Since the first article in this series, Dispatches From InsurTech Survival Island, our principal goal in analyzing the quarterly statutory statements of the most relevant U.S. property/casualty full-stack carriers has been to influence the dialog, debate and deliberations in the InsurTech space debate, and to promote a fact-based perspective to the discussion.

Executive Summary

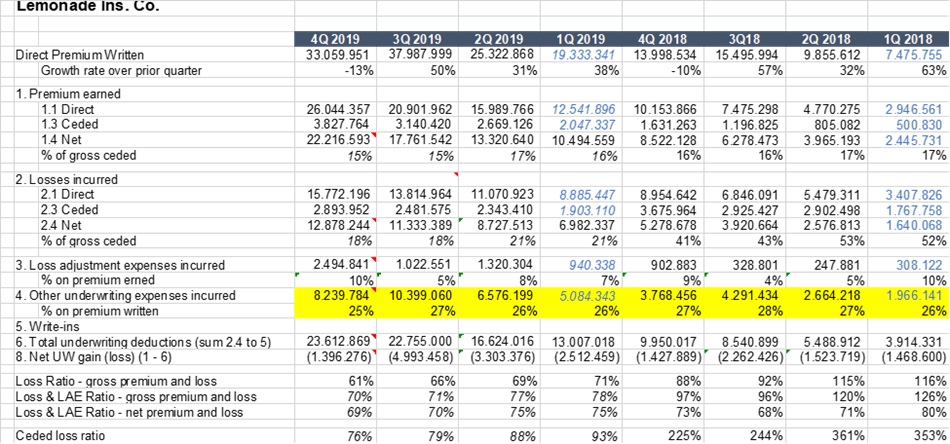

Continuing a series of articles about statutory financials of relevant U.S. InsurTech carriers, Matteo Carbone and Sri Nagarajan focus on standard “insurance KPIs”—loss ratios, in particular—of Metromile, Lemonade and Root, finding Lemonade’s loss ratios improving and Root exhibiting signs of a classic startup.With permission, Carrier Management is republishing this edited version on the analysis originally posted on the LinkedIn pages of Matteo Carbone and Sri Nagarajan.

The article was written prior to Root’s June 3 announcement that Root Home, a homeowners insurance program, is available in 13 states through Root’s partnership with American Family’s Homesite and before Lemonade’s S-1 filing for an initial public offering.

Even as we continue to write about the future of insurance, about a year ago, one of our past articles declared our love for “old insurance KPIs.” While futurologists distanced from assessing P&Ls might disagree, many readers have liked the use and explanation of insurance KPIs in the context of innovation. We are pleased to see more industry experts and authors join us in crunching numbers, assessing issues and taking a fact-based view on insurance innovation. We were especially pleased to see even some executives of InsurTech startups talk about core KPIs in the context of their innovative business models. So, we entered 2020 with a belief we had accomplished our mission to spark a P&L, fact-based dialog in the insurance innovation space.

Surprisingly, neither third-quarter 2019 nor fourth-quarter 2019 financials got any attention from analysts, and some friends pinged us suggesting we continue the series for the foreseeable future. We heard you loud and clear, and we will continue to publish these digests based on assessing the fundamentals of the InsurTech players in the context of the broader insurance industry.

We are back! Our journey continues here today.

We start with a snapshot view that lists the core financial metrics for the three InsurTech players below (click image to enlarge).

“To each his own.”

This phrase probably best sums up how we view the distinction between the three InsurTech players— Lemonade, Root, and Metromile. We see them each taking different paths to customer relevance and financial performance:

• Metromile: An auto insurer with modest growth, has only partially closed the profitability gap with the market (73 loss ratio vs. 64 market average). This, to us, does not seem the story you would expect from a startup in the growth phase.

• Lemonade: A home insurance company that has improved the technical sustainability of their business partially closing the profitability gap with the market (66 vs. 58 market average) and showing a promising trajectory of improvement. However, along this journey, it has sacrificed the expectations many had for this “market disruptor.” (See related sidebar, “Still Bent on Disruption,” below.) The $480 million funding venture has created a book of business that still accounts for just 0.1 percent for the U.S. homeowners insurance market. This $115 million revenue milestone is really a far cry from the “massive disruption effect” which was expected during their debut.

• Root: An auto insurer that continues its journey of exponential growth—their portfolio is three times bigger at the end of 2019 than it was at the end of 2018—but is paying the same amount in claims as it has collected as premium. Root appears to be using the $350 million Series E funding from DST Global and Coatue in August 2019 to cover expenses. This company too accounts for less than 0.2 percent of the auto insurance market.

A Closer Look at Loss Ratios

Digging deeper, we find that Metromile’s loss ratio has been stable in the lower 70s for all of 2019. The carrier started selling their claims tools to other insurers but the performance on its own book does not tell a great story for this new business (albeit older than the other carriers we analyze).

More broadly, the usage of telematics data on claim processing has shown potential to reduce the loss ratio at an international level. If an insurer has to choose a provider for telematics-based claims, it makes more sense to use one that has achieved results in doing it. (A carrier would probably feel more comfortable to use something like the G-evolution services that have already provided competitive advantages on Groupama Italy’s auto portfolio.)

Root ended the year 2019 with a 100 loss ratio, paying out in claims effectively an amount equivalent to the premiums received. Fourth-quarter 2019 saw a loss ratio at 93 compared to 113 in the prior quarter, and 91 in the second quarter. The technical profitability has not yet shown a consistent improvement in the right direction. It is interesting to see, however, that the loss ratios are now fairly consistent in the two components of the core line of business: auto liability and auto physical damage. In contrast, in 2018, auto liability showed a loss ratio not too far from the market average while physical damage showed a terrible loss ratio above 120.

The Root team is smart and we believe they are deliberately underpricing the risks to attract customers. Theoretically, telematics could allow them to improve their loss ratio through behavioral change and the use of data in claims processing to anticipate the first notice of loss and enhance the effectiveness of claim handling processes. It seems they have still ignored this potential, instead focusing only on a few weeks of monitoring. But these strategic options seem achievable in the future.

Lemonade has been on a trajectory of improving its underwriting results over the last few quarters, with a consistent decline in its loss ratios—moving from a loss-ratio of 88 in fourth-quarter 2018 to a loss ratio of 61 in fourth-quarter 2019. Lemonade celebrated its use of advanced AI powered fraud detection in ensuring “bad risks” are caught, assessed and filtered out. But a slowdown in premium growth suggests that an increase in pricing could be the main driver of this technical profitability recovery.

The Top Lines

In the last article we highlighted the “pricing war.” So, let’s take a closer look at the top lines generated by these different approaches to the reach a sustainable loss ratio:

• Root’s quarter-over-quarter growth rate appears to have “settled” at around 20 percent, which is lower than their past performances. Looking back over a two-year horizon, 2019’s quarter over quarter growth rate seems rather sedate compared to the 2018 quarterly growth rates. However, in absolute numbers, this means that in the last quarters they have increased their written premium by $20 million (from $99 million to $119 million) and $24 million (from $119 million to $144 million). These represent their third and second best quarterly growths, after the record of $38 million increase achieved in first-quarter 2019 (from $51 million to $89 million).

With Root now available to more than 65 percent of the U.S. driving population, it remains to be seen how they can continue to capture customers switching for cheaper price. Root has also started to cross- sell their customer base with renters insurance. This business line has contributed for $229,000 to the top line.

• Lemonade’s growth has slowed down. With healthy growth quarter-over-quarter from first-quarter 2019 through third-quarter 2019, we see a reversal in the fourth quarter. The 13 percent drop in fourth-quarter 2019 was worse than the 10 percent reduction between the third and fourth quarters of 2018. One year ago, they said we “messed up an entire quarter” because premium growth turned negative, when in fact the company generated their best quarterly loss ratio ever. And it has happened again!

• Metromile’s written premiums grew only by $3 million in third-quarter 2019 (compared with Q2 ’19) and in fourth-quarter 2019, this InsurTech had, in absolute premium numbers, their worst quarter since third-quarter 2018. This to us is a clear sign that their product likely attracts only users who drive infrequently or never drive.

Expense Position

We are not able to compare the real total costs of running these companies; the companies are not reporting all of their costs in the yellow book anymore and therefore true cost positions cannot be judged. As an example, Metromile’s stated underwriting expenses in the fourth quarter of the year went down, similar to movement we saw in the fourth-quarter 2017.

(Editor’s Note: In its IPO filing yesterday, Lemonade disclosed more expense figures. This article summarizes statutory financials, showing 2019 net earned premiums of $63.8 million, net loss and LAE of $45.8 million and other underwriting expenses of $30.3 million. The figures for premiums and losses in the IPO filing are the same but expenses in the IPO filing are listed as $9.6 million for other insurance expense, $89.1 million for immediately expensed sales and marketing costs, $9.8 million for technology development and $20.9 million for general and administrative expenses. The higher aggregate expense figures result in a bottom line loss of $108.5 million in the filing, compared to a statutory net loss of $12.0 million shown here.)

Our humble opinion

Let’s be frank. From these figures only Root is showing the trajectory expected for a startup in the growth phase. Even with gaps on the technical sustainability of their portfolio, they have a profitability improvement opportunity driven by better usage of telematics data. If the team builds mastery in usage of telematics data for behavior change and claims management, this venture could find the “root” for a sustainable growth. With this focus and strategy, they really wouldn’t need to invent anything fundamentally new and different. There are best practices (deeply studied by the IoT Insurance Observatory) on behavior change and claims management they can emulate from players like Allstate (U.S.) and Discovery Insure (South Africa), and UnipolSai and Groupama (Italy) respectively.

Still in the telematics realm, Metromile’s equity story seem less exciting. Customer appeal towards pay-per-use continues to be limited at best. Uncertainty of a fluctuating premium over the period of coverage is a barrier for the adoption. This model is attracting only customers who drive infrequently and focus on saving on their insurance premium costs.

The long tail of excitement with the disruption buzzword continues to characterize Lemonade’s march in this trio. The charity giveback, which has fascinated many commentators in past years, accounted at $632,000 (1.3 percent of the 2018 premiums) last year and $162,000 the year before (1.8 percent of the 2017 premiums)—a pretty inexpensive public relations and marketing tool. On a different note, forward-looking plans to cross-sell and offer pet insurance appears to be a well thought-out move that fits with the equity story for a startup at their stage. Finally, their expansion into the German market generating €100,000 premiums in 2019 appears to be another checkmark on the “to do list” of the startup. Net-net, Lemonade’s story appears to excite industry commentators more than it excites customers. On this note, there appears to be no sign of disruption in the homeowner insurance sector. But one of us has already earned the title of “cynic” from the Lemonade founder for a similar statement we made a year ago.

Related article: What’s Next for Lemonade, Root and Metromile?

Chubb CEO Greenberg on Personal Insurance Affordability and Data Centers

Chubb CEO Greenberg on Personal Insurance Affordability and Data Centers  Berkshire-owned Utility Urges Oregon Appeals Court to Limit Wildfire Damages

Berkshire-owned Utility Urges Oregon Appeals Court to Limit Wildfire Damages  AIG, Chubb Can’t Use ‘Bump-Up’ Provision in D&O Policy to Avoid Coverage

AIG, Chubb Can’t Use ‘Bump-Up’ Provision in D&O Policy to Avoid Coverage  Experts Say It’s Difficult to Tie AI to Layoffs

Experts Say It’s Difficult to Tie AI to Layoffs