This article is part of Carrier Management’s series on the Future of Insurance.

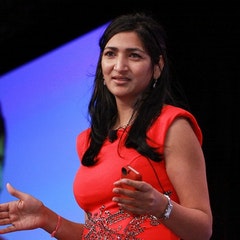

Kathleen Reardon, CEO, Hamilton Re

Kathleen Reardon, CEO, Hamilton ReQ: What major changes do you see on the horizon for the property/casualty insurance industry in the next 10 years? What will insurance companies, insurance leaders, the industry and its workforce look like in the next decade? What risks will they insure?

Reardon (Hamilton Re): It’s now a truism that the future of insurance will be shaped by the digital revolution. According to the World Economic Forum, the fourth industrial age will see a transformation unlike anything humankind has experienced before.

In 2013, experts reported that 90 percent of the world’s data had been created in the prior two years. By extension, more information has been created in the last two years than in all recorded history. According to some projections [most likely based on Futurist Ray Kurzweil’s Law of Accelerating Returns], by 2020, technological advancement will occur every 30 seconds…

Consider those remarkable statistics in the context of their impact on the assessment of emerging risks like cyber for which there are no historical data. Also consider the world’s shifting demographics. Over 50 percent of the global population is under the age of 30. This diverse, digital generation will increasingly expect quick, easy, technology-enabled access to products and service.

The implications for the industry’s workforce are profound. In the face of a world dominated by the digital experience, what role does the broker or agent play? What kind of trusted adviser must you be when product development is being reinvented in real time?

Similarly, what role does the underwriter play when algorithms can analyze data and select and price risk at the speed of light?

However, far from representing a doomsday scenario, the fourth industrial age will spur true innovation, increased efficiency, relevant products and streamlined distribution—the hallmarks of a truly client-centric industry. In that regard, the future of insurance is full of promise.

Read more Future Insights by person

Mike Albert, Co-Founder, Ask Kodiak

Mike Albert, Co-Founder, Ask Kodiak Tim Attia, CEO and Co-Founder, Slice Labs, Inc.

Tim Attia, CEO and Co-Founder, Slice Labs, Inc. Arun Balakrishnan, CEO, Xceedance

Arun Balakrishnan, CEO, Xceedance Ilya Bodner, CEO, Bold Penguin

Ilya Bodner, CEO, Bold Penguin Bobby Bowden, Executive Vice President, Chief Distribution and Marketing Officer, Allied World

Bobby Bowden, Executive Vice President, Chief Distribution and Marketing Officer, Allied World Andy Breen, Senior Vice President, Digital, Argo Group

Andy Breen, Senior Vice President, Digital, Argo Group Adam Cassady, CEO, Tyche Risk

Adam Cassady, CEO, Tyche Risk Chris Cheatham, CEO, RiskGenius

Chris Cheatham, CEO, RiskGenius Trent Cooksley, Head of Open Innovation, Markel Corporation

Trent Cooksley, Head of Open Innovation, Markel Corporation Mike Foley, CEO, Zurich North America

Mike Foley, CEO, Zurich North America Guy Goldstein, Co-Founder and CEO, Next Insurance

Guy Goldstein, Co-Founder and CEO, Next Insurance Mike Greene, CEO & Co-Founder, Hi Marley

Mike Greene, CEO & Co-Founder, Hi Marley Brian Hemesath, Managing Director, Global Insurance Accelerator

Brian Hemesath, Managing Director, Global Insurance Accelerator Russell Johnston, CEO, QBE North America

Russell Johnston, CEO, QBE North America Dr. Henna Karna, Managing Director and Chief Data Officer, XL Catlin

Dr. Henna Karna, Managing Director and Chief Data Officer, XL Catlin Tony Kuczinski, President and CEO of Munich Re, US

Tony Kuczinski, President and CEO of Munich Re, US Rashmi Melgiri, Co-Founder, CoverWallet

Rashmi Melgiri, Co-Founder, CoverWallet David W. Miles, Co-Founder and Managing Partner, ManchesterStory Group

David W. Miles, Co-Founder and Managing Partner, ManchesterStory Group Pranav Pasricha, CEO, Intellect SEEC

Pranav Pasricha, CEO, Intellect SEEC Mike Pritula, President, RMS

Mike Pritula, President, RMS Kathleen Reardon, CEO, Hamilton Re

Kathleen Reardon, CEO, Hamilton Re Jeff Richardson, Senior Vice President, OneBeacon Insurance Group

Jeff Richardson, Senior Vice President, OneBeacon Insurance Group Vikram Sidhu, Partner, Clyde & Co

Vikram Sidhu, Partner, Clyde & Co Christopher Swift, CEO, The Hartford

Christopher Swift, CEO, The Hartford Rebecca Wheeling Purcell, Schedule It

Rebecca Wheeling Purcell, Schedule It Keith Wolfe, President US P/C—Regional and National, Swiss Re

Keith Wolfe, President US P/C—Regional and National, Swiss Re

Get the responses of all 26 leaders neatly packaged in single PDF download. More than 43 pages of content.

RLI Inks 30th Straight Full-Year Underwriting Profit

RLI Inks 30th Straight Full-Year Underwriting Profit  Flood Risk Misconceptions Drive Underinsurance: Chubb

Flood Risk Misconceptions Drive Underinsurance: Chubb  Retired NASCAR Driver Greg Biffle Wasn’t Piloting Plane Before Deadly Crash

Retired NASCAR Driver Greg Biffle Wasn’t Piloting Plane Before Deadly Crash  Allianz Built an AI Agent to Train Claims Professionals in Virtual Reality

Allianz Built an AI Agent to Train Claims Professionals in Virtual Reality