The property/casualty insurance industry faces a critical staffing challenge when it comes to uncovering fraud in claims, while also enabling swift claim processing to meet customer expectations. With more than 4.1 million Americans turning 65 every year from 2024 through 2027, a significant portion of the industry’s most experienced fraud investigators and SIU professionals will retire.

Executive Summary

This article is the second in a series examining the pressing issues confronting SIU decision-makers and the transformative potential of emerging technologies.As these seasoned experts retire, insurers face a growing challenge in attracting and training new talent to fill the widening skills gap. In our recent survey of SIU decision-makers, 25 percent of these leaders ranked the talent shortage as their most pressing concern.

Training to Meet a Growing Threat

Developing skilled fraud investigators requires comprehensive training alongside extensive hands-on experience—something that can take years. Yet many insurers lack the time and resources to provide adequate training, especially as they grapple with workforce constraints and budgetary pressures.

On top of that, SIU teams must contend with increasingly sophisticated fraud tactics. Advanced schemes such as digital forgeries, synthetic identities and large-scale fraud rings cause potential fraud cases to escalate rapidly, adding further strain on already overburdened SIU teams.

Most insurers recognize the need to evolve their approach to fraud detection and investigation. This is where digital transformation can help bridge the talent divide.

Committing to Anti-Fraud Technology

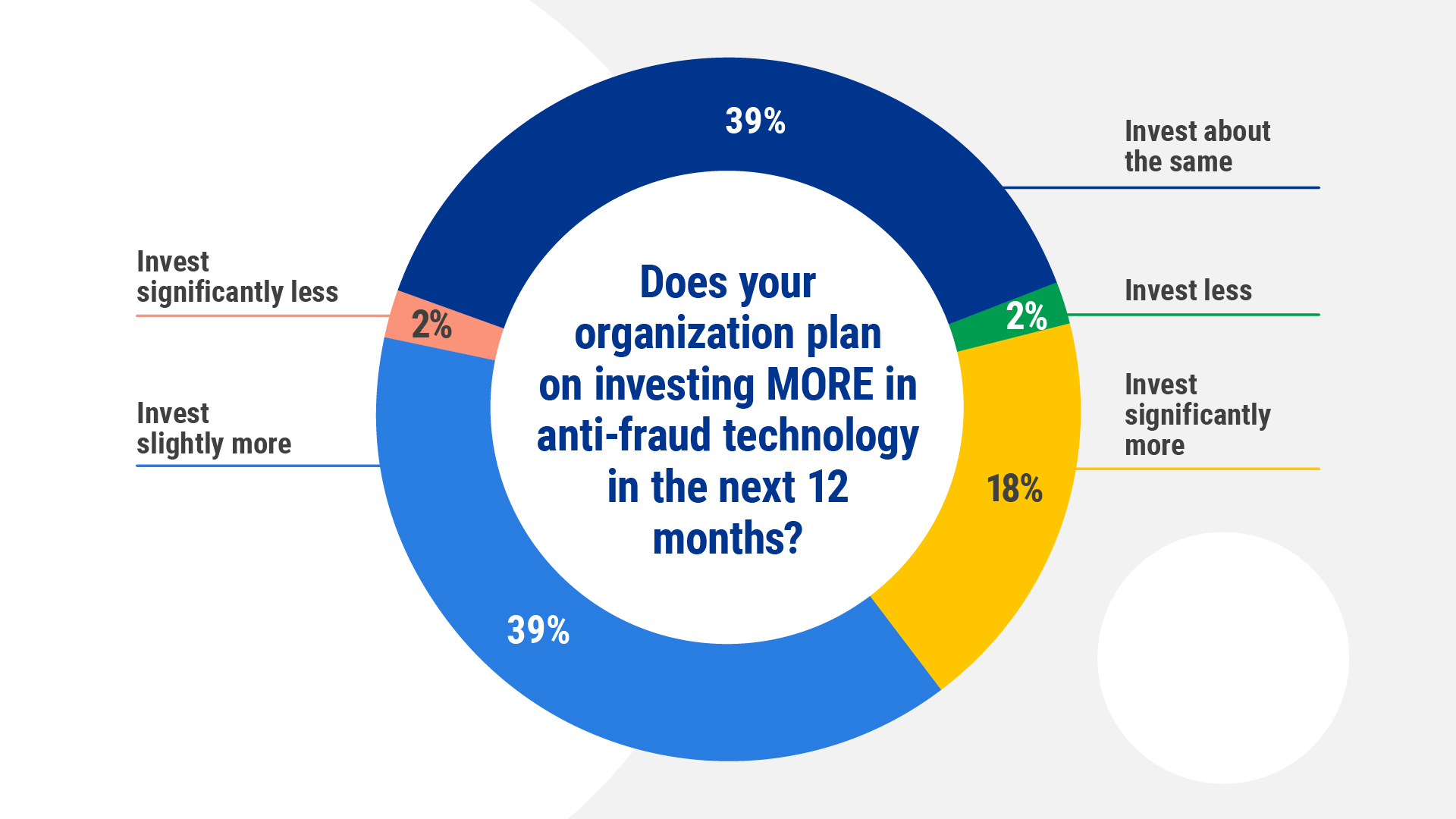

The survey data shows 96 percent of insurers plan to maintain or increase their investment in anti-fraud technologies over the next year. Tapping into advanced technologies such as artificial intelligence (AI), machine learning, process automation and data analytics will allow insurers to not only accelerate investigations but also augment the capabilities of their human investigators.

One key enabler is using predictive analytics to identify fraud patterns and prioritize high-risk claims for investigation.

AI and machine learning models can analyze this vast data pool to detect statistical anomalies, reveal connections across claims and assess their risk propensity. Armed with these insights, SIU teams can focus their limited resources on investigating the highest-priority cases instead of manually sifting through thousands of claims.

Digital forensics solutions further assist investigators by authenticating documents and digital media evidence. Insurers can deploy automated forgery detection and image analysis tools at scale to rapidly validate claims documentation. This not only accelerates the vetting of claims but also reduces the training curve for new investigators.

Rounding out the digital transformation arsenal are workflow automation tools and rules-based decisioning models. These streamline case routing and prioritization of potentially suspicious claims, allowing SIU teams to work smarter and more efficiently despite staffing constraints.

A Critical Role for Skilled Investigators

As insurance fraud schemes multiply and escalate in sophistication, continuous investment in anti-fraud technologies will be essential for insurers to stay ahead of emerging threats. However, no technology can fully replace skilled human investigators and their expertise. Rather, the future paradigm calls for seamlessly combining data-driven AI capabilities with human intelligence.

By outfitting the next generation of fraud fighters with advanced digital tools, insurers can bridge the talent gap created by retiring experts.

Chubb CEO Greenberg on Personal Insurance Affordability and Data Centers

Chubb CEO Greenberg on Personal Insurance Affordability and Data Centers  What Analysts Are Saying About the 2026 P/C Insurance Market

What Analysts Are Saying About the 2026 P/C Insurance Market  Allianz Built an AI Agent to Train Claims Professionals in Virtual Reality

Allianz Built an AI Agent to Train Claims Professionals in Virtual Reality  Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford

Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford