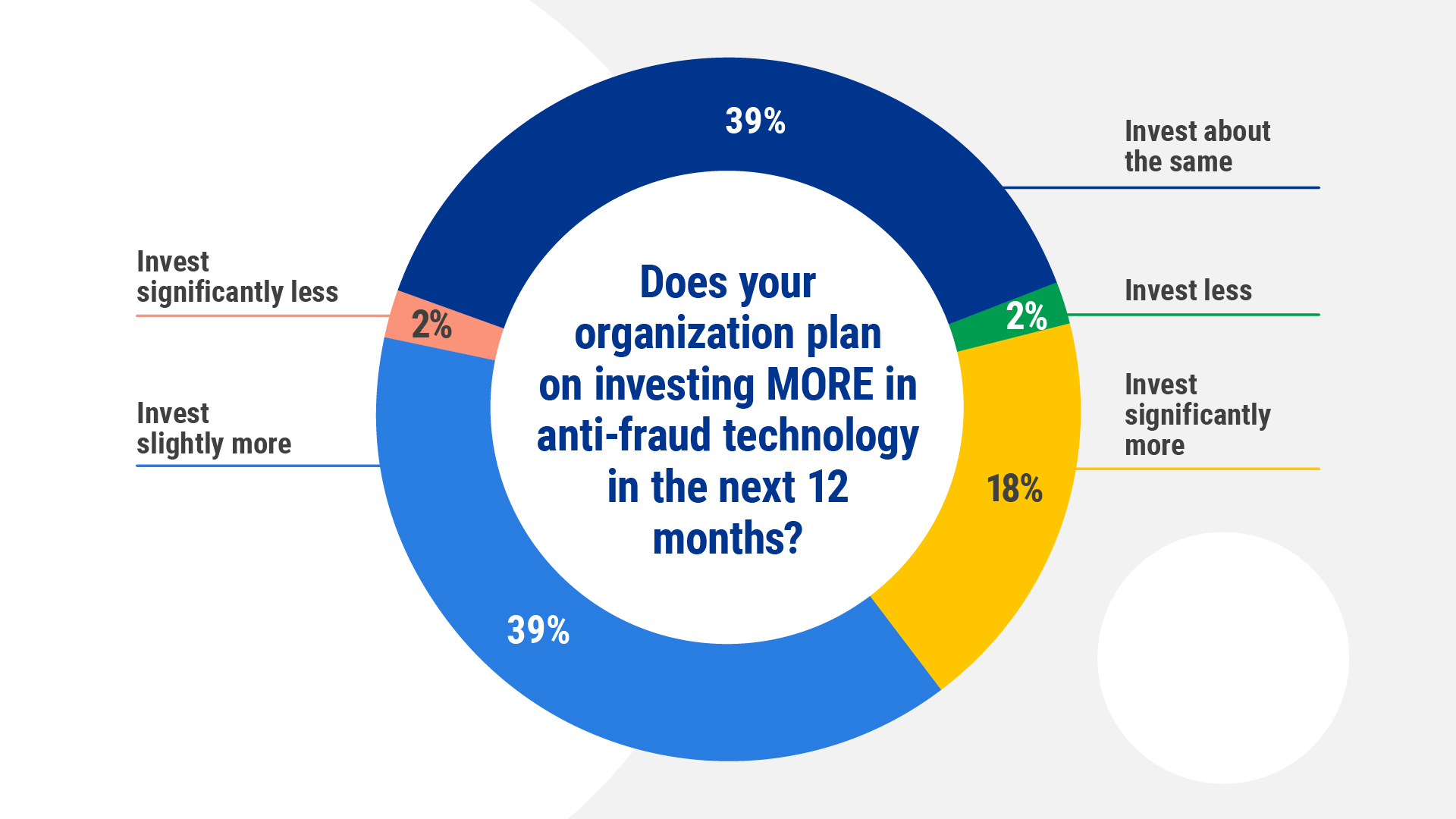

Verisk’s 2024 IFM Conference survey also revealed that the industry recognizes the importance of staying ahead of fraud. An overwhelming 96 percent of respondents plan to maintain or increase their investment in anti-fraud technology over the next 12 months.

This proactive approach to fraud prevention has many benefits that can unlock value throughout the claims journey:

- Reduced claims leakage

- Improved loss ratios

- Enhanced productivity and efficiency

- Increased time for SIU investigators to focus on complex cases

- Expedited straight-through processing

As digital fraud techniques evolve, insurers face pressure to evaluate and upgrade their anti-fraud capabilities. By investing in advanced anti-fraud technologies, insurers can protect themselves and their honest customers from the financial impact of fraud.

Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid

Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid  Modern Underwriting Technology: Decisive Steps to Successful Implementation

Modern Underwriting Technology: Decisive Steps to Successful Implementation  Execs, Risk Experts on Edge: Geopolitical Risks Top ‘Turbulent’ Outlook

Execs, Risk Experts on Edge: Geopolitical Risks Top ‘Turbulent’ Outlook  AIG, Chubb Can’t Use ‘Bump-Up’ Provision in D&O Policy to Avoid Coverage

AIG, Chubb Can’t Use ‘Bump-Up’ Provision in D&O Policy to Avoid Coverage