Insurers’ quest for “big data” helps them segment and price risk more precisely, but competitive pressures and ever-expanding digital information sources call for a simultaneous pursuit of cost-efficiency.

Rich, refined data can drive decisions that help auto insurers boost their competitive position. It’s crucial to innovate with an eye to both accuracy and extracting maximum value from underwriting data.

Here are five strategies for making the most out of established and emerging data resources:

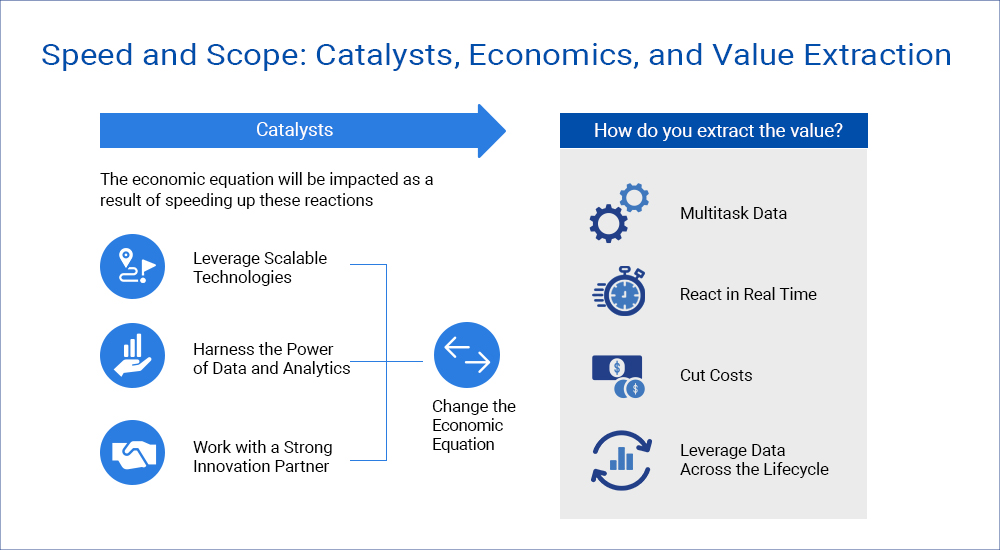

1. Let speed and scope drive a new economic formula

Wider use of scalable technologies can help streamline workflows and enhance products and processes with more accessible customer and policy data.

It’s getting easier to streamline auto insurance underwriting with data translators, accelerators, and single-point-of-contact application programming interfaces (APIs) such as Verisk’s LightSpeed® platform for personal and commercial auto. Contributing, ingesting, and managing first- and third-party data through simplified processes can lead to a different economic equation. Analytical insight from a strong innovation partner can boost responsiveness and lead to a higher return on investment.

Insurers can also realize more value with expanded use cases for underwriting data:

- Use the same information in multiple ways where and when it makes sense.

- Implement processes supporting real-time underwriting and pricing decisions.

- Optimize smart data purchase decisions.

- Leverage total value across the policy life cycle.

2. Put powerful, insurance-ready analytics to work

Quality solutions from a trusted provider can leverage predictive analytics for micro-segmentation of risk, helping to accelerate workflows, raise profitability, and reduce adverse selection. It’s possible when reliable information feeds the analytics—and they’re delivered in insurance-ready form.

For example, telematics-based driving scores can help support more precise point-of-sale segmentation and pricing with detailed measures of driving risk drawn from individual, real-world behavior behind the wheel. Such scores have produced as much as 12 times target-variable lift between the top and bottom segments. Since the score, rating factors, and rules are filed with most state regulators, it may be possible, depending on the state, for customers to have a telematics program online relatively quickly.

Other insurance-ready analytics already in the market include:

- The latest in credit-based insurance scores built on trended-credit modeling

- Plug-and-play, verified prefill to help insurers take on premium leakage with critical information such as commercial auto firmographics delivering industry classifications data, credit scores and years in business

- Insurance and actuarial consulting services to help connect data, analytics, and technology across the value chain, from rating and pricing assistance to guidance for reserving and expansion strategies

3. Gain depth and precision with the latest underwriting intelligence

Competitiveness depends not only on speed but on a true understanding of exposure, driven by robust contributory and proprietary data, predictive analytics, and advances such as artificial intelligence and machine learning. These capabilities should help to reliably connect critical underwriting data and risk points for every insured vehicle, supporting profitable growth and a healthy portfolio across the policy life cycle.

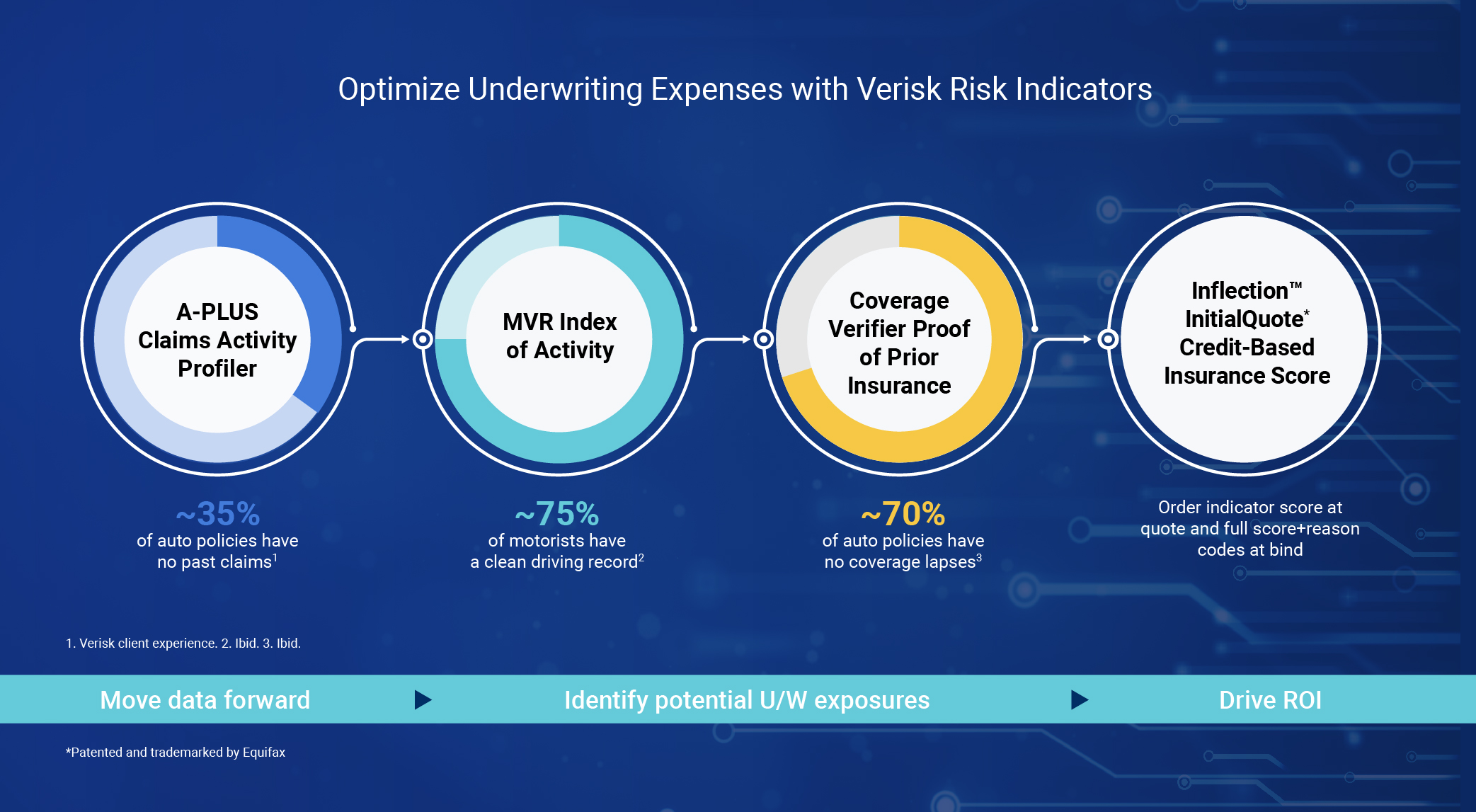

4. Achieve clarity while reducing expenses

Innovative, cost-efficient risk indicators can help contain underwriting expenses when they sit in front of an insurer’s full-report ordering workflow as part of an ecosystem of efficiency.

Verisk has innovated with risk indicators for commercial and personal auto insurers to help insurers cut millions of dollars in unnecessary spending on underwriting reports. Moving data forward in the quote flow can help focus underwriting spend on drivers who are known to have recent adverse activity on their records.

Targeted report ordering offers multiple paths to savings:

- Yes-no indicators of claims activity with A-PLUS Claims Activity Profiler

- A similar tool for recent violations with MVR Index of Activity indicator

- A time-specific indicator of lapses with Coverage Verifier Proof of Prior Insurance

- A credit-based insurance score at point of quote, with the option to order the full score with reason codes when the quote moves to bind

5. Use a digital insurance ecosystem to optimize value

A digital insurance ecosystem rests on strategic partnerships that align an insurer’s core strengths with complementary resources and technology. Plug-and-play solutions can strengthen resiliency, support the flexible embedding of insurance offerings, and drive agile response to on-demand market changes.

An ideal ecosystem partner can:

- Support the full policy life cycle with high-quality solutions

- Deliver interconnected and innovative data sources

- Better use IT capacity and streamline processes with scalable technologies

- Offer enterprise licensing and overall value to help optimize spending

- Help drive a strategic vision to the next level with focused effort

With a strong digital insurance ecosystem, insurers can find new ways to accelerate competitiveness and increase profitable growth.

To learn more about how to embrace these steps, download the new Verisk white paper, Innovation Strategies for Auto Insurance Underwriting: Accelerating Competitiveness with a Digital Insurance Ecosystem.

By Dorothy Kelly and Diane Injic

Dorothy Kelly, Vice President, leads product management within Verisk’s personal auto underwriting division and is part of a team helping insurers achieve profitable growth through data, analytics, and innovative underwriting tools. She has held leadership and executive roles within claims, underwriting, product management, and business development across personal and commercial lines, including co-founding a successful insurance services startup.

Diane Injic, CPCU, leads the commercial auto underwriting solution suite and is responsible for developing innovative policy- and vehicle-level underwriting solutions to help commercial auto insurers increase speed, efficiency, and profitability. These products include Commercial Vehicle Prefill, Commercial Auto Firmographics, RadiusCheck, and a full Driving History Solutions product portfolio. These solutions are especially effective in combating premium leakage and controlling expenses.

Experts Say It’s Difficult to Tie AI to Layoffs

Experts Say It’s Difficult to Tie AI to Layoffs  Modern Underwriting Technology: Decisive Steps to Successful Implementation

Modern Underwriting Technology: Decisive Steps to Successful Implementation  Retired NASCAR Driver Greg Biffle Wasn’t Piloting Plane Before Deadly Crash

Retired NASCAR Driver Greg Biffle Wasn’t Piloting Plane Before Deadly Crash  Insurance Groundhogs Warming Up to Market Changes

Insurance Groundhogs Warming Up to Market Changes