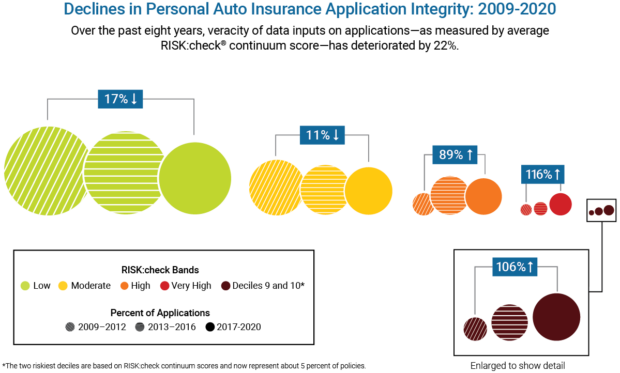

Application integrity for personal auto insurance has deteriorated more than 20 percent over the past eight years, according to Verisk research,[1] including a 5.6 percent decline in the veracity of data inputs on applications in just the past four years.[2]

Cumulatively, Verisk analyzed nearly 4 million applications over more than a decade of research, bringing continuous insight into the challenges of the age of digital auto insurance. It’s a time when consumer demand for a faster online experience is straining many insurers’ capacity to maintain safeguards against fraud.

High-risk applications growing

Auto applications classified into high-risk bands have roughly doubled in the past eight years.[3] Fraudulent applications are also rising, based on scoring of potential fraud indicators using predictive analytics from Verisk. Our composite fraud index shows the percentage of applications carrying one or more indicators has increased from 6.4 percent between 2013 and 2016 to 8.5 percent over the past four years—during which Verisk analysis also shows a 31% jump in applications flagged with one or more potential fraud triggers.[4]

Hard economic times can raise individual financial pressures and the temptation to commit fraud. A survey by the Association of Certified Fraud Examiners found 79 percent of respondents experienced an increase in fraud as of November 2020, and 38 percent deemed the rise “significant.”[5] Most respondents said they expected more of the same in 2021.

How predictive analytics can help

Predictive analytic solutions, based on robust policy and claim data, can help address the application integrity challenge. These solutions can score applications and flag potential fraud, enabling insurers to assess risk more precisely and reduce rating errors. To develop these scores, these solutions may look to validate details in four key categories:

- Identity: Key rating variables and credit header information for the primary insured

- Garaging: Identification of nonresidential address types

- Household: Unlisted drivers, education, and occupation to show possible business use and other risk factors with newly expanded data sources

- Vehicles: Branded titles, commercial vs. personal use, registered owners, and registration state

Verisk’s RISK:check model, built on more than 10 million policies and claims, scores application integrity and flags potential fraud with more than 75 analytic triggers, supporting targeted due diligence on prospects who exhibit a higher risk of hard or soft fraud. To learn more, visit Verisk’s RISK:check solution page.

_________________________________________________

Brad Magick, CPCU, leads the management of Verisk products for auto underwriting fraud, application and rate integrity, and book health. These products include Verisk’s RISK:check suite to help insurers mitigate fraud and confront premium leakage—a $29 billion annual problem for the industry. He oversees point-of-sale and renewal solutions, as well as advanced analytics that enable prioritized pursuit of premium recovery and policyholder outreach programs.

_________________________________________________

[1] Verisk Innovation Paper, Application Integrity: The Whole Truth, 2017; Verisk client, March 2021, comparing average RISK:check continuum scores across two four-year periods 2017-2020 vs. 2009-2012

[2] Verisk client analysis, March 2021, comparing average RISK:check continuum scores across two four-year periods 2017-2020 vs. 2013-2016Benchmarking Report, Association of Certified Financial Examiners, December 2020

[3] Verisk client analysis, March 2021, comparing two four-year periods 2017-2020 vs. 2013-2016Benchmarking Report, Association of Certified Financial Examiners, December 2020

[4] Verisk client analysis, March 2021, comparing two four-year periods 2017-2020 vs. 2013-2016 and based on current fraud triggers and definitionsBenchmarking Report, Association of Certified Financial Examiners, December 2020

[5] Association of Certified Financial Examiners, Fraud in the Wake of COVID-19: Benchmarking Report, Association of Certified Financial Examiners, December 2020

RLI Inks 30th Straight Full-Year Underwriting Profit

RLI Inks 30th Straight Full-Year Underwriting Profit  Experts Say It’s Difficult to Tie AI to Layoffs

Experts Say It’s Difficult to Tie AI to Layoffs  20,000 AI Users at Travelers Prep for Innovation 2.0; Claims Call Centers Cut

20,000 AI Users at Travelers Prep for Innovation 2.0; Claims Call Centers Cut  Preparing for an AI Native Future

Preparing for an AI Native Future