A new Verisk survey highlights the pressing concerns and emerging trends shaping the future of property/casualty insurance claim fraud detection and prevention. The comprehensive survey of 44 industry professionals—primarily leaders and decision-makers for SIU teams—was conducted in March 2024 at the Insurance Fraud Management (IFM) Conference in The Woodlands, Texas.

Executive Summary

This article is the first in a series examining the pressing issues confronting SIU decision-makers and the transformative potential of emerging technologies.The survey revealed that keeping pace with new technology, addressing the talent gap and combating emerging fraud trends are the top concerns for claims and special investigation units (SIU) leaders in 2024. It also indicated varying levels of digital maturity across organizations and a growing interest in advanced technologies like generative AI and predictive analytics. This article examines these findings in detail and offers recommendations for insurers to enhance their fraud detection capabilities.

A Costly Challenge

Insurance fraud continues to be a significant concern for the industry, with an estimated $308.6 billion stolen from American pockets annually. As fraudsters employ increasingly sophisticated technologies and techniques, insurance companies must continually adapt their fraud detection and prevention strategies. The survey aims to provide insights into the current state of insurance fraud management and name key areas for improvement and investment.

Top Challenges Facing SIU Teams

The survey revealed that 32 percent of respondents consider keeping pace with new technology as their top challenge, followed by the talent gap and training investigators (25 percent) and resource constraints (23 percent). These findings reflect the need for insurance companies to invest in both technology and human capital to stay ahead of fraudsters.

Insurers can tackle these challenges by developing comprehensive technology adoption strategies that align with their fraud detection goals. They can also implement robust training programs to upskill existing staff and attract new talent. Additionally, it’s important to foster a culture of innovation and continuous learning within the organization to help teams stay abreast of technological advancements.

Digital Transformation in the Insurance Industry

The survey found a split in digital maturity levels among insurers. While 37 percent of respondents reported keeping pace with general technology trends, a nearly equal percentage (36 percent) admitted to slower adoption of digital strategies.

An underdeveloped digital strategy can significantly affect an insurer’s ability to detect and prevent fraud effectively. To accelerate digital transformation, companies should assess current digital capabilities and identify the gaps. Developing a road map for digital transformation that prioritizes fraud detection and prevention is essential. Moreover, investing in a scalable and flexible technology infrastructure can drive progress in this area.

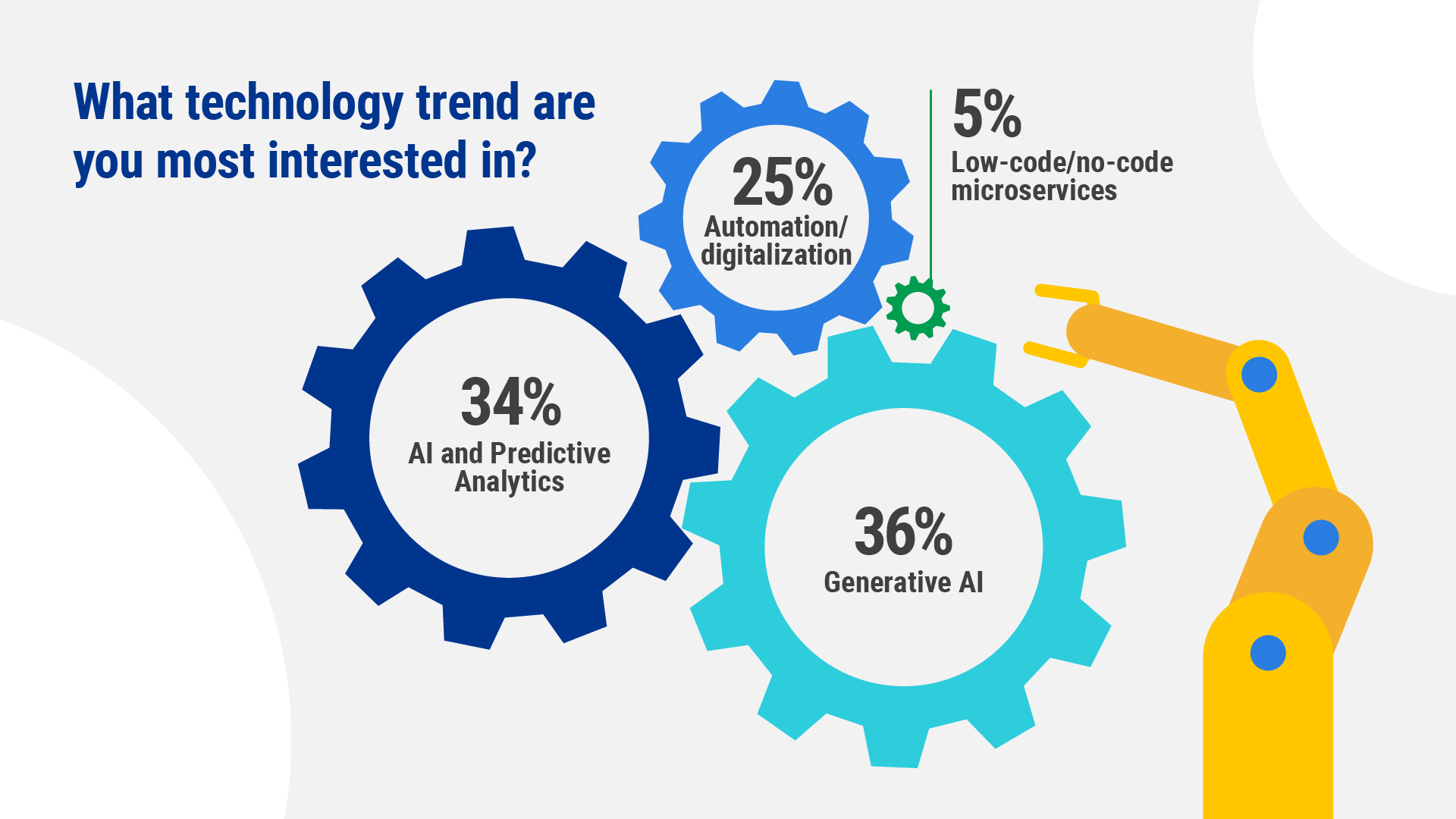

Technology Trends in Fraud Detection

Generative AI (36 percent) and AI-powered predictive analytics (34 percent) emerged as the top technology trends of interest among survey respondents. These technologies offer powerful capabilities for detecting patterns, anomalies and potential fraud indicators that may be difficult for human investigators to identify.

However, implementing these advanced technologies also comes with challenges, including data compliance concerns, the need for skilled personnel and the risk of algorithmic bias. Insurers should carefully evaluate their specific needs and capabilities before investing in these technologies and ensure they have robust governance frameworks in place.

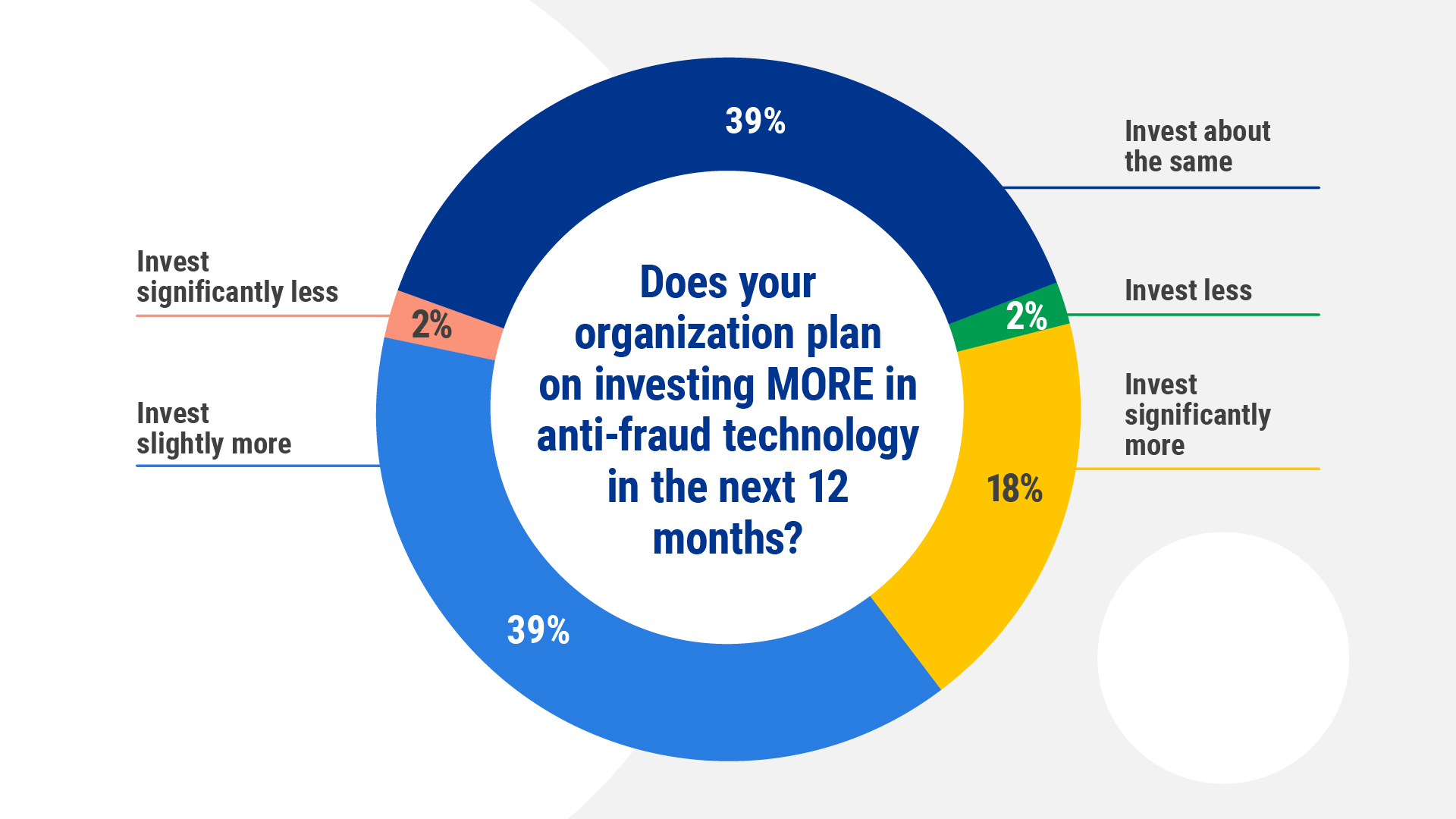

Investments in Anti-Fraud Technology

The survey revealed a positive trend in anti-fraud technology investments, with 39 percent of respondents planning to invest slightly more and 18 percent planning to invest significantly more in the next 12 months, indicating that SIU leaders are aware of technological advancements and are planning to stay ahead of sophisticated insurance fraud.

To maximize the return on these investments, companies need to align them with specific fraud risks and organizational goals. Additionally, developing a talent pipeline, investing in professional development programs can help bridge the talent gap and ensure a skilled workforce to leverage these technologies effectively.

It’s important to prioritize solutions that offer seamless integration with existing systems and workflows to maximize effectiveness and usage. Regularly evaluating the effectiveness of implemented technologies and adjusting strategies accordingly will ensure ongoing improvement in fraud detection.

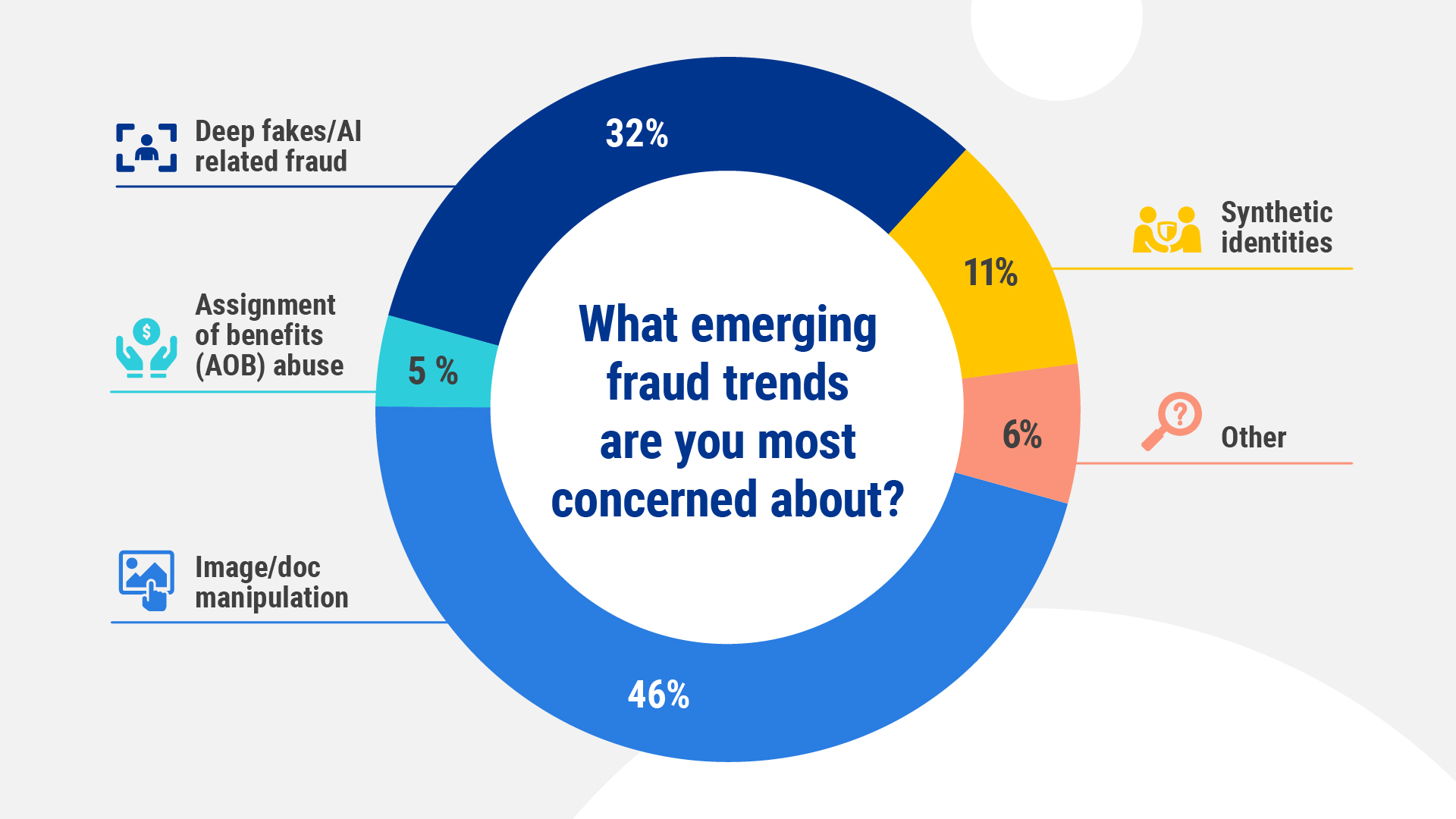

Emerging Fraud Trends

Image and document manipulation (46 percent) and deep fakes/AI-related fraud (32 percent) were identified as the most concerning emerging fraud trends. These sophisticated techniques pose significant challenges to traditional fraud detection methods and require advanced technologies to combat effectively.

Advanced image and document verification technologies—including AI-powered detection systems capable of flagging manipulated media—can help insurers address these emerging threats. Additionally, enhancing staff training to recognize signs of sophisticated fraud techniques, as well as collaborating with industry peers and law enforcement, can also bolster efforts against evolving threats.

Embracing Innovation for Fraud Prevention

The insurance industry faces significant challenges in fraud detection and prevention, but also has many opportunities to leverage advanced technologies and strategies. By investing in digital transformation, embracing AI and predictive analytics, and addressing the talent gap, insurers can enhance their fraud detection capabilities and stay ahead of emerging threats.

As fraud practices continue to evolve, insurance companies must remain vigilant and adaptable. By fostering a culture of innovation, collaboration and continuous learning, insurers can build robust fraud management systems that protect both their customers and their bottom lines.

RLI Inks 30th Straight Full-Year Underwriting Profit

RLI Inks 30th Straight Full-Year Underwriting Profit  Winter Storm Fern to Cost $4B to $6.7B in Insured Losses: KCC, Verisk

Winter Storm Fern to Cost $4B to $6.7B in Insured Losses: KCC, Verisk  Chubb CEO Greenberg on Personal Insurance Affordability and Data Centers

Chubb CEO Greenberg on Personal Insurance Affordability and Data Centers  Lessons From 25 Years Leading Accident & Health at Crum & Forster

Lessons From 25 Years Leading Accident & Health at Crum & Forster