Just as the iconic film Back to the Future ingeniously combines the nostalgic and the futuristic, leveraging historical policy insights can lead to forward-thinking solutions and innovative use cases that serve as the “flux capacitor” to propel progress in personal auto insurance quoting.

Much like Doc Brown’s DeLorean, understanding where personal auto applicants have been is key to unlocking predictive behavioral patterns that help insurance leaders realize the vision of where modern buying experiences are going.

Outdated coverage verification solutions are stuck in the present

Many personal auto insurers use coverage verification data such as proof of existing insurance. But they may face challenges identifying predictive behavioral patterns to drive dynamic workflows and refine segmentation on new business.

Analyzing complex historical information for rapid consumption demands deep data—and a major IT commitment. The result: Many insurers simply focus on a snapshot in time when they could do much more with a chronological, 360-degree view of risk.

Verisk’s Coverage VerifierSM (CV) is a comprehensive, versatile, and data-forward solution that can help personal auto insurers segment risks using traditional analytics such as proof of existing insurance. But Verisk’s proprietary structure challenges the industry’s status quo by delivering every policy change for up to seven years, providing unique insights into the applicant’s full transaction history—with no need to solve the riddle of time travel.

Next evolution: Enabling innovative, data-forward, point-of-quote use cases

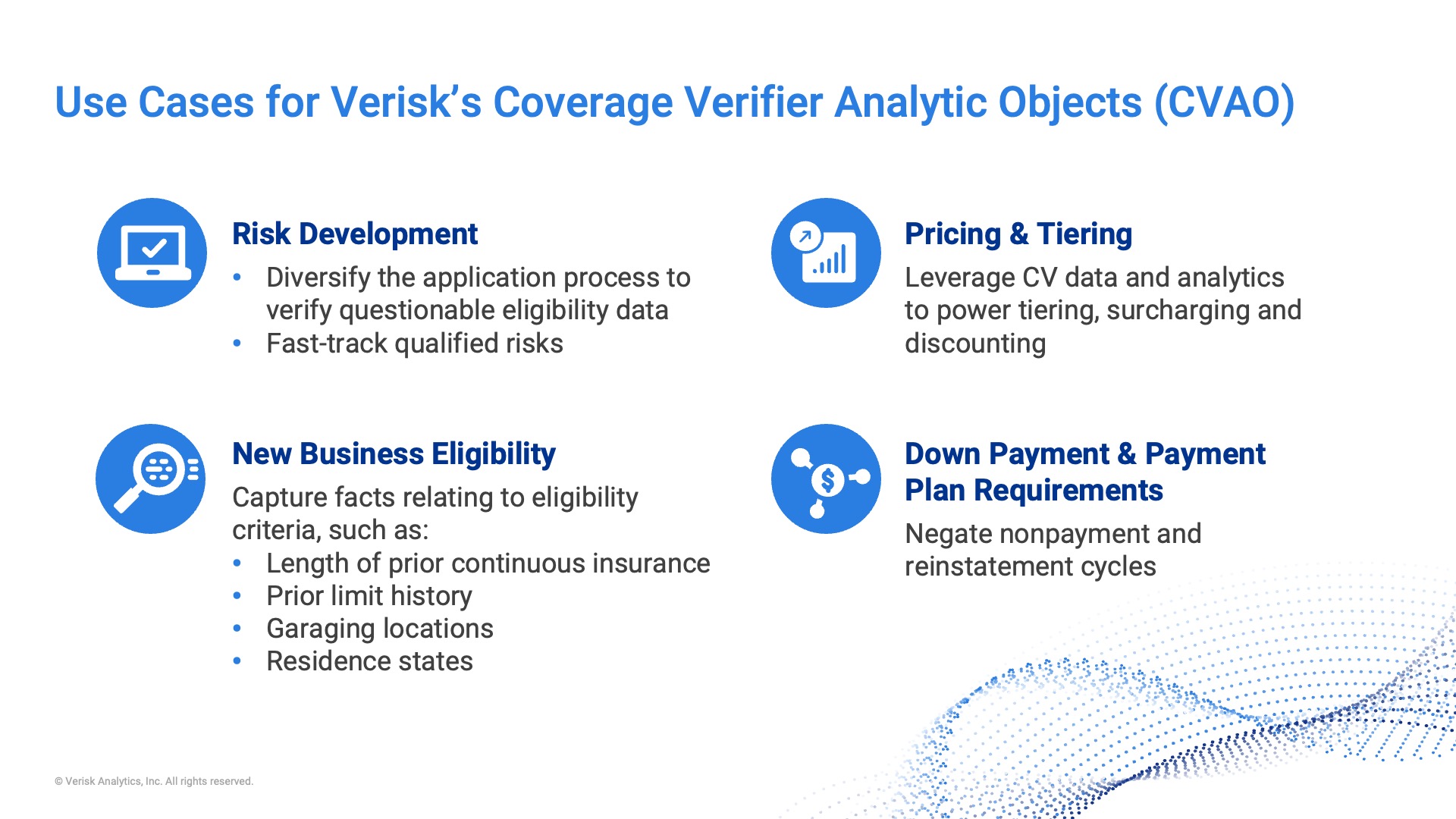

Based on voice-of-the-customer research, Verisk has developed Coverage Verifier Analytic Objects (CVAO), harnessing the power of more than 60 actionable, summarized, simple-to-consume analytics designed to identify critical insured- and policy-level insights upfront. A Verisk study uncovered analytic object attributes with loss cost relativities up to 3 times greater than average, while other objects indicate significantly lower risk on average.*

A new standard for personal auto insurance policy history solutions enables forward-thinking use cases. Unlocking predictive behavioral patterns around such criteria as shopping, payment and endorsement habits, and retention leads to discoveries that can be leveraged at the point of quote. These insights can inform tailored workflows, modernized buying experiences, and improved profitability.

While insurers have tackled some of the above use cases in-house, CVAO helps simplify decisions and brings innovation forward. Insurance-ready analytics can be integrated across many systems with minimal demand on IT resources, and CV’s vast data fuels a growth and profitability engine with diverse insights: What if you could identify an applicant who has had five policies canceled for nonpayment in the past seven years? Would you handle that quote flow differently and perhaps require a down payment or payment plan upfront?

Get the most out of policy history to gain future competitive advantages

It takes holistic customer data, laser-focused segmentation, and actionable analytics—delivered seamlessly at the point of quote—to modernize insurance buying while confidently assessing risk and growing profitably.

Verisk is transforming what’s possible by applying insurance and actuarial expertise to analyze deep data and bring actionable insights to the point of quote and beyond. And to drive future innovation, we’re pioneering research into loss and retention models. In addition, you can simplify CV integration and automate underwriting with LightSpeed®.

To learn more about forward-thinking coverage history analytics, ask your Verisk account executive about a proof-of-concept test or visit verisk.com/cvauto.

Suzette Dela Rama is an underwriting product manager for personal auto solutions at Verisk, including its latest innovation, Coverage Verifier Analytic Objects. She has been with Verisk for 14 years and has held numerous roles within product management, operations, and development. Prior to joining Verisk, Suzette worked as a consultant for major international consulting firms. Suzette’s expertise lies in leveraging data to boost customer profitability and enhancing the client experience.

* Study limited to policy history data available for research. Actual results may vary based on full production data and the risk profile of individual insurers’ books of business, as well as the sophistication of their current rating plan.

Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford

Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford  Modern Underwriting Technology: Decisive Steps to Successful Implementation

Modern Underwriting Technology: Decisive Steps to Successful Implementation  Insurance Groundhogs Warming Up to Market Changes

Insurance Groundhogs Warming Up to Market Changes  Nearly 26.2M Workers Are Expected to Miss Work on Super Bowl Monday

Nearly 26.2M Workers Are Expected to Miss Work on Super Bowl Monday