Reconstruction prices are continuing to rise heading into April 2022. Overall inflation—up 8.5 percent in March year-over-year[1]—and rising fuel prices are driving prices higher as the cost of producing and transporting goods increases.

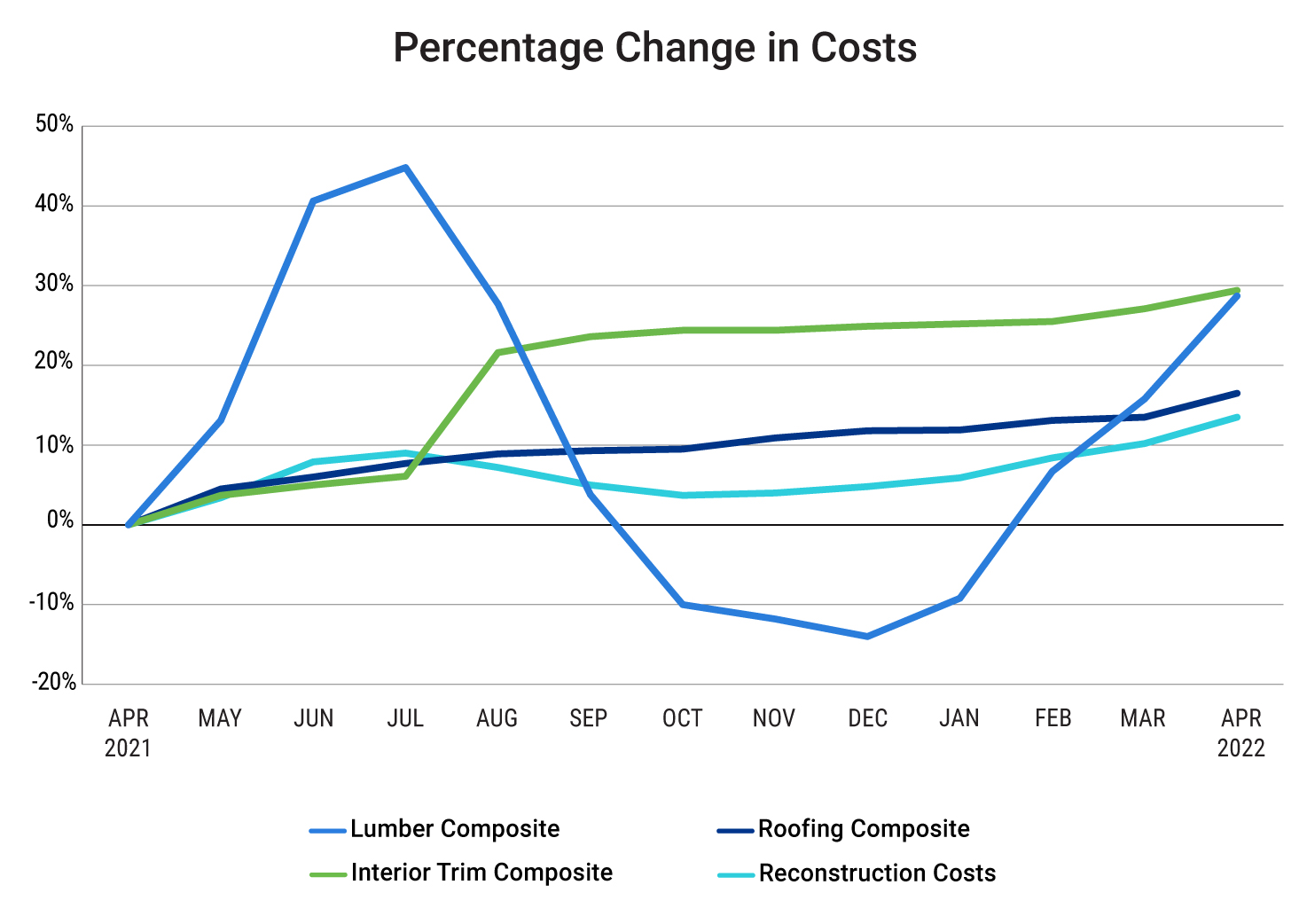

The latest Verisk research reveals that national reconstruction costs in the United States rose 13.5 percent between April 2021 and April 2022, nearly doubling the rate of increase from January 2021 to January 2022, when costs rose 7.2 percent.

Costs are up more than a third—an average of 35 percent— in the past two years since April 2020. By contrast, it took the prior seven years—from April 2013 to April 2020—to see a 35 percent increase.[2]

While volatility has increased with accompanying swings in some categories, a return to pre-pandemic pricing seems increasingly unlikely as inflation continues to spike.

Fuel prices exacerbate price increases

Rising fuel prices, which increased 45.9 percent in March, trickled into nearly every category. Making construction materials is often an energy-intensive process, and materials very often must be transported from factories to job sites.

Combined costs for material composites increased 16.5 percent from April 2021 to April 2022, up from January 2021 to January 2022, when costs rose 7.5 percent. Roofing, which is typically produced from petroleum, rose 16.5 percent year-over-year.

Lumber, which reached historic highs last year before moderating, is again surging, with costs rising 28.7 percent year-over-year in April, nearly triple the rate of increase from three months ago. Lumber-derived finished goods also climbed, including interior trim composite, which increased 29.4 percent year-over-year.

Building and renovation activity remains strong

In addition to the effects of inflation, continuing demand in the homebuilding and renovation market is also influencing the cost of building materials and labor. Year-over-year growth has continued in recent months, with single-family housing authorizations up 2.7 percent in March 2022, an indicator of future housing starts and new home sales. Maintenance costs were up 14.4 percent from a year ago, with remodeling costs increasing at 10.2 percent in March 2022.

Verisk understands the critical importance of up-to-date pricing for labor and materials to help insurers refine their commercial property and homeowners underwriting. Using data from real-world claims and surveys of contractors nationwide, Verisk updates its pricing data monthly to help insurers generate replacement cost estimates that reflect today’s market realities.

To stay up to date on the latest in reconstruction cost trends at the state and national levels, sign up to be notified for the latest 360Value® Quarterly Reconstruction Cost Analysis.

By: Trish Hopkinson, Product Director, 360Value Personal Lines, Verisk

By: Joel Teemant,Product Director, 360Value Commercial Lines, Verisk

By: Barbara Gipson, Senior Director, Personal Property Product Management, Verisk

[1] Consumer Price Index, U.S. Bureau of Labor Statistics, https://www.bls.gov/cpi/

[2] Verisk data

20,000 AI Users at Travelers Prep for Innovation 2.0; Claims Call Centers Cut

20,000 AI Users at Travelers Prep for Innovation 2.0; Claims Call Centers Cut  Retired NASCAR Driver Greg Biffle Wasn’t Piloting Plane Before Deadly Crash

Retired NASCAR Driver Greg Biffle Wasn’t Piloting Plane Before Deadly Crash  Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid

Beazley Agrees to Zurich’s Sweetened £8 Billion Takeover Bid  AIG, Chubb Can’t Use ‘Bump-Up’ Provision in D&O Policy to Avoid Coverage

AIG, Chubb Can’t Use ‘Bump-Up’ Provision in D&O Policy to Avoid Coverage