The latest 360Value® Quarterly Reconstruction Cost Analysis report gives an overview of current reconstruction cost trends at the national and state levels for the United States from October 2023 to October 2024.

Total reconstruction costs, including materials and retail labor, increased by 4.9% from October 2023 to October 2024. This is slightly down from cost growth from October 2022 to October 2023 (5.1%), and cost growth in Q3 2024 also dipped to 1.4% from 1.6% the previous quarter.

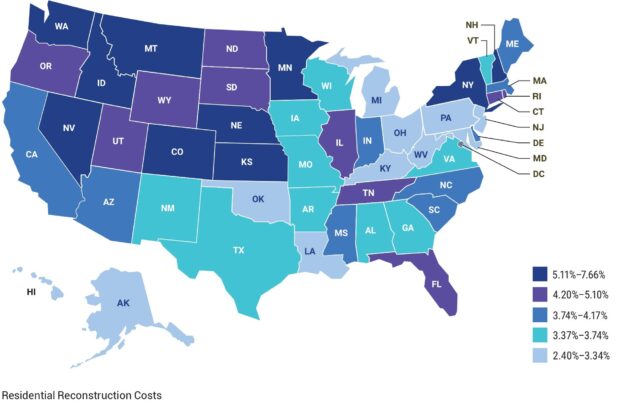

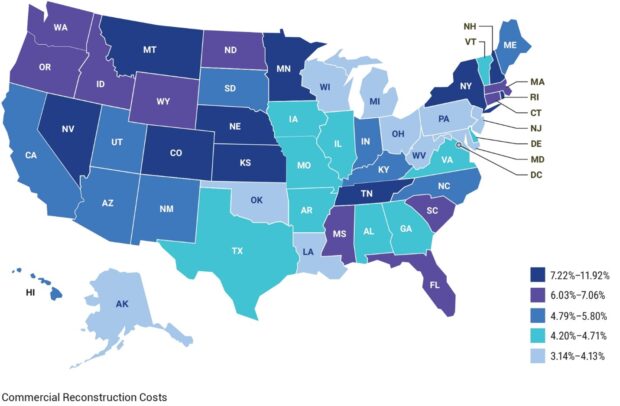

State changes for reconstruction costs

Total residential costs increased by 4.2% from October 2023 to October 2024 and 1.2% from July 2024 to October 2024. Residential reconstruction costs increased year over year in all states.

New Hampshire had the largest increase at 7.66%, followed by Nebraska (6.41%) and Kansas (6.20%). Minnesota’s rank changed most significantly, from 42nd in July 2024 to 6th in October 2024; costs were up 5.62% in the state year-over-year.

Total commercial reconstruction costs increased 5.6% from October 2023 to October 2024 and 1.6% from July 2024 to October 2024. Commercial reconstruction costs increased by at least 3.14% in all states.

As with residential costs, New Hampshire had the largest increase at 11.92%, followed by New York at 8.13%. Kansas had the largest rank jump—from 39th to 4th—with an increase of 7.92%.

Material and labor cost changes

Material costs rose by 1.9% from October 2023 to October 2024. However, the trends were variable over the 12 months—declining through the first quarter of 2024 and rising monthly at an accelerating pace thereafter. Lumber showed a 12-month decrease of 2.20% after a 12-month increase of 2.12% from July 2023 to July 2024. It was the only material category that had a 12-month decline, mostly due to a drop from August to September attributed to the cost of sheathing materials, which decreased 3.59%.

Combined hourly retail labor costs increased by 4.7% from October 2023 to October 2024, up slightly from their 4.3% increase from July 2023 to July 2024. Concrete masons had the largest quarterly change by far, increasing 8.49%, following an increase of 9.36% last quarter and 28.0% in the past 12 months.

Market expectations

The Verisk Market Expectations Index for reconstruction costs anticipate a 1.49% increase for residential and 1.98% for commercial from October 2024 to April 2025.

Verisk’s Market Expectations Index delivers forward-facing insights every quarter via CSV download. Get 3-, 6-, and 12-month future indexes for residential and commercial structures based on regional reconstruction costs down to individual ZIP codes. To learn more about the Market Expectations Index, contact Trish Hopkinson, head of 360Value, at trish.hopkinson@verisk.com.

Read the latest 360Value Quarterly Reconstruction Cost Analysis for more information on this quarter’s performance: Verisk Reconstruction Cost Analysis | Verisk

Berkshire-owned Utility Urges Oregon Appeals Court to Limit Wildfire Damages

Berkshire-owned Utility Urges Oregon Appeals Court to Limit Wildfire Damages  Allianz Built an AI Agent to Train Claims Professionals in Virtual Reality

Allianz Built an AI Agent to Train Claims Professionals in Virtual Reality  Winter Storm Fern to Cost $4B to $6.7B in Insured Losses: KCC, Verisk

Winter Storm Fern to Cost $4B to $6.7B in Insured Losses: KCC, Verisk  RLI Inks 30th Straight Full-Year Underwriting Profit

RLI Inks 30th Straight Full-Year Underwriting Profit