Property/casualty insurance carriers looking to hire talent in 2022 need to move quickly to snap up in-demand professionals, including sought-after claims professionals and underwriters with multiple offers, an insurance adviser said recently.

But some carriers are moving too quickly, an insurance recruiter said, noting that ghosting is a possible consequence of acting hastily.

Jeff Rieder, head of Ward Group, a unit of Aon, and Greg Jacobson, chief executive officer of The Jacobson Group, shared the assessments as they reported the results of the The Jacobson Group and Ward Semi-Annual U.S. Insurance Labor Market Study. (Related article: Insurers Anticipate Staffing Increase Over the Next Year Despite Recruiting Difficulty: The Jacobson Group)

“People are making job offers 15 minutes into interviews, particularly for these claims and underwriting positions. [There are] even some stories [of companies] making job offers just off of résumés only in order to fill their talent needs,” Rieder said, offering some information from anecdotal reports during a webinar that was mostly focused on hard data from a midyear survey of insurance carriers employing more than 270,000 industry professionals (77 percent P/C carriers; 22 percent life/health).

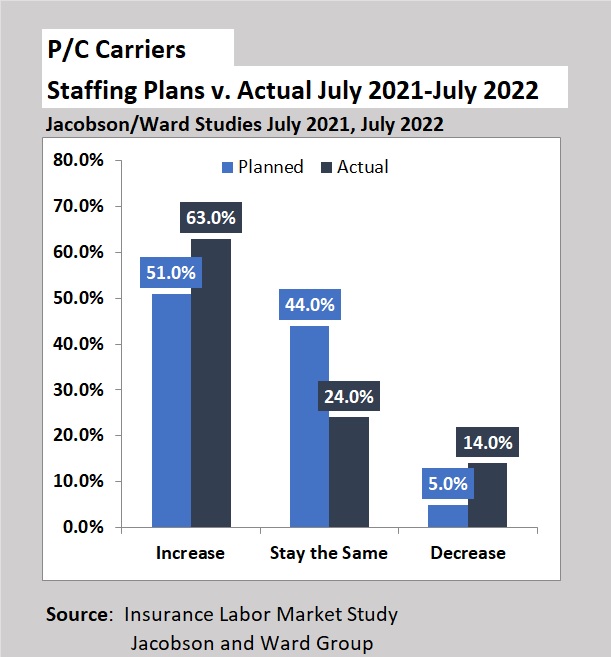

The survey data revealed that more P/C carriers increased staffing during the past year than had expected to do so when surveyed in July 2021. Sixty-three percent actually increased staffing while 51 percent had planned to do so.

The bad news, however, was that P/C carriers reported losing staff over and above planned workforce cuts in the year, with just 5 percent of P/C carriers saying they planned to cut staffing when asked about in July 2021 and 14 percent actually losing staff between July 2021 and July 2022.

Citing some industry job figures from the Bureau of Labor Statistics, Jacobson said that insurance carrier total employment is currently at about 1.56 million people, down by 85,000 employees compared to two years ago. “This is not because insurance companies are not hiring people. They are trying to hire lots of people,” Jacobson said. “Companies cannot hire fast enough to replace the workers who are leaving.”

Citing some industry job figures from the Bureau of Labor Statistics, Jacobson said that insurance carrier total employment is currently at about 1.56 million people, down by 85,000 employees compared to two years ago. “This is not because insurance companies are not hiring people. They are trying to hire lots of people,” Jacobson said. “Companies cannot hire fast enough to replace the workers who are leaving.”

Not So Fast; Beware of Ghosts

Still, Jacobson went on to warn against hiring too fast as he responded to a question about whether either of the two firms had any data on ghosting in the insurance industry.

Neither firm had the numbers on ghosting—when new hires don’t show up for their new jobs. But Jacobson said that “there’s a lot of it,” referring to situations he’s heard about where people accept a job offer and then just disappear. “That’s been a problem,” he said.

Rieder remarked that these ghosters are keeping in good stead with their current employers, but Jacobson said that the vanishing new hires haven’t necessarily decided to stay at their old jobs. “They’re just going to another, a third job…Virtually, everybody who’s actively looking or just considering other opportunities has multiple offers,” Jacobson said, explaining why potential employers are putting out offers just a few minutes into an interview, as Rieder suggested.

“This is not just about putting money in front of somebody. This is about selling an opportunity, selling a relationship, selling a culture.”

“This is not just about putting money in front of somebody,” Jacobson stressed, going on to make a point about recognizing that more than speed is needed to attract new talent. “This is about selling an opportunity, selling a relationship, selling a culture…”

“There are a lot of companies that are too slow, but there are some companies that are too fast. And if you don’t take time to develop a relationship with the potential employee, that’s where you’re going to [see] those ghosting situations come out.”

5% Not 3.5; Budgets Blown for Midyear Merit Hikes

Still, compensation is important, and Rieder fielded several questions about salaries during the webinar, including one about what to do for incumbents when new hires are lured on board with equivalent or higher salary levels.

“This has been a sweeping challenge for most organizations,” he said, noting that some companies are putting more focus on internal pay equity analyses “to make sure that individuals are being paid respective to their contribution to the organization.”

“This is causing more companies to have to make salary adjustments midyear,” he said. “While many companies probably budgeted for only 3.5-4 percent” in merit increases this year, “the reality we’re seeing overall, year to year, [is a] trend of about a 5 percent increase,” Rieder said, noting that the midyear market adjustments are not being applied completely across the entire organization, instead selectively addressing the “high performer population most directly.”

Related article: Paying More for Experienced Hires? Be Prepared for Pay Equity Challenges

Rieder also tackled another audience question about pay differentials by location: Are you finding that companies pay remote out-of-state employees at the local hometown rate or at the headquarters rate?

“It’s a little bit of both, but candidly, it appears that more companies are trying to target paying a more geographically differentiated salary,” Rieder replied. Explaining by example, he said that individuals based in Iowa or Nebraska that go to work for a company on the East Coast “often do get a benefit from their current market, but not quite to the same level as the headquarters rate.”

Jacobson said attempts at varying compensation by location are a new trend—and one that may not have legs. Until recently, compensation levels were being evened out across the country. “There was no difference in compensation regardless of where you were, or very little difference. And now we’re starting to see some of that changing,” Jacobson reported. (Article continues below)

“I think what’s happening is companies are trying to figure out how can they keep their costs in line, and banding [comp levels] essentially by cost-of-living areas,” he said. At a time when people can work from anywhere, “I’m not sure that’s really sustainable,” he said.

Asked to identify the biggest impact that work-from-anywhere possibilities have had on recruiting patterns, Jacobson said “the most difficult thing to do is to get people to relocate for a job these days. It makes some jobs not fillable,” he said. Going on to describe the roots of the P/C insurance industry in farm mutuals and the existence of carriers in very small one- or two-employer towns, he said, “It is very, very difficult to get people to move, even for CEO searches to those smaller towns.”

“We have to make twice as many phone calls as we used to for a job that required relocation,” Jacobson said.

Later, when Rieder showed some responses to a survey question specifically asking about flexible working options, Jacobson said carriers make a mistake when they believe that “hybrid work equals flexibility”—the type of flexibility that attracts talent. “It doesn’t necessarily equal flexibility. It just means you can work from home Monday and Friday” and work in the office other days, he said, giving the example of a common setup. “You still have to live in the same town. That’s not the same as flexibility. I think some companies might want to think about that if they’re having a difficult time attracting and retaining the talent that they need in order to do their business,” he said.

Claims in Demand; Executives, Not So Much

At another point in the webinar, Jacobson noted that survey respondents indicated that they were having more difficulty this year than last year filling most types of positions. One notable exception he flagged was executives, who are not only less difficult to recruit in 2022 but also the least sought after among 11 different insurance carrier functions. (Sales/marketing and operations professionals also are easier to recruit in 2022 than 2021, according to a chart summarizing difficulty scores in both years, assessed on a 10-point scale.)

For personal lines insurers and P/C balanced (commercial and personal lines) carriers, claims is the No. 1 area respondents said they’re trying to fill, while underwriters are at the top of commercial insurance carriers’ lists of likely hires for 2022.

Responding to underwriting talent losses in commercial lines, Rieder said he’s seen carriers allowing underwriters to work 100 percent remotely. “And we’re hearing many of those anecdotal stories of $15,000 to $25,000 increases in pay for select commercial underwriters.”

In personal lines, Rieder noted that some carriers paused hiring claims professionals in 2020 and 2021 when COVID lockdowns drove down claims frequencies. With normalized, and sometimes elevated, frequency levels back in 2022, those pauses are “catching up to them, in perhaps slightly negative ways,” he said, referring to servicing issues in responding to Midwest catastrophe activity and rising loss ratios in personal auto.

Rieder turned to Jacobson to explain why executive positions are no longer viewed as difficult to fill by the survey takers, wondering if it was because the claims and underwriting areas had higher demand.

Beyond the fact that there aren’t as many executive positions to fill, Jacobson said that leadership training has better prepared a new generation of leaders. “The industry has been screaming about the lack of development for a long time. So, about 10 or 15 years ago, the industry started doing more and more—certainly than [had been done in] the prior five to 10 years.”

“Now, there are more people with 10-plus years’ experience, 15 years’ experience than there were that are ready for executive-level positions,” he said.

Planned Hires for 2022

At an earlier point in the webinar, Rieder noted that the average age of insurance industry professionals is 45-46 years, with an average tenure of 10-11 years. “For many companies, we are seeing a slight dip for the first time in tenure and age levels,” he said.

One reason might be a greater willingness to hire entry-level workers than in past years for some functions. While responses to a survey question about experience requirements indicates that more than three-quarters of the employees to be added this year will need experience—a figure that’s been relatively constant over several editions of the survey—that percentage drops to 65 percent for claims and operations staff, and to 59 percent for actuarial.

There’s less willingness to relax experience requirements for underwriters. Despite the high demand, respondents said they expect 82 percent of underwriting hires to be experienced. That figure is actually up from a similar survey that Jacobson and Ward conducted in January, when the desired split of underwriting hires was 74 percent experienced/26 percent entry level.

Across all positions, following a year in which 63 percent of P/C insurance carriers were able to increase staff, 71 percent said they expect to expand their workforces in the next 12 months.

According to Rieder, 77 percent of balanced lines P/C carriers are expecting to grow staff levels during the next 12 months compared to 69 percent of commercial lines carriers and 62 percent of personal lines P/C carriers.

Preparing for an AI Native Future

Preparing for an AI Native Future  Execs, Risk Experts on Edge: Geopolitical Risks Top ‘Turbulent’ Outlook

Execs, Risk Experts on Edge: Geopolitical Risks Top ‘Turbulent’ Outlook  Winter Storm Fern to Cost $4B to $6.7B in Insured Losses: KCC, Verisk

Winter Storm Fern to Cost $4B to $6.7B in Insured Losses: KCC, Verisk  Experts Say It’s Difficult to Tie AI to Layoffs

Experts Say It’s Difficult to Tie AI to Layoffs