Entering 2022, we expect insurers will focus on belt-tightening and streamlining operations through creative solutions. Verisk recently held a webinar on improving personal auto insurance performance, featuring strategies to drive efficiencies in underwriting. Here are a few highlights from the event:

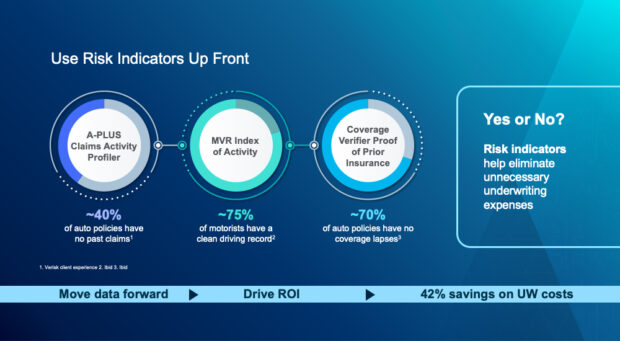

Efficiency Strategy #1: Disrupt the Status Quo with Risk Indicators

What if personal auto leaders could spend less on underwriting reports that show no adverse activity? Risk indicators can provide a “crystal ball” that gives a yes-no indicator of adverse activity for a fraction of the cost of the full detailed report.

This strategy can check multiple boxes: Save on underwriting expenses. Optimize report ordering. Fast-track low-risk applicants for reliable and quick quotes.

Efficiency Strategy #2: Move Data Forward at Quote with Robust Platforms

Modern insurance buyers have less tolerance for a second rate call once they get a quote. And it’s possible to change the economics of quoting to enable one-rate acquisition by leveraging today’s platforms.

Check out the recording at the end of this article to learn how insurers can simplify buying to create connected experiences, increase speed to bind and boost conversion rates, all while lowering fraud and acquisition costs.

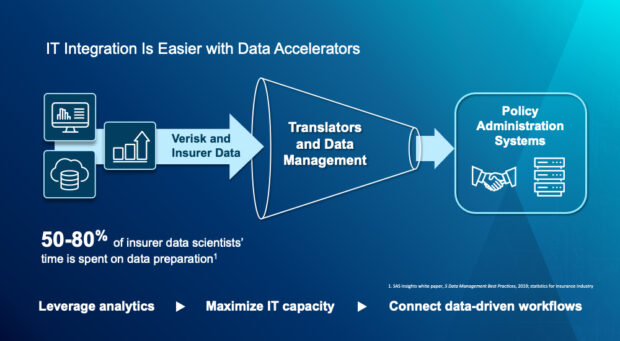

Efficiency Strategy #3: Accelerate Innovation with Scalable Technologies

According to SAS Insights, 50-80 percent of insurer data scientists’ time is spent on data preparation. IT integration can be easier with scalable technologies such as the cloud, translators and accelerators, and data management solutions. These have the potential to accelerate reactions as they multitask data, react in real time, cut costs, and leverage data across the policyholder life cycle.

Efficiency Strategy #4: Streamline Third-Party Reporting with Strategic Outsourcing

There are numerous opportunities to work smarter by outsourcing third-party reporting, including automobile liability insurance reporting, DMV web services, driver liability insurance reporting (SR22s), lender portals and lienholder notices.

This strategy can enable insurers to leverage third parties’ subject matter expertise, drive efficiencies, and focus on more value-added organizational priorities to develop a competitive edge.

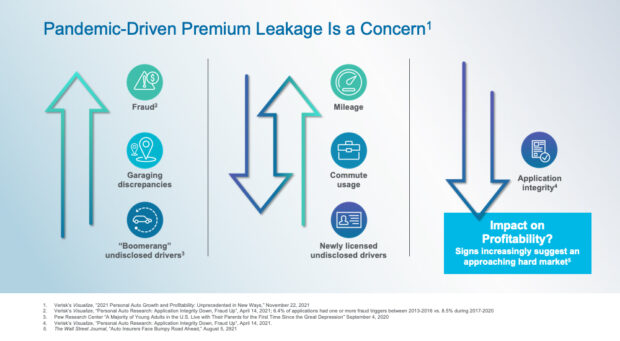

Efficiency Strategy #5: Optimize Auto Book Health

Competing in personal auto’s evolving new normal calls for rapid adaptation. Loss costs returned to 2019 levels in the second quarter of 2021, and Verisk data indicates we’re heading into 2022 with pure premium eclipsing pre-pandemic levels. While the pandemic’s third wave may temporarily pause a few rebounding trends, signs increasingly suggest an approaching hard market for the industry.

Accordingly, renewal underwriting programs may be more critical than ever to keep insurers’ books of business profitable. Young adults are moving back home, miles driven have nearly rebounded to historical patterns, and rate increase filings face continued scrutiny from departments of insurance.

In the webinar, we outlined best practices for addressing auto book health and premium leakage at renewal. Benefits include improving competitiveness with immediate bottom-line impact, confronting pandemic-driven premium leakage, and achieving an average 22:1 return on investment relative to rating integrity solutions spend over the policy life cycle.

Efficiency Strategy #6: Enhance Competitiveness with a Digital Auto Insurance Ecosystem

The webinar also explored leveraging innovation and the benefits of a digital auto insurance ecosystem, such as reducing spend through enterprise licensing and value-focused selection of underwriting tools, plugging into interconnected solutions at scale, and driving strategic vision to the next level.

Insurers need to find the right fit in an ecosystem partnership, so we laid out several factors to consider.

To learn more, we invite you to view the on-demand webinar, Personal Auto Performance: 6 Strategies to Drive Efficiencies.

By: Dorothy Kelly, Jason Polayes, and Stacy Howard

Dorothy Kelly, vice president, leads product management within Verisk’s personal auto underwriting division and is part of a team helping insurers achieve profitable growth through data, analytics, and innovative underwriting tools. She has held leadership and executive roles within claims, underwriting, product management, and business development across personal and commercial lines, including co-founding a successful insurance services startup.

Jason Polayes, senior director of personal lines product management at Verisk, is responsible for product innovation and management strategies in the underwriting and point-of-sale space. Before joining Verisk, he had more than 15 years’ experience working at or with insurers in technology, innovation, process improvement, underwriting, and product management across auto, property, and small commercial lines of businesses, with a focus on new product development and profitable acquisition.

Stacy Howard, senior product manager of innovation-CV Services at Verisk, manages a suite of services supporting compliance reporting among insurers, departments of motor vehicles, and lenders. She has more than 20 years’ experience in the property/casualty industry, with expertise in data compliance and supporting insurers in a business process outsourcing environment.

Insurance Groundhogs Warming Up to Market Changes

Insurance Groundhogs Warming Up to Market Changes  Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford

Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford  Chubb CEO Greenberg on Personal Insurance Affordability and Data Centers

Chubb CEO Greenberg on Personal Insurance Affordability and Data Centers  Berkshire-owned Utility Urges Oregon Appeals Court to Limit Wildfire Damages

Berkshire-owned Utility Urges Oregon Appeals Court to Limit Wildfire Damages