A tumultuous pandemic has pressure-tested the efficiency of commercial and personal auto insurance digitization strategies. With less opportunity for human-to-human interaction, e-commerce channels are experiencing unprecedented spikes.[1]

Insurance buyers are increasingly influenced by fast, on-demand experiences.

Competition is heating up: Verisk surveys revealed 89 percent of auto insurers accelerated digital transformation plans as pandemic lockdowns lifted.[2] Modern insurance buyers are increasingly influenced by fast, on-demand experiences from e-commerce giants and digital innovators. As the market is likely to continue along this trendline, how can auto insurers adapt?

Unlock straight-through processing to lift CX

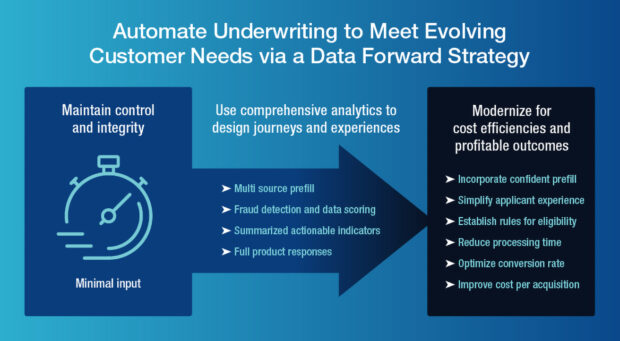

Elevated digital expectations for speed are becoming the norm. Digital transformation and a data-forward strategy deliver critical insights earlier in the quote workflow. This can lead to faster decisions, more online auto quotes, and improved customer experience (CX) and conversion rates—all based on minimal inputs.

Intelligent underwriting platforms can enable auto insurers to increase throughput while using increasingly complex business and product-configuration rules to improve underwriting decisions. Sophisticated automation capabilities rely on advanced analytics for high-confidence decisions.

Spotlight on Personal Auto: LightSpeed® Indicators and the latest enhancements

The key to unlocking one-rate acquisition[3] begins with name, address, and date of birth; a phone number; or a mobile QR code. LightSpeed for Personal Auto, backed by RISK:check® Point of Sale, sorts and scores quotes by potential risk and fraud, which is on the rise since the onset of the pandemic.[4] The platform delivers prefill data on drivers, vehicles, mileage, coverages, licensing, violations, and losses, plus the next generation of innovative data sources, such as adding telematics to the buying process for usage-based insurance.

Six new releases for LightSpeed Auto in 2021 brought enhancements ranging from refined logic and connections to adding more configurability options and including the MileageConfirm® solution for verified mileage estimates at point of quote.

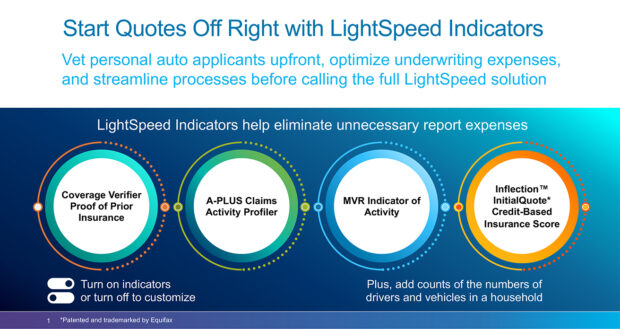

An additional innovation is a more economical way to obtain data upfront by pulling in yes-no risk indicators as an early “sneak peek” at applicants. LightSpeed Indicators can help personal auto insurers save money by identifying applicants with adverse activity before proceeding to a full quote and ordering detailed underwriting reports on specific items, such as lapses in coverage, past claims, or driving infractions. Another risk indicator, Verisk’s Inflection™ InitialQuote* credit-based insurance score, powered by Equifax credit data, is now available for a fraction of the cost of the full score with adverse action codes. The full Inflection solution can then be ordered when a quote moves to bind.

For faster and simpler integration, LightSpeed for Personal Auto is now integrated with the Guidewire accelerator platform, and upcoming LightSpeed innovations include authentication services.

The ultimate potential benefits for insurers plugging into Verisk’s LightSpeed platform are the ability to leverage robust underwriting data to accelerate digital growth and lift CX while lowering acquisition costs.

Spotlight on Commercial Auto: Streamlining the quoting process with a data-forward strategy

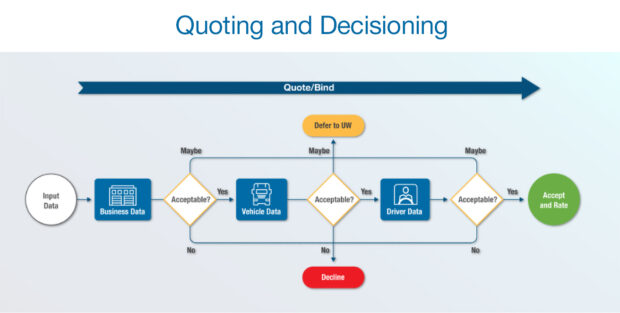

Accuracy, speed of quote, and ease of submitting an application ranked as the three most important elements among independent agents for commercial auto lines.[5] With minimal inputs of name and address, important business and vehicle data can prefill quotes, bringing significant gains in efficiency and accuracy while allowing commercial auto writers to focus underwriting resources on the most complex risks with Lightspeed for Commercial Auto. Additionally, leveraging cost-containment tools such as index of activity can reduce underwriting expenses by 35 percent.[6]

Transform digitally for what comes next

It’s critical to transform auto quote experiences now to compete in today’s marketplace, where the pandemic has accelerated trends that were already in play.

To learn more about how to adapt to these issues, download the new Verisk white paper, Innovation Strategies for Auto Insurance Underwriting: Accelerating Competitiveness with a Digital Insurance Ecosystem.

By: Diane Injic director of ISO Commercial Auto Underwriting at Verisk. Reach her at Diane.Injic@verisk.com.

&

Jason Polayes director of product management at Verisk. He can be reached at Jason.Polayes@verisk.com.

[1] GA Agency, “Ecommerce Sales Growth as % of Retail,” April 2020; spike occurred in the 8 weeks preceding April 20, 2020, < https://www.ga.agency/en/blog/ecommerce-sales-growth-retail-united-states-2020 >, accessed on January 4, 2022.

[2] Verisk Webinar Survey, “Personal Auto Insurance: Trends, Predictions, and Strategies to Compete in the New Normal,” June 23, 2020.

[3] Verisk Innovation Paper, “Unlocking One-Rate Auto Insurance Acquisition: 7 Keys for Competing in the InsurTech Revolution,” 2019.

[4] Brad Magick, “Personal auto research: Application integrity down, fraud up,” Verisk’s Visualize, April 14, 2021 < https://www.verisk.com/insurance/visualize/personal-auto-research-application-integrity-down-fraud-up/ >, accessed on January 4, 2022.

[5] Verisk, “Automated Underwriting: The Race to Zero,” October 2020.

[6] Verisk client experience

* Patented and trademarked by Equifax

Experts Say It’s Difficult to Tie AI to Layoffs

Experts Say It’s Difficult to Tie AI to Layoffs  How Americans Are Using AI at Work: Gallup Poll

How Americans Are Using AI at Work: Gallup Poll  Insurance Groundhogs Warming Up to Market Changes

Insurance Groundhogs Warming Up to Market Changes  Modern Underwriting Technology: Decisive Steps to Successful Implementation

Modern Underwriting Technology: Decisive Steps to Successful Implementation