There may be no cure-all for the significant headache of a hard market, but non-rate actions—solutions that don’t require a rate filing— are among the fastest ways to help with profitability.

Personal auto insurers’ margins are under pressure during an unprecedented hard market. From the pandemic to supply-chain issues to inflation to increased regulatory scrutiny, insurance leaders face a combination of challenges unlike anything they’ve seen:

- Pure premium began the year at or exceeding pre-pandemic levels for each of the previous three-quarters.[1]

- As a result, in 2021, the industry’s direct combined ratio broke 100 for the first time since 2017.[2]

- In June, inflation reached a 40-year high, rising to 9 percent.[3]

- In July, auto-body repair prices hit a 44-year high, up nearly 15 percent.[4]

- Meanwhile, some state departments of insurance (DOIs) are withholding or delaying rate increase approvals on new business, leading one of the country’s largest insurers to eliminate all of its California agencies.[5]

How can you improve results while watching expenses and prioritizing limited IT capacity? Consider one of the most promising non-rate-action strategies for insurers and how Verisk innovations can help.

Combat premium leakage with renewal underwriting programs

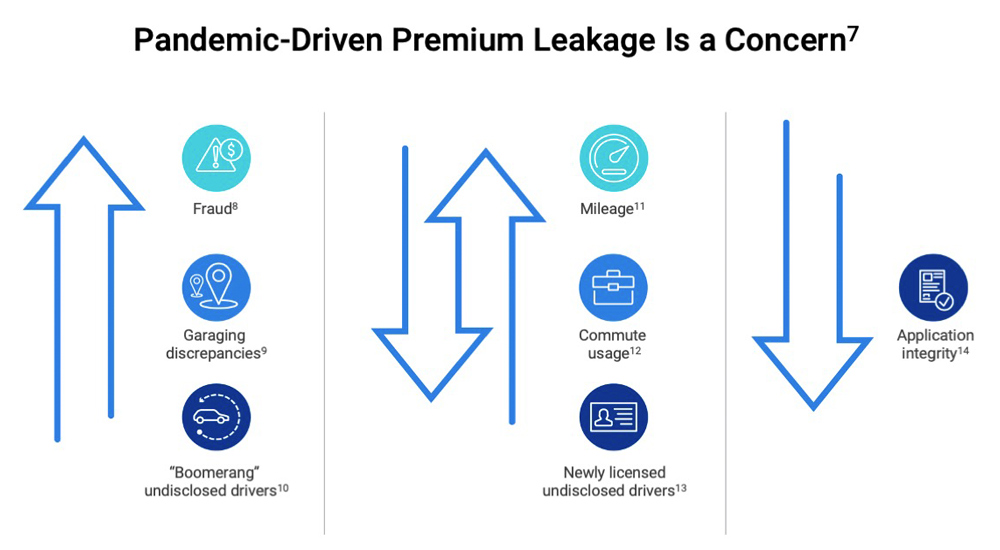

Earlier this year, I offered best practices to optimize personal auto book health.[6] At the top of the list was prioritizing the pursuit of pandemic- and inflation-driven premium leakage.

Here are seven renewal-business “levers” insurers can use to tighten their focus on profitability:

- Pursue premium from discovered drivers not currently on policies

- Verify and true up annual mileage

- Fix garaging discrepancies

- Verify usage such as commute, pleasure, or business

- Identify and rate missing violations

- Confirm other discounts

- Increase nonrenewals when unable to get the right rate for the risk

How Verisk can help

With regulators pumping the brakes on personal auto rate hike requests, renewal underwriting programs are among the fastest ways to keep insurers’ books of business profitable. Verisk can help in two ways:

- A quick batch run of powerful renewal underwriting analytics, with little or no IT lift, can leverage unique data sources such as Infutor, Verisk’s recent acquisition, to discover missing drivers, validate underreported mileage, identify vehicle registration/title issues, and more.

- With Verisk’s turnkey RISK:check® Renewal suite, you can outsource all of the steps, from potential premium leakage identification and analytics scoring to prioritization of missing-premium pursuit and policyholder outreach. This program has an average return on investment of 7:1 in the first year and 22:1 over the policy life cycle.[15]

Get relief to end the year

Some focused effort today can help insurers capture missing premium in 2022 and position them for a better 2023. Further non-rate actions to consider include making smart marketing choices to gain advantages during a time with more shopping and less competition, pausing or closing distribution channels, tightening eligibility guidelines, modifying payment plans, and increasing actions in the initial underwriting period.

We encourage you to connect with your Verisk account executive to consult on potential non-rate actions to help relieve profitability concerns during this hard market, and feel free to reach out to me to discuss your auto book health and Verisk innovations.

Brad Magick, CPCU, leads the management of Verisk products for auto underwriting fraud, application and rate integrity, and book health. These products include Verisk’s RISK:check suite to help insurers mitigate fraud and confront premium leakage—a $29 billion annual problem for the industry. He oversees point-of-sale and renewal solutions, as well as advanced analytics that enable prioritized pursuit of premium recovery and policyholder outreach programs.

[1] Verisk’s Visualize, “Between and Rock and a Hard Market: Solutions for Personal Auto Insurers”, May 5, 2022, and ISO Personal Auto Statistical Plan data for Q4 2021

[2] AM Best Aggregates and Averages, 2017-2022

[3] Federal Reserve Bank of St. Louis (FRED), Consumer Price Index for All Urban Consumers: All Items in U.S. City Average, June 2022

[4] Collision Week,”U.S. Auto Body Repair Prices Up Nearly 15% In July Compared to Last Year,” August 12, 2022

[5] AM Best Information Services, “California Commissioner Withholds Auto Insurance Rate Approvals, Rattles Market,” August 10, 2022

[6] Property Casualty 360, Brad Magick, “How Insurers Can Optimize Their Auto Book Health”, February 1, 2022

[7] Verisk’s Visualize, “2021 Personal Auto Growth and Profitability: Unprecedented in New Ways”, November 22, 2022

[8] Verisk’s Visualize, “Personal Auto Research: Application Integrity Down, Fraud Up”, April 14, 2021; 6.4% of applications had one or more fraud triggers between 2013-2016 vs. 8.5% during 2017-2020

[9] Verisk client research

[10] Pew Research Center, “A Majority of Young Adults in the U.S. Live with Their Parents for the First Time Since the Great Depression”, September 4, 2020

[11] Verisk’s Visualize, “Unpacking 2021’s New Normal in Personal Auto Mileage”, September 14, 2021

[12] Verisk client experience

[13] Ibid.

[14] Verisk’s Visualize, “Personal Auto Research: Application Integrity Down, Fraud Up”, April 14, 2021; 6.4% of applications had one or more fraud triggers between 2013-2016 vs. 8.5% during 2017-2020

[15] Verisk client experience

[16] AM Best Information Services, “California Commissioner Withholds Auto Insurance Rate Approvals, Rattles Market,” August 10, 2022

20,000 AI Users at Travelers Prep for Innovation 2.0; Claims Call Centers Cut

20,000 AI Users at Travelers Prep for Innovation 2.0; Claims Call Centers Cut  Retired NASCAR Driver Greg Biffle Wasn’t Piloting Plane Before Deadly Crash

Retired NASCAR Driver Greg Biffle Wasn’t Piloting Plane Before Deadly Crash  AIG, Chubb Can’t Use ‘Bump-Up’ Provision in D&O Policy to Avoid Coverage

AIG, Chubb Can’t Use ‘Bump-Up’ Provision in D&O Policy to Avoid Coverage  Lessons From 25 Years Leading Accident & Health at Crum & Forster

Lessons From 25 Years Leading Accident & Health at Crum & Forster