They may not be the new black, but references to adverse development covers and capital relief solutions and cropped up more than once in conversations with reinsurance market participants during the PCI Annual Meeting in October.

David Flandro, executive vice president and Global Head of Strategic Advisory for JLT Re, was among the meeting attendees who told Carrier Management about an uptick in demand for loss reserve development covers, and Greg Coda, who heads the client management team for the reinsurance division of Munich Re America, said his company is find opportunities in customizing capital relief transactions.

See related video, “JLT Re: A Strong No. 4.”

Is this kind of activity being fueled by particular pockets of trouble or just willing available capacity?

Flandro referenced an analysis of industry capital and loss reserve cycles that he provided in an article he authored for Carrier Management to explain what’s behind the trend.

“We are getting a lot of interest adverse development covers and loss portfolio transfers because the idea of capital in the insurance and reinsurance sector is really sort of a vague and loose idea. We have very intelligent and well-educated people who try to guess in a very educated way at what capital levels are, but we don’t really know until we find out what happens with reserves,” he said, restating a key theme of the article.

“We have seen a heightened interest this year in adverse development covers on the part of buyers. There is some appetite out there, not just in property lines but in other lines, too, where terms and conditions are getting better and where there are opportunities to be creative.”

“It gives [insurers] the opportunity to continue to expand and grow in the business,” Coda said, referring to a broader category of capital relief transactions. “We’re helping with our strength of our balance sheet and providing that to these clients to help them grow in their markets.

Neither Coda nor Flandro see any indication of industrywide problems underlying the trend.

“I believe it’s just company by company—as [carriers] evaluate their capital needs and come to the different conclusions about how they want to manage their capital, how they want to expose their capital. At those points in time, they’ll be motivated to reach out and work with us to help them with a solution for capital relief.

As for the reserve item on the balance sheet, Flandro said there may be “a specific worry that a carrier will have about something that might develop. It also could just be based on the fact that a carrier thinks that they have excess capital, but they can’t really deploy it because of the way that they want to reserve. An adverse development cover enables them to do that.”

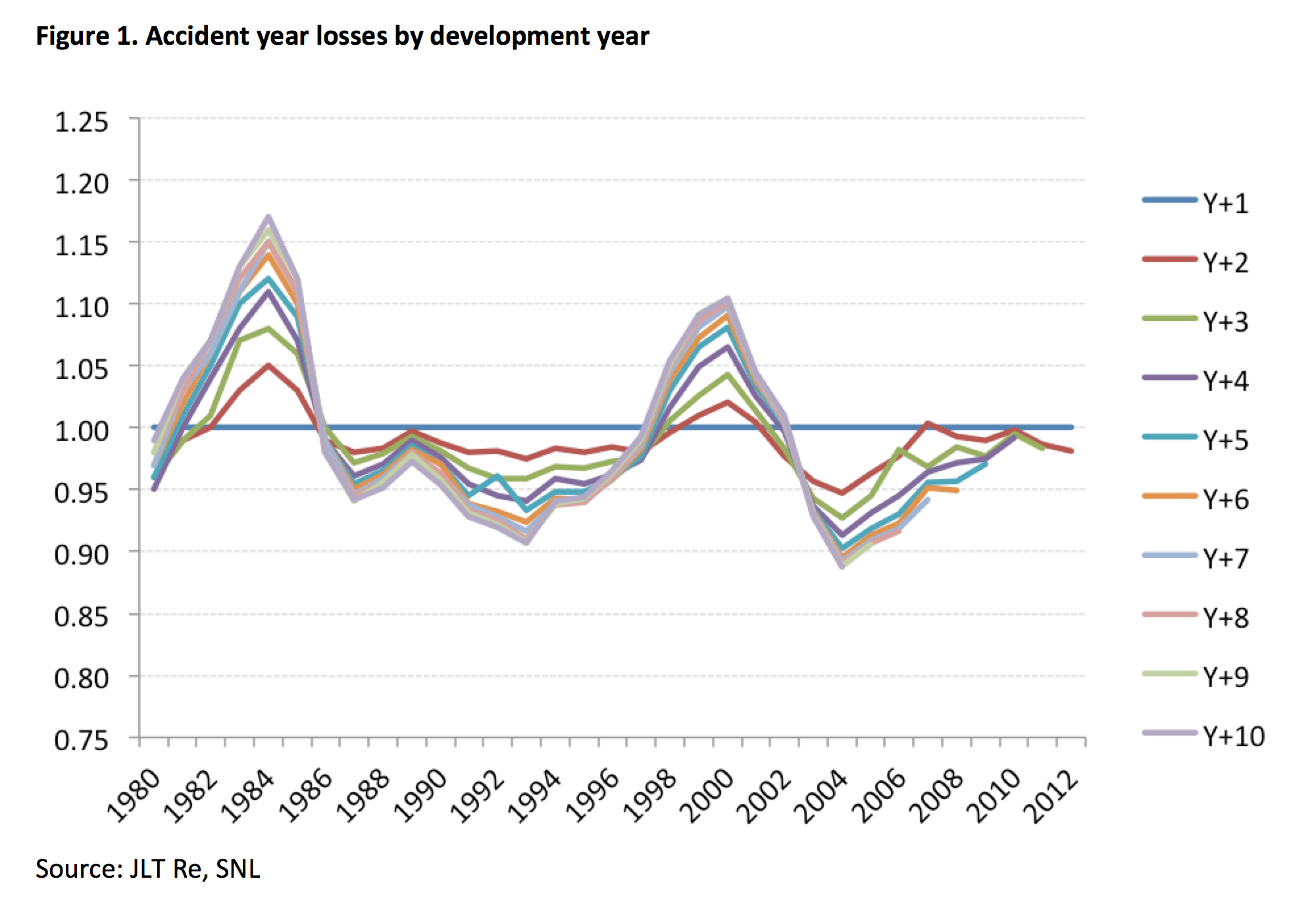

More broadly, Flandro asserts, “There is a reserving cycle,” referring to the historical analysis in the chart below.

“Nobody knows what’s going to happen in the future, but if you look at history, it looks like a bit if a sine wave. We’ve just come through the phase of the cycle where there have been a lot of redundancies …But if you look closely at some of the insurance lines they’re not all as redundant as people thought. It’s probably going to take quite a long time for the cycle to actually turn the reserving cycle, but it’s always cheaper to buy cover when the tide is in.”

“Nobody knows what’s going to happen in the future, but if you look at history, it looks like a bit if a sine wave. We’ve just come through the phase of the cycle where there have been a lot of redundancies …But if you look closely at some of the insurance lines they’re not all as redundant as people thought. It’s probably going to take quite a long time for the cycle to actually turn the reserving cycle, but it’s always cheaper to buy cover when the tide is in.”

“Terms and conditions are more attractive and pricing is more attractive” right now.

Still, when reporting to investment analysts, publicly traded insurers typically stress their practices of setting adequate or conservative results. How then do they sell the purchase of reserve covers to the Street?

“The irony isn’t lost on us either,” Flandro said, adding, however, that “a big adverse development cover can have a very positive effect on somebody’s share price.”

He explains: “If your investors are making an assumption that three, four, five, six, seven quarters out you might have some sort of reserve‑strengthening event and if investors don’t have a lot of trust in the volatility of your reserves, then if you can go to them and say, ‘Listen. We’ve secured this cover and by definition it means that our reserves will be less volatile over this period.'”

He continued: “You cede some premium. You cede some income to do that. But then you’ve lower the volatility of your book basically. That gives you a valuation uplift.

“Then sometimes you can free up capital that you’ve got now to do other things, or you can return it to shareholders, which can actually increase your ROE.”

“The combination of those things can create a benevolent outcome,” Flandro concludes. “If you have that opportunity, you should take it because it’ll help your valuation, all other things equal. It’s an effective and efficient way to deploy capital.”

Opportunities for Reinsurers

The buzz about reserve covers wasn’t just apparent at the PCI meeting. Separately, in the weeks leading up to the meeting, chief executives of two Bermuda-based hedge-fund reinsurers told Carrier Management that they also see opportunities in providing reserve covers to P/C insurers.

“We get a lot of phone calls from companies that have a particular problem—they’re looking for a tailor-made reinsurance solution, and they don’t want it broadcast to the whole marketplace,” said John Berger, CEO of Third Point Re.

Unlike Coda, who stressed the idea that Munich Re’s capital position gives it the clout to craft these deals, Berger and John Rathgeber, CEO of Watford Re, pointed to the competitive advantages of having hedge fund partners who can produce higher investment returns than the carriers can achieve on their own.

“There are various ways you can do loss reserves. Some companies will do a discounting exercise. We don’t do that. We will take reserves off the company’s books. We’ll give the company a limit for adverse development. So they’re getting real reinsurance. But we will embed in the deal a profit-sharing, and in that profit-sharing is an investment credit.”

During a presentation at the Keefe, Bruyette & Woods Insurance Conference in early September, Berger said Third Point Re has done reserve deals where the guaranteed investment return embedded in the profit-sharing arrangement was as low as 1.9 percent and as high as 3 percent. One deal that was publicly disclosed was a 2012 deal for Platinum Underwriters Holdings Ltd. in which Third Point Re guaranteed the high end—3 percent. The deal also included terms allowing the parties to share in a further upside, where they could earn up to 6 percent, he reported. (Editor’s Note: Renaissance Re announced its intention to acquire Platinum in late November.)

“These days most companies are making very small amounts of money on the investment side,” Berger said. Because they’re worried about inflation, they have short-duration, high-quality but low-yielding bond portfolios. With the tailor-made coverage, the benefits are threefold: “The company gets to take reserves off the books, which helps them with their capital ratios; they get adverse development protection in case the reserves do develop adversely; and, in many cases, they get a better investment return than they were getting on their own.

Similarly, Rathgeber suggested that Watford Re is in a better position to offer loss portfolio transfers on old blocks of long-tail business than traditional reinsurers.

“It’s not that the traditional market would never do those transactions [but] in this current interest-rate environment, they really don’t have the ability to offer that kind of product. Watford has a much better chance of being able to structure something that would make sense to both parties.

From the insurer perspective, Rathgeber noted that increasing capital standards are fueling demand. “Transferring some of the past reserves may be seen as a way of freeing up some of that capital in order to meet higher capital standards,” he said.

At the KBW conference, Berger noted that Third Point Re wrote roughly $40 million (limit) of reserve deals this year.

“We’ve seen about $5 billion,” he added. “The $5 billion we’ve seen are people looking for magic.”

Experts Say It’s Difficult to Tie AI to Layoffs

Experts Say It’s Difficult to Tie AI to Layoffs  Insurance Groundhogs Warming Up to Market Changes

Insurance Groundhogs Warming Up to Market Changes  How Americans Are Using AI at Work: Gallup Poll

How Americans Are Using AI at Work: Gallup Poll  Chubb CEO Greenberg on Personal Insurance Affordability and Data Centers

Chubb CEO Greenberg on Personal Insurance Affordability and Data Centers