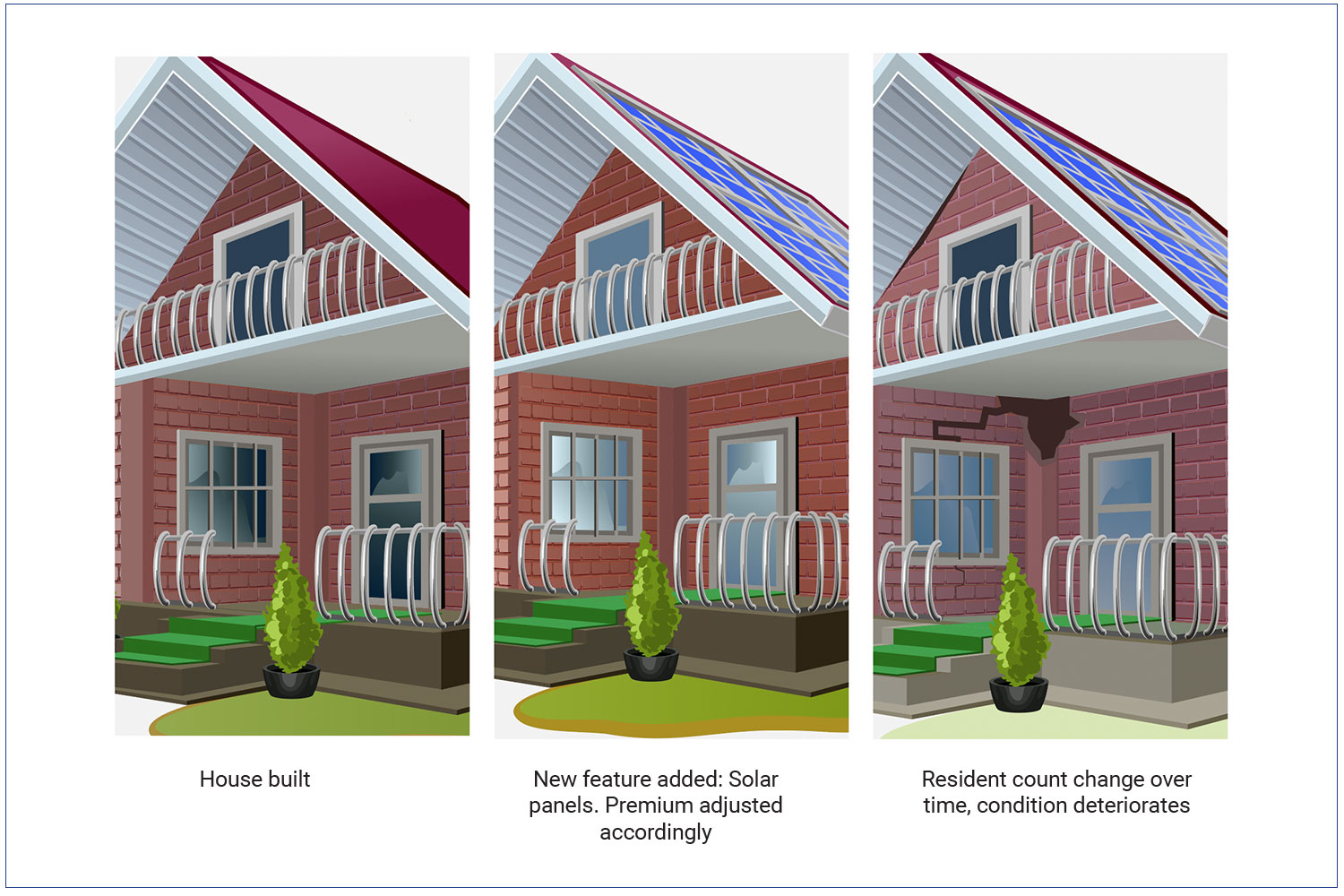

A home can be a living document of its occupants’ stories, changing with their wants, needs, and family milestones. The location and fundamental structure don’t change, but the property’s condition, owners, renovations, or maintenance can add up to an evolving risk picture for insurers to capture.

Robust data and advanced analytics can help insurers verify critical changes to homes throughout the policy life cycle. Verisk’s research points to key findings on current trends and their implications for property underwriting and pricing.

Today’s changes are having greater effects on risk

Recent years have brought a flurry of exterior property changes with potential risk implications. Verisk data shows the largest increases in permitted activities from 2017 to 2021 included solar panels, up 123 percent; pools, up 68 percent; decking, up 26 percent; and secondary structures, up 41 percent. These increases appear to reflect two trends: The effects of increasing regulations and incentives that drove solar installations, and families adapting their spaces to spend more recreational time at home. Combining extensive permit data with aerial imagery can help insurers keep up with these changes from point of sale to renewal.

Insurance to value is a pressure point

The accelerating pace and volume of renovations appear to have increased pressure on many property insurers to monitor changes, thereby maintaining premium alignment and insurance-to-value (ITV) that helps ensure appropriate protection from loss for policyholders. Complicating this task are volatile reconstruction costs—which typically rise 2 percent to 4 percent annually but have spiked as much as 8 percent amid pandemic-induced shortages of labor and materials, especially lumber, according to Verisk data. Robust ITV tools based on localized, frequently updated materials and labor costs can help insurers meet these challenges.

There may be more risk beneath the surface

Finally, there may be hidden risks beyond the reach of conventional underwriting tools. For example, a property’s history and ownership status could raise condition issues that may require inspection. These include risks from vacancies, foreclosures, and changes in ownership status. Nearly one in every 100 properties on an insurer’s book is vacant, according to Verisk’s analysis. These factors may emerge only with a deeper dive into innovative data sources and analytics

Verisk has resources for deeper exploration of these issues.

- Download the white paper, The Life Cycle of a Property: Uncovering property changes and hidden risks to support insurance to value.

- And view a free, on-demand webinar, The Renewal Revolution: Leveraging Advanced Analytics to Help Capture a Home’s Evolving Risk Profile.

Alli Sarfaty, Product Manager, Personal Property, Underwriting Solutions, Verisk

Barbara Gipson, Senior Director of Personal Property Product Management, Underwriting Solutions, Verisk

Trish Hopkinson, Product Director, 360Value Personal Lines, Underwriting Solutions, Verisk

Preparing for an AI Native Future

Preparing for an AI Native Future  What Analysts Are Saying About the 2026 P/C Insurance Market

What Analysts Are Saying About the 2026 P/C Insurance Market  How Americans Are Using AI at Work: Gallup Poll

How Americans Are Using AI at Work: Gallup Poll  Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford

Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford