Although nearly two-thirds of underwriting professionals surveyed in 2021 said that AI and automation tools aren’t easing their workloads—and 28 percent said their workloads have increased—”carriers are absolutely making the investments” in emerging technology.

Kenneth Saldanha, senior managing director and global insurance lead at Accenture, gave that assessment of carrier spending during a recent interview with Carrier Management as he reviewed survey results published by Accenture and The Institutes in the “2021 P/C Underwriting Survey.”

“We see them making the investments. We’re working on them on those investments,” he said, attributing some negative views coming from front-line underwriters about the success of their implementations to carriers’ failure to also invest in change management initiatives to help underwriters embrace and accept the new tools. (Related article, “The Road to 2032: Big Changes Ahead for Commercial Underwriters,” published in CM’s fourth-quarter magazine)

Where are they putting their dollars as they attempt to introduce robotics and artificial intelligence to the underwriting function? What parts of the underwriting process are they focusing on?

Saldanha said Accenture sees three main areas of focus:

Data Ingestion. “When submissions come in the door in all the different formats—all the different ACORD forms and emails from a broker or phone calls, etc.—there’s a whole set of work that’s being done around streamlining the intake or ingestion of a submission.”

Noting that this is a complicated part of the underwriting funnel to streamline, he said, “This would be one of the places where underwriters could say, ‘Well, I don’t see it at all because not every format is solved.'” He reasoned that despite investments, carriers are “not going to be able to entirely control all of the behavior of every single broker and agent.” There will always be variability in what comes in, he said.

“An underwriter deals with a broker who chooses to put in the submission the way they want it, or a customer who sends them something in whichever format they might want.”

Data Enrichment. Saldanha explains this step, what some refer to as “data augmentation,” as using third-party data so you can actually increase the quality of what information you get without having to ask a bunch of follow-up questions or chase around” for answers.

It’s a big step, but “I’m seeing less being done in that data enrichment space honestly than the ingestion space,” he said.

Risk Appetite and Winnability. Saldanha sees the bulk of current efforts going into decision support to focus on risks that are within the carrier’s appetite and likely to be won. “What is the risk rating and pricing that we want to do on this? And what is our propensity to win?”

“When I think about where the carriers are really investing, where the AI side of this comes in, beyond pure automation, it’s a lot more [focused] on this [question], ‘How can we get better at making sure this is in appetite and that it isn’t breaking our risk accumulation rules?'”

Beyond those three areas, he said, “The last mile is bringing [all this] into the underwriting desktop, which is, I think, a necessary piece of the puzzle.”

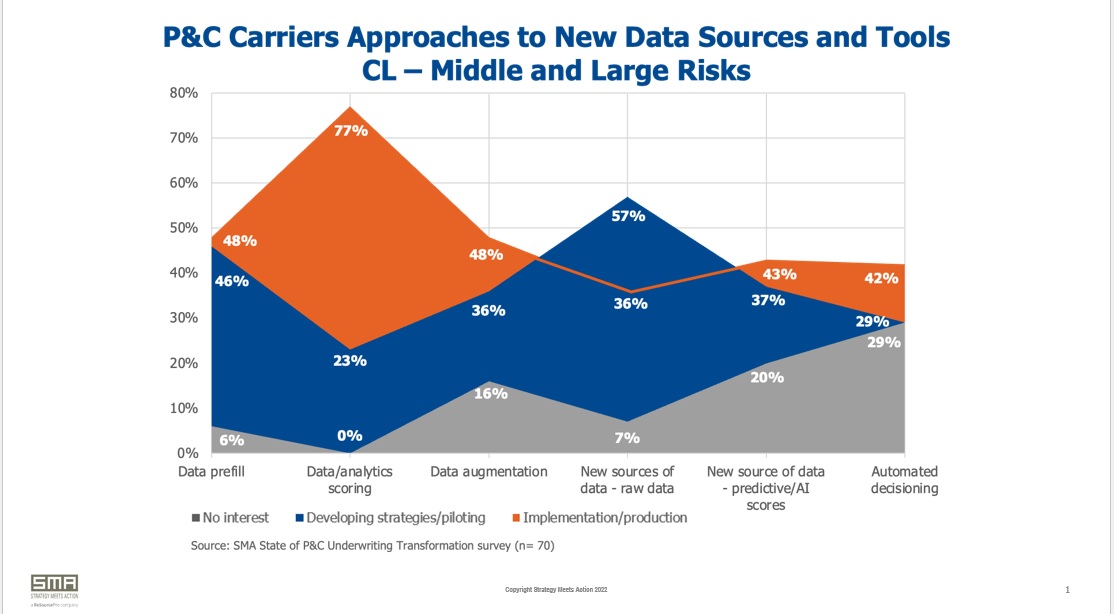

Separately, Deb Smallwood, a senior partner for Strategy Meets Action, a ReSource Pro company, reviewed results of a 2022 SMA survey in which P/C insurance industry executives for carriers in the middle-market and large commercial segment described their interest and progress in putting various automation and AI tools into practice to transform their commercial lines underwriting operations.

Reviewing a line graph that displayed the highest peaks for implementation of “data/analytics scoring,” with 77 percent of insurers surveyed indicating they are using analytics scoring tools, she also called attention to the next highest peak—for “new sources of data” and AI scores based on that new data. “There’s some implementation—at 42 percent. “They’re starting to get there,” she said, referring to a lower percentage—roughly 35 percent—saying they are only at the stage of piloting or developing strategies around new data sources.

Like Accenture, the SMA survey results reveal interest in data augmentation. with roughly 45 percent of commercial lines business and technology leaders surveyed saying data augmentation is in production or being implemented and around 35 percent piloting and developing strategies.

SMA’s eBook report on the survey results highlighted “automated decisioning” as the area with the least activity from carriers, with 29 percent of survey respondents saying they have no automated decisioning initiatives underway.

This article previews some of featured content of Carrier Management’s fourth-quarter magazine, “Travels In Time: The Future of Commercial Underwriting.” Consider becoming a Carrier Management member to unlock all the content.

How Americans Are Using AI at Work: Gallup Poll

How Americans Are Using AI at Work: Gallup Poll  20,000 AI Users at Travelers Prep for Innovation 2.0; Claims Call Centers Cut

20,000 AI Users at Travelers Prep for Innovation 2.0; Claims Call Centers Cut  Nearly 26.2M Workers Are Expected to Miss Work on Super Bowl Monday

Nearly 26.2M Workers Are Expected to Miss Work on Super Bowl Monday  Retired NASCAR Driver Greg Biffle Wasn’t Piloting Plane Before Deadly Crash

Retired NASCAR Driver Greg Biffle Wasn’t Piloting Plane Before Deadly Crash