Personal auto insurance has turned the corner into a hard market as 2022 dawns, with pure premium now exceeding levels seen before the pandemic. This shift amplifies the market’s already dynamic state, marked by trends such as more young adults living at home, a resurgence of miles driven, and regulatory pushback on filings for rate increases.

Now may be the time to hone renewal underwriting to safeguard profitability. Auto book health initiatives have given some Verisk clients a first-year return on investment of 7:1—and 22:1 over the life of a policy—while combatting adverse selection and helping protect their market position. Insurers can take multiple steps in this regard as they respond to current conditions:

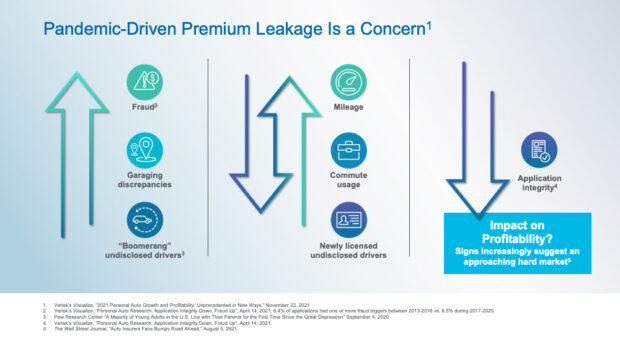

1. Catch up on premium leakage that crept in during the pandemic. Insurers adjusted mileage and commute-usage rating variables downward on many policies during the 2020 lockdowns. While the pandemic’s third wave may temporarily pause a few rebounding trends, rush hour is back and mileage has been climbing again. Meanwhile, the Pew Research Center found a majority of 18- to 29-year-olds living with their parents. And Verisk discovered-driver data shows the pandemic-related pause in licensing of youthful drivers coming to an end.

These shifts, along with rising fraud and falling application integrity seen by Verisk clients, indicate a need to realign key rating factors to reflect the pandemic’s changing trajectory. A sizable return on investment can flow from using high-quality analytics to update mileage and commute factors, pursue “hidden” driver discovery, and ensure accurate garaging information. Targeting the policies that most need updating can help balance premium recovery with retention and the customer experience (CX).

2. Remove roadblocks to your program’s success. Workflows, agent behaviors, and infrastructure problems can all stand in the way of a program’s success. Agents may guide application inputs, interact with policyholders, override policy adjustments, and staff critical functions in ways that aren’t helpful to renewal underwriting. Data and analytics can help uncover possible issues and suggest ways to restructure a program for more cohesion and consistency. Effective use of these tools can go a long way toward ensuring a successful program.

2. Remove roadblocks to your program’s success. Workflows, agent behaviors, and infrastructure problems can all stand in the way of a program’s success. Agents may guide application inputs, interact with policyholders, override policy adjustments, and staff critical functions in ways that aren’t helpful to renewal underwriting. Data and analytics can help uncover possible issues and suggest ways to restructure a program for more cohesion and consistency. Effective use of these tools can go a long way toward ensuring a successful program.

Meanwhile, skilled policyholder outreach through a reputable partner can help keep the messaging and voice on brand—all through the channels that make the most sense for each insurer, whether email, mail, web, or phone. Outsourced policyholder outreach can allow in-house staff to focus on value-added work that builds a better CX and boosts retention. And even in-house outreach can keep re-underwriting manageable by aligning targeted policies to a staff’s skillsets and capacity.

3. Automate across the policy life cycle. Data, analytics, and technology can form an ecosystem that unifies disjointed operations and optimizes workflows with solution sets scaled to each insurer’s resources. Where full automation isn’t needed or practicable, a renewal underwriting program can still benefit from a dedicated back-office team.

With a built-in focus on book health, it’s possible to end irregular cycles of premium pursuit that may hurt an insurer’s competitive position. A long-term commitment to testing, learning, and adjusting for the business mix can help ensure alignment with the insurer’s desired customer experience and geographic footprint. Starting with core states and gradually expanding can help with a manageable rollout. Regular follow-up can keep track of ROI and staffing considerations for an auto book health program that goes the distance.

A cure is better than the ailment

Auto-book health initiatives can immediately help boost the bottom line. Monitoring changes in policy risk profiles and selectively adjusting prices with the help of analytics can enable insurers to stay competitive by growing market share, lowering loss ratios and improving profitability, all while reducing the need for rate increases that may face regulatory hurdles.

Learn more about how Verisk’s RISK:check suite can help insurers mitigate fraud and confront premium leakage, and ask your account executive about a complimentary Auto Book Health Report to demonstrate how much pandemic-driven premium leakage you could recover at renewal.

By: Brad Magick, CPCU, leads the management of Verisk products for auto underwriting fraud, application and rate integrity, and book health. These products include Verisk’s RISK:check suite to help insurers mitigate fraud and confront premium leakage—a $29 billion annual problem for the industry. He oversees point-of-sale and renewal solutions, as well as advanced analytics that enable prioritized pursuit of premium recovery and policyholder outreach programs.

AIG, Chubb Can’t Use ‘Bump-Up’ Provision in D&O Policy to Avoid Coverage

AIG, Chubb Can’t Use ‘Bump-Up’ Provision in D&O Policy to Avoid Coverage  Winter Storm Fern to Cost $4B to $6.7B in Insured Losses: KCC, Verisk

Winter Storm Fern to Cost $4B to $6.7B in Insured Losses: KCC, Verisk  Execs, Risk Experts on Edge: Geopolitical Risks Top ‘Turbulent’ Outlook

Execs, Risk Experts on Edge: Geopolitical Risks Top ‘Turbulent’ Outlook  How Americans Are Using AI at Work: Gallup Poll

How Americans Are Using AI at Work: Gallup Poll