A few weeks ago, German shoppers at supermarket Rewe, in Cologne, began filling their carts and walking out of the store without checking out. Rewe is testing a process pioneered by Trigo, a tech provider that has consolidated cameras, scanners and AI technology, in order to virtually watch shoppers shop and leave. It then charges them for their purchases.[i]

Digital tech and automation will run the future. “Pay-as-you-live” technologies, “Protect-as-you-go” and “Prevent-as-you-live” insurance is beginning to command corporate attention. Today, customers pay right where they are, often without cracking a wallet open. They are asking Alexa to do their research, buy and pay. They are talking to their cars and their cars are intermediating transactions for them using voice recognition and digital connectivity. In September of 2020, Juniper Research released its report on in-vehicle payments, predicting $86 billion in payments in 2025 through embedded vehicle systems, up from $542 million in 2020.[ii]

Meanwhile, phone apps are keeping track of what we eat, how we sleep, how we exercise, capturing our tastes in music and they are anticipating our next steps and suggesting responses in an attempt to save us time through automation. Wearables are watching us walk and insurance like John Hancock Vitality is incentivizing healthy behavior.

Is the world actually spinning faster or does it just feel like it?

In one year, we have hit warp speed on digital developments with some insurers flying ahead of the industry and others still back at the starting line, asking engineering if it’s okay to engage the hyper drive.

Reality: The world of digital engagement IS spinning faster.

According to a recent KPMG survey, 48% of CEOs say that the pandemic has sharply accelerated progress in creating seamless digital customer experiences.[iii] In the same group, 54% are investing more in customer-centric technology. This is happening at the same time that many companies have struggled to keep pace with the demand for digitization, particularly as customers have accelerated their adoption of digital in nearly all aspects of their life, as shown in Majesco’s customer research. Majesco recently released its latest thought-leadership report, Digital Insurance: The Inflection Point, a deeper dive into the 2021 Strategic Priorities research looking at today’s digital and competitive landscape for insurers in light of a COVID-fueled acceleration.

Pre-COVID digital efforts highlight growing gap

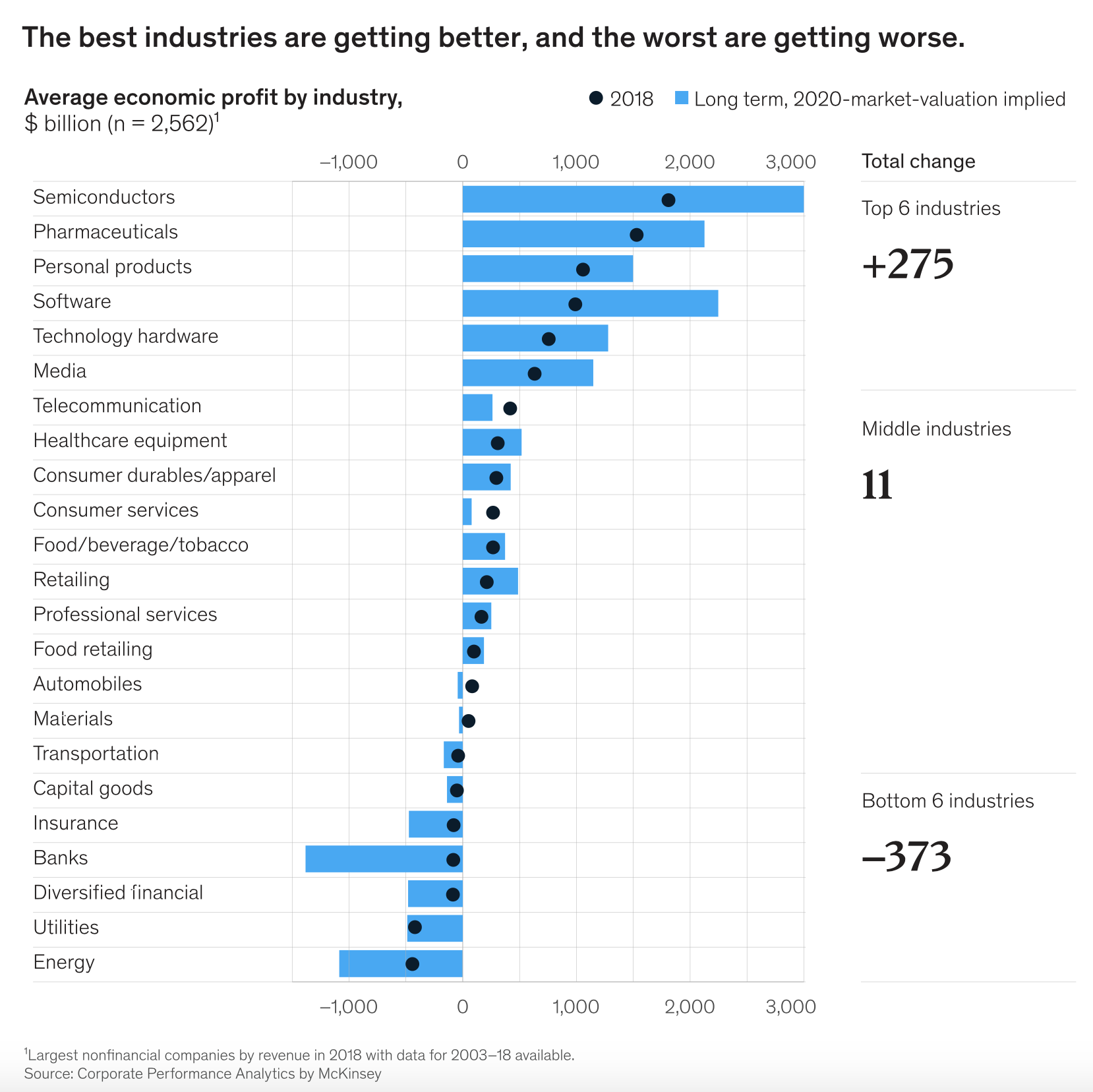

Even before COVID, many industries were at different stages of digital transformation. McKinsey research over a number of years found that industries which were adapting to the digital era had better economic results in terms of growth and profitability. Those organizations had future-ready, digital business models, underpinned by next-generation technology including platform and digital technologies like cloud, digital experience platforms, AI/ML, APIs, ecosystems and more. These organizations proved more resilient and they experienced growth during the crisis as noted in Figure 1.

Figure 1: Figure 1: Average economic profit by industry (McKinsey)

The McKinsey research identified what they term an “economic profit gap,” which became evident in 2010 and has been widening ever since.[iv] COVID has accelerated these trends and widened the gaps between the top (leaders), middle (followers) and bottom (laggards), which aligns to the Leader-Follower-Laggard gap from our 2021 Strategic Priorities research. What is notable is that leaders have robust digital business models that support online buying and servicing. Insurance as an industry is within the laggard group, highlighting the challenges for the industry to accelerate their digital transformation.

Some insurance leaders have been early adopters and innovators – like Progressive, while many are still behind the curve. At the same time, we have seen InsurTech start-ups emerge with highly digital business models like Lemonade, Metromile, Next, Haven Life and Ladder Life that are constantly innovating and raising the bar.

Insurance companies must reinvent themselves as technology-forward companies that can deliver customized products and highly personalized services to meet new expectations from customers and keep in step with new digital leaders. What are the new capabilities that will wow customers and the new products that will protect-as-they-go?

Going forward, insurers must support multi-channel engagement; embrace platform technologies including cloud and APIs to support increased real-time data exchange across systems; use advanced digital and data analytics to rethink underwriting; embrace ecosystems for access to data, distribution channels and digital capabilities from a growing array of partners; and implement digital experience platforms to build next-gen customer experiences. These capabilities must leverage next-gen core technology to realize the value of digital transformation.

Within this year’s Strategic Priorities research, we did a deeper dive into some of these digital capabilities to assess where insurers were focusing their time and resources and to understand where they are leading, following or lagging compared to peers. Encouragingly, insurers are focused on customer self-service solutions, but are behind in other areas. While they may be focused on these areas, the question is, are they using the next-gen approach or are they still using the siloed approach of the past?

Who and what is driving digital?

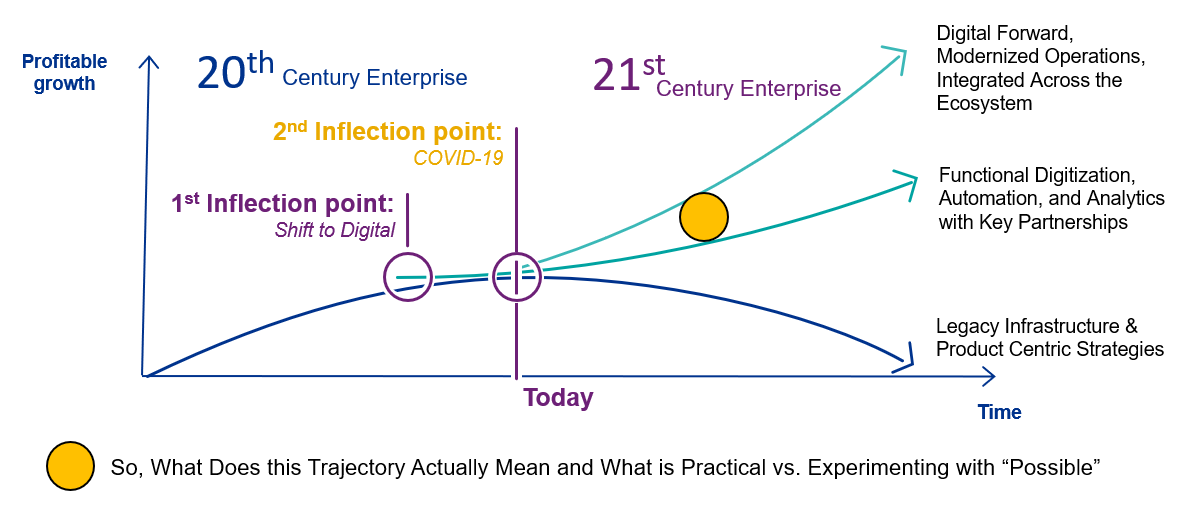

First, it was the introduction of the Apple iPhone. Then it was COVID. Both of these “events” are major inflection points that shifted the industry to digital and then accelerated that shift, as reflected in Figure 2.

Customers are driving the shift, from changing demographics to new behaviors and expectations. This shift has created an “outside-in” view, shifting from a transaction focus to creating a holistic, compelling experience. Our customer research for auto and life in 2020 highlighted this shift. Unfortunately, the current customer experience is fragmented, inconsistent and difficult at best, as they are forced to interact with disparate “portals or apps” to complete anything from servicing and billing to claims. Over the last decade insurers have gotten “portal happy” – creating portals for every type of transaction, not just for customers, but for distributors as well.

The result of disparate portal development is layers of solutions that create a maze of confusion, cost and dissatisfaction.

Figure 2: Inflection points leading to the digital enterprise

Shifting customer demographics, behaviors and expectations are accelerating the demand for a holistic digital experience.

- Forrester recently stated that digital customer service interactions will increase by another 40% in 2021.[v]

- Gartner says that business customers are developing a strong preference for B2B self-service, with 44% of Millennials preferring no human [vi] (McKinsey echoes this as well.)

- According to both the Forrester study and the KPMG CEO Outlook survey, nearly 75% of organizations consider a seamless customer experience a top or high priority supporting their digital transformation.

The industry status quo is rapidly eroding. Insurance is changing from a growing array of influences, upending decades of business assumptions. In this new era, insurance must be digital across the entire spectrum of capabilities, from the front to the back of the insurance operation.

Which digital road will improve our competitive edge?

A recent article, “Disrupted: Challengers Finally Overtake Incumbents,” by Commerce Ventures, a leading venture capital firm, noted that it took COVID-19 less than a year to change consumer behavior so drastically and accelerate the adoption of digital capabilities so quickly, that the retail, payments and banking industries (among others) fundamentally transformed from how we used to know them.[vii] Incredible amounts of change that normally would take years were compressed into this much smaller time box. Some examples for these three areas cited in the article include:

- Retail: E-Commerce grew more than 40% during the pandemic.

- Payments: Payment processor Square estimated that the size of the COVID-driven one-year decline in cash usage would have normally taken three years under normal circumstances.

- Banking: Digital sales went from 25% pre-pandemic to 75% during COVID.

The rapid adoption of digital technologies for shopping, payments and banking by home-bound consumers and company employees has also led to an upset in the balance of power between entrenched incumbents and new challengers in FinTech. For insurers, this marks a complete shift in the digital landscape.

Like the compressed and accelerated changes in customer behaviors, the magnitude of the shifts in market power seen in one year probably would have normally taken a decade. The evidence is seen in the dramatic increases in business results experienced by some of these challengers, including these examples highlighted in the article:

Retail: Instacart Grocery Delivery

- Delivered more groceries early in the pandemic than incumbents Walmart, Kroger and Albertsons.

- Revenue reached $1.5 billion, increasing 300% YoY.

- Market valuation exceeds the market capitalization of Kroger and Albertsons.

Payments: Square

- Grew its number of active Cash App users by 50% YoY, accounting for 45% of gross profit.

- Doubled its revenue from 2019 to 2020.

- Enterprise value exceeds the valuations of the three largest payment processor incumbents.

Retail Trading: Robinhood

- Driven by COVID’s shelter-in-place necessity, consumers flocked to retail investing, fueling growth of platforms like Robinhood. In June 2020, Robinhood’s daily trading volumes beat all other publicly traded trading platforms. Current registered accounts number 20 million.

- Its market valuation is estimated to be more than $40 billion.

What does this mean for insurance?

We have begun to see the shift both during and post COVID, with increased digital sales for life insurance from startups like Haven Life and Ladder Life, and the shift to usage-based auto insurance with more and more customers switching to insurers who provide it. What has happened in other industry segments is beginning to play out in insurance. This highlights that traditional insurers must immediately begin planning, investing in and implementing their digital transformations across a wide array of capabilities.

Some are heeding this urgency, but too many are still not. Consider nearly any digital advancement within other industries and you may envision corollaries within insurance.

“Alexa, turn off the living room lights.”

Why not, “Alexa, turn on my auto insurance.” or “Alexa, what is the accumulated value of my life policy?”

…or for business insurance, “Alexa, we’ve added four trucks to our fleet,” or “We lost refrigeration in our warehouse. I’d like immediate help to minimize the claim and to file a claim.”

These scenarios may seem far-fetched to some, but they are real for some and represent the path on where digital engagement is leading us. Of course, some of the greatest and most valuable digital enhancements and automations will use AI to take care of many issues with even less client-facing communication and more back-office communication. Insurance processes, protection and access to value added services will be “built-in” to the lifestyles and business lives of customers. This kind of administration-lowering digital capability will mean a far more holistic digital transformation that will enable streamlining. It takes big picture digital focus because it can’t be covered with piecemeal enhancements.

What would Alexa tell you if you asked these questions … Is your organization ready for a greater focus on enterprise-wide digital transformation? Are you ready to utilize digital in your bid to become a competitive and relevant insurance leader and achieve the profitable growth that comes with it?

Watch Majesco’s recent webinar, Customer360 – Creating an Enriched Digital Customer Experience, and be sure to download our latest thought-leadership report, Digital Insurance: The Inflection Point, for insights on how your organization can adopt a new digital model for insurance leadership.

_________________________________________________

By: Denise Garth, Chief Strategy Officer

Denise is responsible for leading marketing, industry relations and innovation in support of Majesco’s client centric strategy, working closely with Majesco customers, partners and the industry.

_________________________________________________

[i] Phillips, Tom, German supermarket to trial anonymous checkout-free shopping, NFC, May 12, 2021, https://www.nfcw.com/2021/05/12/372222/german-supermarket-to-trial-anonymous-checkout-free-shopping/

[ii] Phillips, Tom, Juniper forecasts “dramatic growth” in in-vehicle payments for fuel, parking and ecommerce. https://www.nfcw.com/2020/09/28/368195/juniper-forecasts-dramatic-growth-in-in-vehicle-payments-for-fuel-parking-and-ecommerce/

[iii] “2021 KPMG U.S. CEO Outlook – Pulse Survey,” KPMG, 2021, https://www.kpmg.us/content/dam/global/pdfs/2021/2021-us-ceo-outlook.pdf

[iv] Bradley, Chris, et al., “The great acceleration,” McKinsey & Company, July 14, 2020, https://www.mckinsey.com/business-functions/strategy-and-corporate-finance/our-insights/the-great-acceleration

[v] Jacobs, Ian, “Predictions 2021: It’s All About Empathy, Digital, And Virtualizing Customer Care,” Forrester, October 21, 2021, https://go.forrester.com/blogs/customer-service-predictions-2021/

[vi] “Gartner Says 80% of B2B Sales Interactions Between Suppliers and Buyers Will Occur in Digital Channels by 2025,” Gartner, September 15, 2020, https://www.gartner.com/en/newsroom/press-releases/2020-09-15-gartner-says-80–of-b2b-sales-interactions-between-su

[vii] “Disrupted: Challengers Finally Overtake Incumbents,” Commerce Ventures, May 4, 2021, https://commercevc.medium.com/disrupted-challengers-finally-overtake-incumbents-b291b4d47465

Flood Risk Misconceptions Drive Underinsurance: Chubb

Flood Risk Misconceptions Drive Underinsurance: Chubb  Execs, Risk Experts on Edge: Geopolitical Risks Top ‘Turbulent’ Outlook

Execs, Risk Experts on Edge: Geopolitical Risks Top ‘Turbulent’ Outlook  Berkshire-owned Utility Urges Oregon Appeals Court to Limit Wildfire Damages

Berkshire-owned Utility Urges Oregon Appeals Court to Limit Wildfire Damages  How Americans Are Using AI at Work: Gallup Poll

How Americans Are Using AI at Work: Gallup Poll