Knowledge is no longer just power — it’s business gold. Advanced analytics in insurance, when coupled with the right data, can identify new customers, drive operational improvements, or create better claims outcomes. We’ve moved from reporting and business intelligence dashboards to analytic solutions that can adapt and organize data based on what it is seeing and experiencing. It’s a quantum leap. Data’s new level of intelligence answers many of the questions that we’ve always had, but now has the ability to act on the answers. Today’s analytics – BI, AI/ML and GenAI-capable solutions turn insurance data and analytics into knowledge and knowledge into actions, which means that decision and operational improvement is happening at the same time as workload reduction. From a business model standpoint and an operational perspective, insurers have a lot to be excited about.

The flip side of the excitement, however, needs to be tenacity. If insurers don’t grasp the full potential and impact of today’s data usage or if they delay plans, thinking that timing isn’t critical, they will find themselves irretrievably behind. All indicators (and most consulting and rating organizations, such as McKinsey and AM Best) point to the fact that companies that win the data game, win the whole game. The difficulty is that today’s insurance data and analytics game can’t be won by yesterday’s data strategy. It needs to be understood within a whole new framework.

Insurers who have made great strides with their EDW, business intelligence, and reporting may be tempted to think they are exempt. But that is a fallacy. Today’s data and analytics strategy and solutions must address the full scope of solutions from data lakes to business intelligence, AI/ML models they build or partner with, and most importantly now GenAI – and embedded in the operations to completely new things that drive operational effectiveness, productivity, innovation, profitability and growth.

According to a recent McKinsey article, “Four technology shifts, in particular, have enabled companies to create new data products faster and less expensively than ever.”

These include enhanced data management efficiency, Generative AI, increased access to real-world data, and the growing use of internally created or integrated data products.[i] This has generated a whole new business model that will rapidly separate Leaders from Followers, as Majesco pointed out in its Core Systems report, Realignment in Insurance: Legacy Core Impact.

“Leaders are embedding insurance data and analytics into their solutions – from underwriting to core, to digital and more, providing an accelerant to the industry’s transformation.”

Mind the gap!

For those familiar with the London Underground train stations, the phrase “Mind the gap” will mean something. It’s the audio message that plays at every stop, warning passengers to not get caught in the gap between the train and the platform. The principle is universally important. Gaps can be hazardous — in insurance, in business, and in information. As we look further at just how integral the new data intelligence is to the full insurance organization, we can see how a dangerous competitive gap might exist and grow.

To help us assess and recognize the existing gap, Majesco surveyed insurance executives on their current priorities, development initiatives, and plans for bringing intelligent data into the enterprise. We share some of our findings below. For the full picture, be sure to read the Majesco Thought Leadership report, Realignment in Insurance: Legacy Core Impact.

Prioritizing the business model that integrates intelligence

An October 2023 Forbes article notes that the digital transformation of insurance companies has increased speed, efficiency, and accuracy across every branch of insurance.[ii] AI and Generative AI in insurance, for example, significantly accelerates digitization for insurers. It can assist companies in assessing risk, detecting fraud, improving operational efficiencies and productivity across workflows and business processes. AI and GenAI are revolutionizing the insurance industry by enabling automation, optimizing claims, and developing effective customer engagement strategies, and creating efficiency.

And The Future of AI Insurance report by Reuters highlights how insurers are investing in and integrating AI, particularly GenAI in insurance, to transform how they manage risks, optimize operations, and serve customers. However, the report reveals a stark divide across the industry, with those embracing AI reaping benefits while others risk falling behind.[iii]

Data and analytics are foundational to the industry and have been a stalwart for decades, through reporting, business intelligence, and more recently, predictive models. Today, the rapid adoption of AI, ML and now GenAI has turned data and analytics from a long-term strategy of incremental investment into a near-term reality and a must-have that is upending and accelerating the focus of investment and adoption.

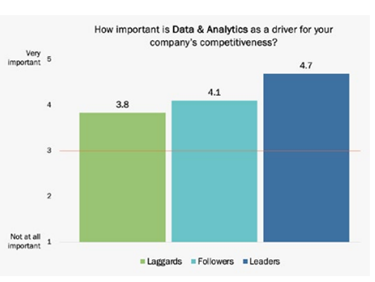

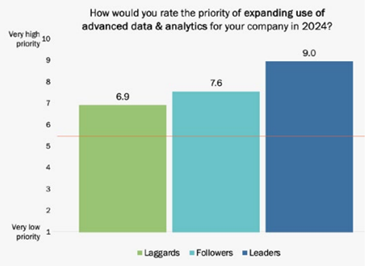

Majesco found an interesting contrast in the importance and priority of data and analytics between Leaders and Followers and Laggards, with Leaders outpacing the others by 20%-30% in our research as reflected in Figure 1. The gap will accelerate given the pace of experimentation and adoption and the potential for advanced analytics to enable insurers to leapfrog the competition.

This prioritization is truly the key to winning the data game in order to make the organization more intelligent. Insurers once saw data as an enhancement, then as “fuel” for growth. Now insurers may see data increasingly as the synapses that link all facets of their business intelligence — the one operational mind that oversees processes as it learns. The new intelligence represented by data’s new value will also help business users to work together more efficiently and effectively.

Figure 1: Importance of data & analytics, by Leaders, Followers, Laggards

The new intelligence utilizes ever-expanding data sources

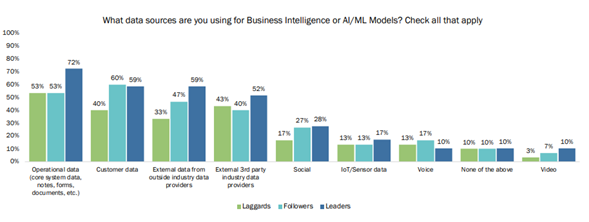

Expanding sources of data, as pointed out earlier, is crucial to the effective use of advanced data analytics for insurance. The survey highlights the dominant four sources used by insurers as operational (60%), customer (53%), data from outside the industry (46%), and data from industry providers (45%), as seen in Figure 2. Other data sources include social (24%), IoT/sensor (15%), voice (13%), and video (7%).

What’s important to note from the chart, is the difference between Leaders versus Followers and Laggards in the sources of data where they are leading, sometimes by nearly 40%-50%, in use of the sources except for voice data. Leaders are executing a strategy of pulling in many different sources of data to leverage and use with AI and ML models to empower their business across the value chain.

Most interesting is their use of operational data, indicating they have focused on their data governance and technology foundation, such as a Data Lakehouse, to effectively access all operational data in real-time for analysis and decision-making, providing a significant competitive edge.

Figure 2: Data sources used for BI or AI/ML models, by Leaders, Followers, Laggards

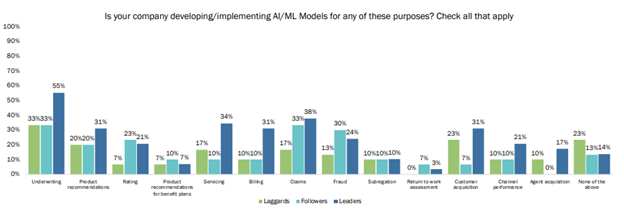

The development of AI/ML models tracks with industry top-of-mind issues, including underwriting (40%) and claims (29%) which together impact operational results and profitability, as reflected in Figure 3. A large number of use cases fall in the range of 17%-24% with more niche-focused areas.

Figure 3: Development of AI/ML models, by Leaders, Followers, Laggards

GenAI unlocks data’s value to bring intelligence into the organization.

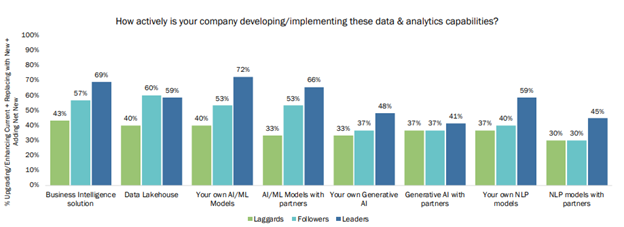

The release of ChatGPT (GenAI) in late 2022 unleashed massive interest, experimentation, creativity, and productivity potential, not just for GenAI but for NLP and AI/ML models as well. In Figure 4, we see how that is playing out with Leaders.

Leaders are developing and implementing the solutions that unlock the power of the data. They see the power of GenAI, NLP, and AI/ML models. They understand that they need it, will help differentiate them, and are utilizing both in-house and software partners to help them implement them.

Once again, Leaders are leaping forward faster than Followers and Laggards, particularly around AI/ML models, NLP models, and GenAI, giving them a competitive edge.

Followers and Laggards must realign their priorities to keep in step with Leaders, with partnering the most likely option. They will need to seek software partners who increasingly embed advanced analytics, both AI/ML, NLP, and GenAI, into their solutions, allowing them to leverage the value to not just keep pace with the competition but to surpass them. The choice in software partners and criteria is now much different with embedded analytics. The partner should have a holistic data and analytics strategy that allows access to all operational data in real-time to a data lake, embeds business intelligence, AI/ML models, and GenAI across the workflow and processes to provide maximum value to the operation.

GenAI has generated more interest, rapid development, and implementation than even the introduction of the Internet or mobile phones, suggesting the overall business impact is high.

Figure 4: Development of data & analytics capabilities, by Leaders, Followers, Laggards

The recent approval of the NAIC model in December 2023 for insurer use of AI presents a new regulatory and compliance requirement. We found that large companies are more focused on putting in place a program with rigorous control processes and monitoring of their AI partners than others.[iv] With the adoption of the new regulations, all insurers will need to focus on this and lean into their software partners for support. Data, effectively used, will always have ground-breaking, business-changing, and mind-enlightening value. Advanced analytics, particularly AI/ML, NLP, and GenAI are poised to be a game-changer for insurance.

Mind shift: transforming the organization with the new intelligence.

Insurance is an industry built on data. We have utilized data and analytics to assess risk, protect, grow, and improve. Our industry and people represent some of the finest minds in the world. It makes sense for insurance to aggressively move to the next level of analytics, embedding them in the operations to bring intelligence to bear upon the science we have already created. That’s the fascinating part about the application of GenAI and AI/ML within insurance. We now have tools that can take us where we have always wanted to be the best: assessing, recommending, selling, predicting, underwriting, rating, and operating. What it takes is a path forward and the drive to move quickly, not hesitating in making this decision.

Majesco anticipates and develops the solutions insurers want and need to make them competitive. We embedded our data and analytics, including access to all the operational data real-time in our data lake, business intelligence including dashboards in the workflow, embedded Majesco AI/ML models, access to our partner AI/ML models, and GenAI on every screen across each solution to accelerate our customers path forward to intelligence. Majesco Copilot brings insurers an advanced experience that is unmatched in its effectiveness and usefulness to business users – performing tasks 10-15x faster with less effort to improve expense ratios, decrease per unit costs, and enable operational optimization, improved product pricing, and competitive positioning.

Your organization and teams can now create a new business model to meet the changing world of insurance head-on with the intelligent technology you need.

Is it time for you to capitalize on Majesco’s intelligent solutions for intelligent insurance? Find out more by viewing our P&C and L&AH webinars, Building the Intelligent P&C Core: Empowering Architecture with Embedded Analytics & GenAI or Unleashing the Future: Transforming L&AH Insurance with Intelligent Core.

By Denise Garth

[i] Libarikian, Ari, Markus Berger-de León, Kayvaun Rowshankish, Vishnu Kamalnath, From raw data to real profits: A primer for building a thriving data business, McKinsey & Co, July 18, 2024

[ii] Magyar, Judith, “How AI Is Revolutionizing The Insurance Industry,” Forbes, October 12, 2023

[iii] “AI Investment Trends for the Insurance Sector,” Reuters Events Insurance Insights, February 6, 2024

[iv] Moss, Teresa, “NAIC approves model bulletin for insurer AI use,” RDN Repairer Driven News, December 13, 2023

How Americans Are Using AI at Work: Gallup Poll

How Americans Are Using AI at Work: Gallup Poll  Insurance Groundhogs Warming Up to Market Changes

Insurance Groundhogs Warming Up to Market Changes  Allianz Built an AI Agent to Train Claims Professionals in Virtual Reality

Allianz Built an AI Agent to Train Claims Professionals in Virtual Reality  Nearly 26.2M Workers Are Expected to Miss Work on Super Bowl Monday

Nearly 26.2M Workers Are Expected to Miss Work on Super Bowl Monday