Buying is changing.

If we examine what is happening in retail, we can get a glimpse of what customers will be wanting in insurance. Coming to big box stores or a grocery store near you — pick up your item, scan it, and walk out of the store. Your cart or your phone will keep the tally and make the transaction for you.

“Transactionless” transactions could become the norm. (Isn’t this the role of embedded insurance?)

Then there is the new world of guided customer experiences, where everything you need for a dinner or party is picked and delivered without the need for your attention to detail. Is insurance prepared to help customers change their coverage seamlessly as they shift needs?

In-store, AI-generated human-looking bots (on video screens) will soon be in the aisles where you commonly need help in getting questions answered. Is insurance ready to take the next step with personal assistance in finding the right products? How personalized can we get with our assistance?

In our industry, many thought that online purchasing and streamlined customer experiences were the epitome of digital engagement, but it turns out that guided experiences with AI and GenAI tools will force insurers to change everything from insurance product development to servicing, claims, and even channel design. Traditional products and channels won’t go away, but with growing risk, protection gaps, and customer demographics, there is a growing demand for alternative options that can leverage automated guides and artificial intelligence.

Value-based pricing is on the rise in every area, as seen by electronic shelf tags where the price can change multiple times daily to test the market. Product and service marketing will change as well, as data-based advertising matures, and customized ad experiences move from phones and computers out into the places we walk and shop.

Insurers, already challenged by pricing issues created by rising risk, claims costs, and more, are now finding themselves competing on price as customers look for alternative options more than ever before. Many insurers are now considering technologies that will engage and provide customers with options to meet their personal risk and financial parameters, such as usage-based insurance, on-demand insurance, and telematic-enabled products.

Ready for it?

Some insurers are ready. Some are preparing. Others have not started or paused plans. Some insurers are pulling out of markets and pulling back from business and technology transformation to stave off losses.

The problem is that future growth necessitates investment in transformation and innovation in insurance products and an ever-improving selection of channels. In Majesco’s 2024 report, Realignment in Insurance: Strategic Priorities for Success, we found that the steady progress in the right direction has stalled in some areas as traditional products and channels are still receiving greater priority and focus.

Product trends signal an untimely scaling back in innovative product development.

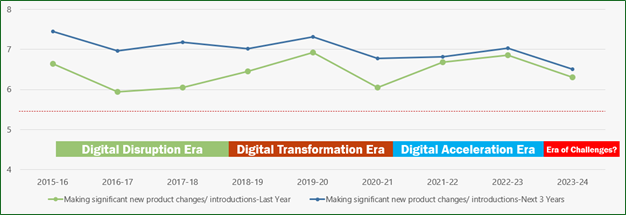

The gap between new product changes for last year as compared to the next three years has been quickly closing the last few years, reflecting risk and customer demands for new products that align with a changing market and customer demographic as seen in Figure 1.

The challenges of insurer’s business results and today’s marketplace seem to be keeping a focus on existing traditional products rather than new innovative products. Whether it is a focus on getting rate changes approved for existing products and markets, determining where to stay and exit markets or pulling back on investment in new technology that is needed to rapidly launch new products, the decline reflects a focus on today’s operations at the risk of tomorrows.

Figure 1: Insurers’ prior-year and planned strategic activities in developing new products

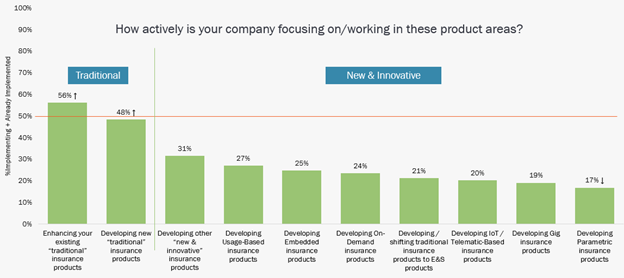

Figure 2, below, highlights the strong focus on “traditional” products rather than new, innovative products. Many of the new products are in a planning or pilot phase which is above 25%. However, the remaining are still in the consideration phase, indicating interest, but a lack of action.

Given the significant changes in risks, customer behaviors, customer needs, and economic conditions, the primary focus on traditional products is likely misaligned to what customers are needing and where the market is heading. As an example, the J.D. Power 2024 U.S. Insurance Shopping Study,SM highlights that a notable increase in premiums combined with lackluster customer satisfaction scores is incentivizing insurance customers to go to market for a new policy more than ever before, with nearly half (49%) of U.S. auto insurance customers actively shopping. In addition, the growth in the E&S market of 17.5% in 2022 following 28.8% growth in 2021, highlights a red-hot market for MGAs and E&S.[i] With the growing volatility of risk, insurers pulling out of markets, the need to raise rates, and increased insurance exposure across many lines of business, insurers need to consider alternatives to attract and retain customers.

Likewise, inflationary, profitability, and competitive conditions in the insurance marketplace require insurers to evaluate their products, particularly as they relate to:

- Pricing

- IoT-enabled products

- Gig economy offerings

- Parametric insurance

- On-demand insurance

- and Usage-based products

All of these product types and business growth levers are focused on providing more cost-effective risk coverage that customers need and help to close the protection gap. They sit in the sweet spot of balancing risk, profitability and pricing and can effectively address the current industry-wide decline in customer satisfaction.

According to the J.D. Power 2023 U.S. Auto Insurance StudySM, released mid-2023, satisfaction with auto insurance dropped 12 points (on a 1,000-point scale) between 2022 and 2023, the largest decline in the last 20 years and as noted above dropped further this year. J.D. Power indicated the decline was driven by lower satisfaction with the price customers pay, representing a 25-point decline in 2023. The report suggests that this satisfaction decline is driving an increase in usage-based adoption, helping customers manage costs. They found that customers new to an insurer have a high UBI participation rate of 26%.[ii]

Figure 2: Insurers’ level of activity in traditional and new product areas

Interestingly, when digging deeper into the Strategic Priority report survey results, half of the 31% of insurers who said they are implementing or have already implemented other “new & innovative” products — are currently or have already implemented On-Demand, IoT/Telematic-based, and Usage-Based insurance products, suggesting these are some of the top product innovation areas of focus.

Channel and experience trends point to an untimely loss of insurance focus.

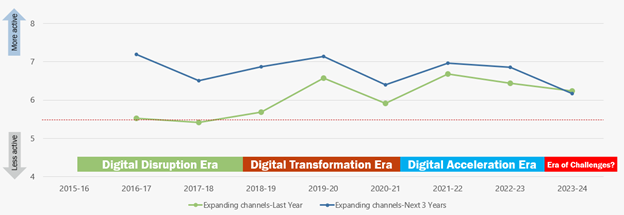

The trends in distribution channel expansion in the prior year and expectations for the next three years are like the other strategic activities: Both peak just before COVID, drop in 2020-21, rebound briefly, and then decline this year due to the confluence of challenges. The gap between the two has been converging since their peak in 2019-20.

However, this year for the first time, expectations for the next three years are slightly lower than the level of activity last year. This is likely similar to new products, that insurers are hunkering down with the current business model, including channels rather than investing in the new as they address financial and market challenges. This is unfortunate and short-sighted and would limit market reach and growth, not just for today but for the future. Some insurers are investing to establish a market presence for growth, putting them in a favorable position for the future.

Figure 3: Insurers’ prior-year and planned strategic activities in expanding distribution channels

With the increasing competitive challenges to attract and retain customers, insurers must develop and utilize a broader distribution ecosystem that engages customers when and how they want…putting the customer first. If distribution channels are easy to use with products that are easy to understand, then insurance has an opportunity to grow through a friction-free multi-channel distribution.

In today’s interconnected world, insurance must play across a distribution spectrum of channel options, expanding channels and partners to reach customers when, where, and with whom they want to buy insurance. In our survey, insurers are moving to this multi-channel, inter-connected world as shown in Figure 4 below.

The combination of a company website and direct channels top even agent channels by over 20 points. This reflects the gradual shift to direct as digitalization takes hold within the industry and a younger generation becomes the dominant buyer group in the market.

Affinity, third-party, and MGA channels all top over 50% and are relatively close. These channels focus on trusted partnerships and relationships to sell insurance products and have gained momentum. According to Conning’s 2023 annual MGA report, direct premiums written rose by 24% as compared to 2021 resulting in MGA growth outpacing the overall P&C market by 10.5% in 2022.[iii]

Embedded insurance, another hot topic in the industry, continues to gain momentum. Combined, 41% are working with insurance and non-insurance partners, highlighting continued growth.

A Swiss Re report based on discussions with a peer group of major insurers, notes the vision for Embedded Insurance 2.0 (EI 2.0) is “More and better protection baked into the everyday lives of everyone.” The report indicates that by 2032, EI 2.0 could account for around 16% of total global insurance distribution or $1.5 trillion of GWP, and for the US it could reach $150 billion in five years, rising to $500 billion by 2032. In addition, the potential to increase the size of the overall insurance market (as a percentage of global GDP) could add $1 trillion of net new GWP by the end of the decade by leveraging the reach of digital platforms. That reach can help close the protection gap of individuals and businesses.[iv]

Figure 4: Insurers’ level of activity in developing/expanding channels

The survey this year highlights the growing distribution ecosystem used by insurers to rapidly reach more markets, potential customers, and current customers by offering them purchase and service options through this growing array of channels, connecting with customers when and how they want to.

So, when it comes to insurance channel development, perspective is key. Yes, insurers are pursuing new channels for distributing products and many of them are finding success. The concern is that the industry is trending lower in its overall interest. Those who have begun these crucial shifts may see their way to the finish line, but those who haven’t started (and need to), may pause too long in their consideration. Insurers need insurance product innovation, expanded channels, more partners, and additional placement as a part of the new customer experience. Insurers must seek alternative channels to offer their products to expand market reach and improve the customer experience … removing obstacles to purchase and making it easy to do business with them.

Are insurers still speaking the customer’s language?

As other industries and businesses keep innovating to expand market reach and improve the customer experience, insurers must keep in step or advance in directions that set the pace. And technology is a key to advancement.

Today’s technology talks. It warns. It guides. It entertains. It answers some detailed questions. All of this means that insurance can be intelligent. It can find insurance gaps. It can make better suggestions. Insurance products and channels both can advise and engage in the language of the customer. As data and analytics continue their rapid use and advancement, insurers have more tools than ever before to create a new business model that aligns with a changing customer and market. Swiss Re’s prediction for embedded channels bringing in additional GWP can help interpolate what will happen when we lower the barriers to purchase, letting customers buy without the challenges of traditional transactions.

Majesco is proactively preparing for these moments by designing that embed the use of AI and GenAI to lower nearly any barrier of an insurer’s existing business model, empowering them to redefine the business and technology that easily adapt to a continuous changing marketplace. is a key component in our next-gen intelligent, native-cloud solutions, bringing insurers embedded, advanced data and analytics combined with engaging digital experiences.

Learn more about the application of GenAI in our informative podcast, Unleashing the Power of GenAI, our mainstage panel with Microsoft and our customer Tokio Marine at InsurTech Insights, our most recent webinar Unleashing the Future: Transforming L&AH Insurance with Intelligent Core, or read our recent Thought Leadership report, Realignment in Business Models, Products, Value-Added Services, can chart a new course for your business.

By Denise Garth

[i] “U.S. MGA Market Grows Swiftly, Exceeds $85 Billion in Premium in 2022,” Conning, July 24, 2023, https://www.conning.com/about-us/news/ir-pr—2023-mga

[ii] “Auto Insurance Customer Satisfaction Plummets as Rates Continue to Surge, J.D. Power Finds,” J.D. Power press release, June 13, 2023, https://www.jdpower.com/business/press-releases/2023-us-auto-insurance-study

[iii] “U.S. MGA Market Grows Swiftly, Exceeds $85 Billion in Premium in 2022,” Conning, July 24, 2023, https://www.conning.com/about-us/news/ir-pr—2023-mga

[iv] “Embedded Insurance Peer Group Report June 2022: How and why insurers should increase investment in ‘Embedded Insurance 2.0’,” Embedded Finance & Super App Strategies 2022, June 2022, https://www.swissre.com/dam/jcr:0a92d176-548a-4b2a-9b27-6f83548987b9/Embedded%20Insurance%202.0%20-%20Incumbent%20Strategy%20-%20International%20Peer%20Group%20Report%20-%20June%202022.pdf?ref=jaredfranklin.com

Lessons From 25 Years Leading Accident & Health at Crum & Forster

Lessons From 25 Years Leading Accident & Health at Crum & Forster  RLI Inks 30th Straight Full-Year Underwriting Profit

RLI Inks 30th Straight Full-Year Underwriting Profit  What Analysts Are Saying About the 2026 P/C Insurance Market

What Analysts Are Saying About the 2026 P/C Insurance Market  20,000 AI Users at Travelers Prep for Innovation 2.0; Claims Call Centers Cut

20,000 AI Users at Travelers Prep for Innovation 2.0; Claims Call Centers Cut