The latest 360Value® Quarterly Reconstruction Cost Analysis report gives an overview of current reconstruction cost trends at the national and state levels for the United States from July 2023 to July 2024.

Total reconstruction costs, including materials and retail labor, increased by 5.2% from July 2023 to July 2024. This is a significant increase over cost growth from July 2022 to July 2023 (4.0%) and over cost growth in Q2 2024 (1.6%).

State changes for reconstruction costs

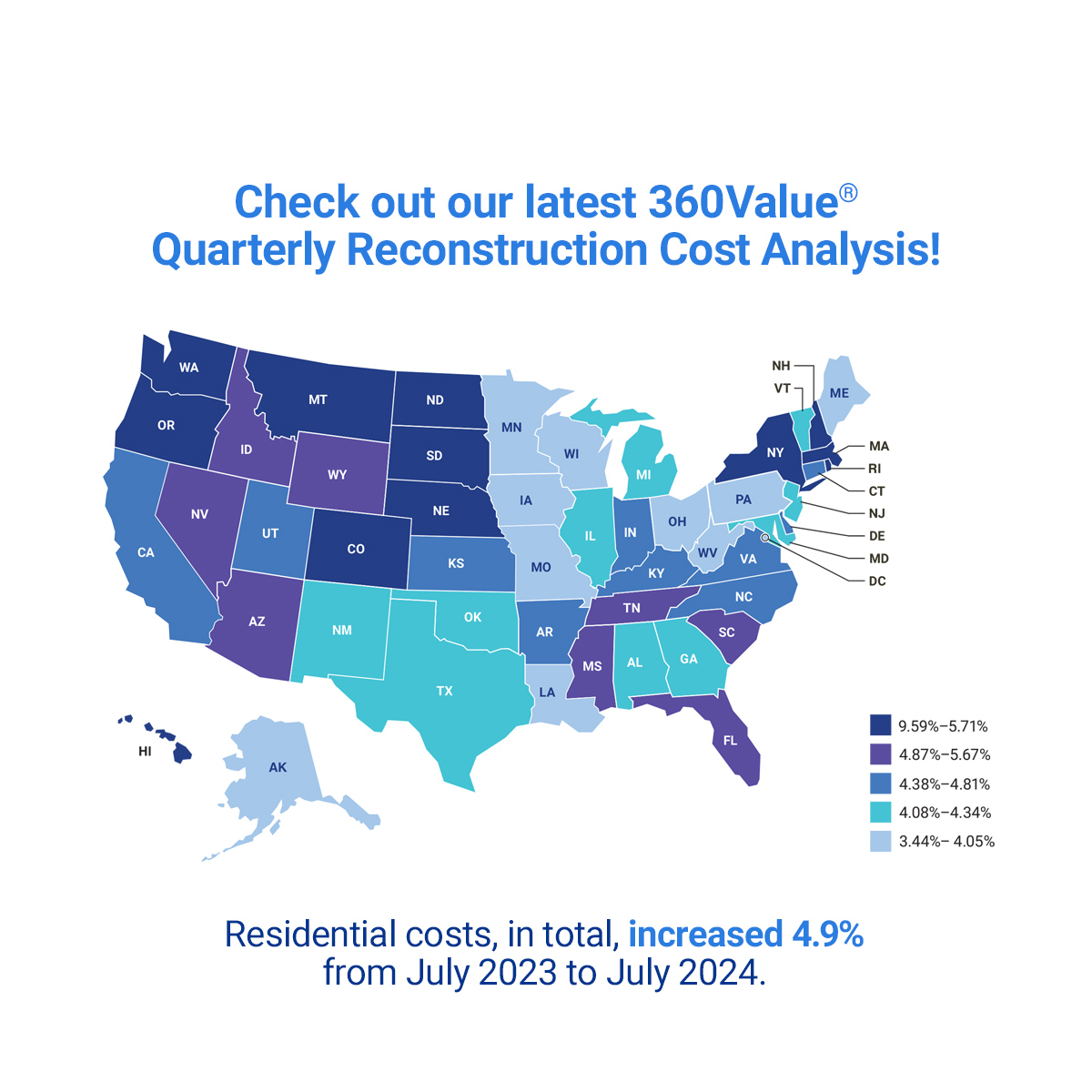

Total residential costs increased by 4.9% from July 2023 to July 2024 and 1.4% from April 2024 to July 2024. Residential reconstruction costs increased year over year in all states.

New Hampshire had the largest increase at 9.59%, followed by Colorado (9.05%) and Nebraska (6.37%). Nevada’s rank changed most significantly, going from the lowest cost increase in April 2024 to the 12th-highest in July 2024; costs were up 5.58% in the state year-over-year.

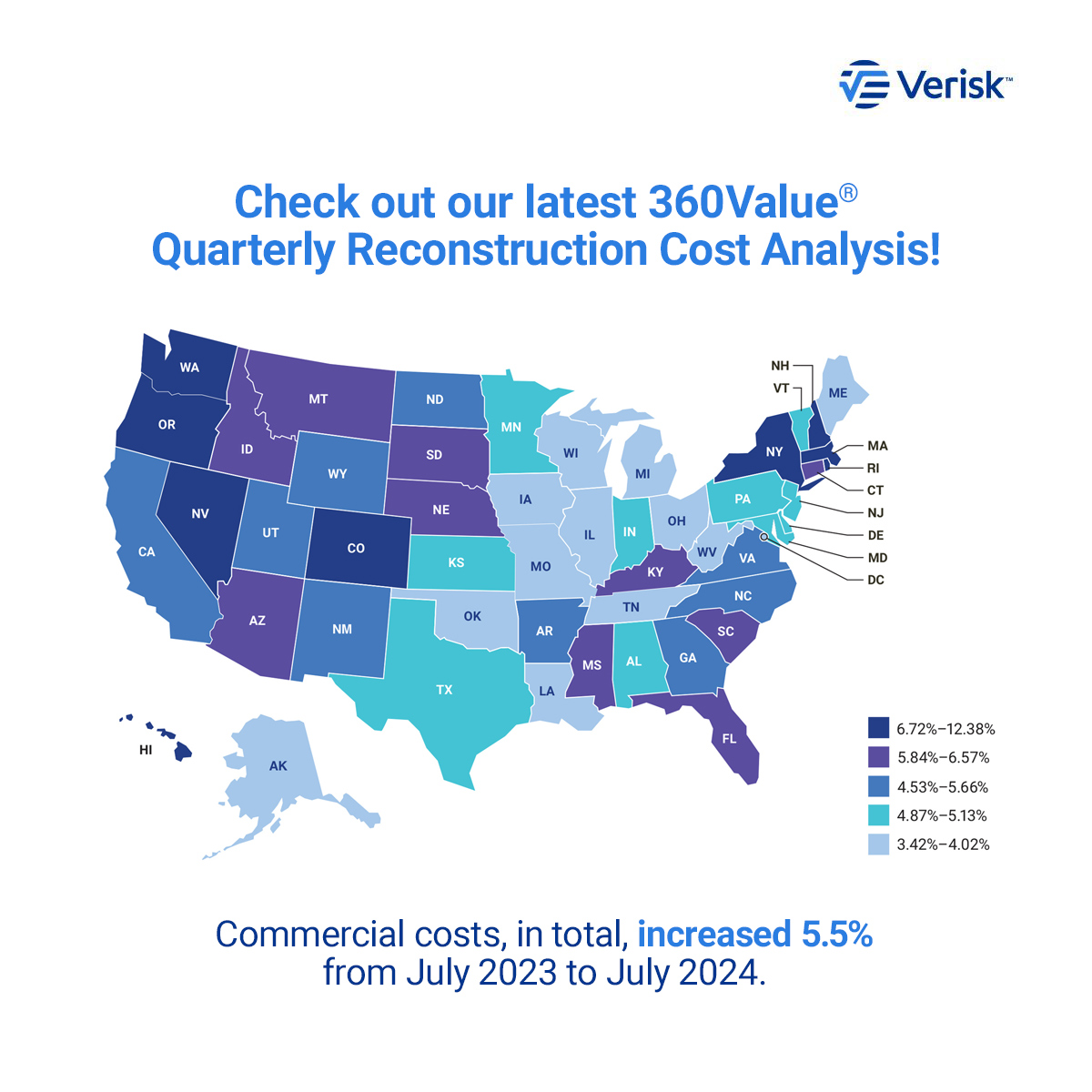

Total commercial reconstruction costs increased 5.5% from July 2023 to July 2024 and 1.8% from April 2024 to July 2024. Commercial reconstruction costs increased by at least 3.42% in all states.

For the third quarter in a row, New Hampshire and Colorado had the two highest year-over-year commercial reconstruction cost increases, at 12.38% and 11.57%, respectively. As with residential reconstruction costs, Nevada had the largest rank jump, going from 46th to 9th place with increases of 6.91%.

Material and labor cost changes

Material costs rose by 4.35% from July 2023 to July 2024, with cumulative lumber cost increases staying above zero all 12 months for the first time in years. Material cost increases are accelerating compared to 2023: growth from January 2024 to July 2024 has already surpassed the total growth for 2023, increasing 1.75% compared to 2023’s total of 1.20%.

Combined hourly retail labor costs increased by 4.3% from July 2023 to July 2024, a significant drop from their 6.2% increase from January 2023 to January 2024. For the first time in years, labor costs rose less than material costs. Year over year, concrete mason rates rose more than five times as much as the next-highest group: 20.4% vs. 4.0% growth for drywall finisher/installer rates.

Market expectations

The Verisk Market Expectations Index for reconstruction costs increased by 2.0% for residential and 2.2% for commercial from July 2024 to January 2025. The most significant indicator was concrete, increasing by 5.6%.

Verisk’s Market Expectations Index delivers forward-facing insights every quarter via CSV download. Get 3-, 6-, and 12-month future indexes for residential and commercial structures based on regional reconstruction costs down to individual ZIP codes.To learn more about the Market Expectations Index, contact Trish Hopkinson, head of 360Value, at trish.hopkinson@verisk.com.

By Trish Hopkinson and Joel Teemant

Preparing for an AI Native Future

Preparing for an AI Native Future  Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid

Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid  How Americans Are Using AI at Work: Gallup Poll

How Americans Are Using AI at Work: Gallup Poll  Modern Underwriting Technology: Decisive Steps to Successful Implementation

Modern Underwriting Technology: Decisive Steps to Successful Implementation