The idea of buyer personas never gets old, but the personas themselves need a constant refresh. Insurance buyer demographics are constantly shifting, and this means that insurance business practices can become out of touch. And with the continued rapid advancement and adoption of technologies by consumers, this becomes a crucial component of the buyer persona. Anything from quoting to underwriting, servicing, billing or claims may no longer operate at the level expected by customers, putting trust and loyalty at risk.

Timeliness, accuracy, personalization, and the full course of the customer journey need a continual fresh look. If you take a fresh look right now, weighing these factors against insurance buyer demographics, you’ll see that we’ve reached a tipping point — the point at which a growing set of changes are significant enough to cause a dramatic impact. Tipping points don’t happen every day, so when they do, companies need to pay close attention to how they should respond.

Recently, Majesco looked closely at demographic shifts in insurance perceptions and buying behaviors among the full spectrum of insurance customers. We surveyed individuals and outlined our findings in our thought-leadership report, From Trust to Technology: The Tipping Point for Insurance Customers. In today’s article, we’ll look closely at our findings for one key demographic — GenZ and Millennial buyers.

To effectively engage with them, insurers must embrace and implement innovative tactics and best practices that resonate with these tech-savvy, value-motivated, differing lifestyle, and socially conscious generations to educate, engage, and offer them the value of insurance products that align with their personal needs, behaviors and expectations.

Shifting Buyer Personas for GenZ and Millennials

Gen Z and Millennials now represent the largest cohort of buyers, overtaking Gen X and Baby Boomers. They will require new products, and they also require insurers to engage them differently.

If you are building Gen Z and Millennial buyer personas today, your first consideration would need to be finances. Our research found that financial/budgeting challenges had a significant percentage of Gen Z & Millennials (71%) who said they’ve cut back on spending and tightened their budget. They also have a second job for additional income (25%, 10%) and are working as an independent contractor or Gig worker (21%, 10%). An additional 9% of Gen Z and Millennials are using their vehicle for ridesharing service. This is consistent with the J.D. Power’s 2024 U.S. Auto Insurance StudySM released June 2024, 76% of the younger generation have had to cut back and tighten their budget compared to 61% of the older generation.[i]

The financial challenges are reshaping buying and decisions regarding insurance, particularly for the younger generation who are even more strapped.

P&C Insurance Products

In the Majesco survey, we asked both generational groups how they worked – from home, hybrid, or at the office. Both groups were similar and averaged 55% who travel to an office, 25% who work at home, and 20% who work on a hybrid basis. Within this group, 35% of Gen Z and Millennial were renters rather than homeowners.

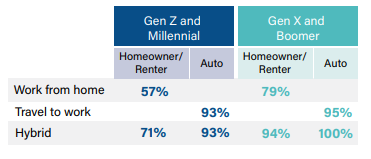

Based on those behaviors, we asked each generational group about ownership of homeowners/renters and auto insurance, which showed significant differences as noted in Table 1.

Table 1: Types of insurance owned by method of working

While both generational groups have high auto insurance ownership – primarily due to the state regulation of requiring auto insurance, there are large gaps for homeowners/renter insurance. This highlights the likely differences in home ownership vs. renting and the lack of protection for Gen Z and Millennials for insurance, offering a huge market opportunity for those who can reach this generation.

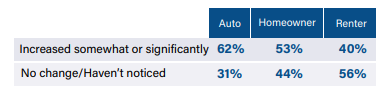

Given the top-of-mind issue of finances, we asked consumers if the cost of their insurance changed this year as represented in Table 2. Except for renters insurance, overwhelmingly everyone saw an increase for both auto and homeowners’ insurance, reflecting the growing risk exposures and higher claims costs that are resulting in increased prices.

Table 2: Reported changes in P&C insurance costs by Gen Z & Millennial customers

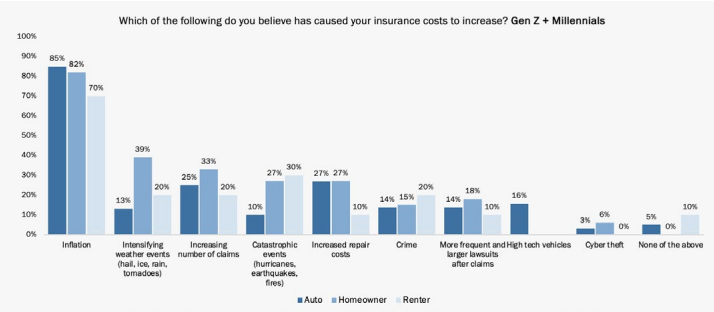

Among those who had increased costs, inflation was far and away the most cited reason across all coverage types as seen in Figure 1. The chart highlights the different areas that consumers attribute to increased insurance costs. Interestingly, many do not see the impact of lawsuits or crime on their insurance – an opportunity for insurers to help their customers understand the wider aspects of insurance costs.

Understanding these perceptions and motivations and how they impact insurance rates, offers an opportunity for insurers to work with this segment to manage or reduce their risk (and pressures) with proactive communications and engagement, gaining loyalty and trust.

Figure 1: Gen Z & Millennial customers’ perceived causes of increases in cost of P&C insurance

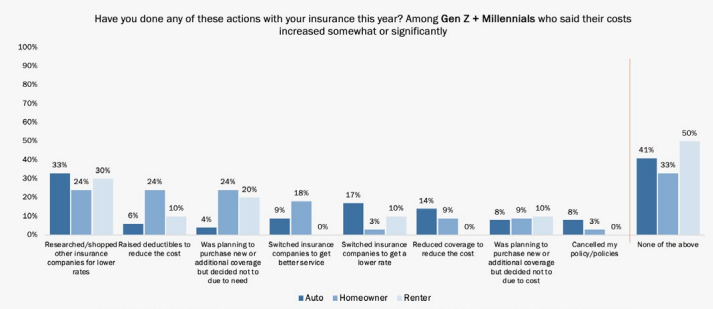

Surprisingly, many Gen Z and Millennial customers with increased insurance rates didn’t take any actions to reduce their costs – from 33% for homeowner to 41% for auto and 50% for renters. (See Figure 2.) However, among those who did act, researching/shopping for lower rates was done the most, but only 10% switched renters and only 17% switched auto.

In addition, other actions taken included raising deductibles, particularly for homeowners, and reducing coverage for both auto and homeowners. While these actions help to reduce the cost of insurance, they create a widening protection gap for consumers that could ultimately create trust and loyalty problems for insurers when there is not enough or the proper coverage when an accident or event occurs.

Figure 2: P&C insurance-related actions done this year by Gen Z & Millennial customers

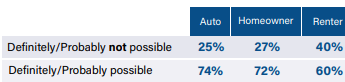

Building on the market opportunity to help customers minimize, mitigate, or eliminate risk, Gen Z and Millennials strongly believe that for Auto (74%), homeowner (72%), and renters (60%) they can do things to reduce their risk and chances of having a claim, which could lead to better pricing and avoidance of a claim as shown in Table 3.

This is an increasingly important area for insurers to invest in new products and capabilities to help customers create risk resilience in a world of increasing risk with new risk resilient business processes and technologies to assess, communicate, educate, and recommend prevention and mitigation strategies.

Table 3: Gen Z and Millennial customers’ belief there are things they can do to reduce risk and chances of having a claim, which could lead to a lower price for their P&C insurance

Data — Capitalizing on the Tipping Point

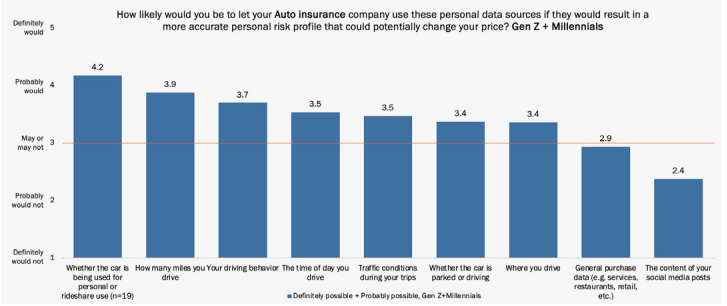

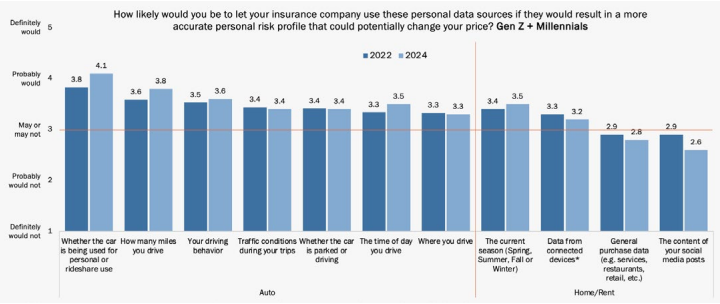

If there was ever a moment in time when insurers and insureds see eye to eye, it may be now — both recognizing that data can help with pricing. For auto insurance, this generational segment is extremely open to sharing their personal data sources with insurers to get a more accurate risk profile and hopefully, a lower insurance rate, as seen in Figure 3. A small sub-segment, rideshare drivers, showed the highest interest across all data source options, based on using the car personally or for rideshare.

Nearly all other data sources based on driving activity (miles, behavior, time of day, traffic conditions, driving/parked, location) receive very high levels of interest of 3.4 to 4.2 out of 5, offering an opportunity for insurers to meet their expectations with products that are more personalized based on behaviors and use. J.D. Power’s 2023 US Auto Survey reported that customers’ unhappiness with price increases drove more carriers to offer usage-based insurance programs and telematics products, with more consumers adopting them reflected in participation rates more than doubling since 2016, from 8% to 17%.[ii] Interestingly, new customers are participating at a rate of 26%, reflecting the demand for this product and the risk for those who do not offer it.

Figure 3: Gen Z & Millennial customers’ likelihood to use personal data sources for auto insurance pricing

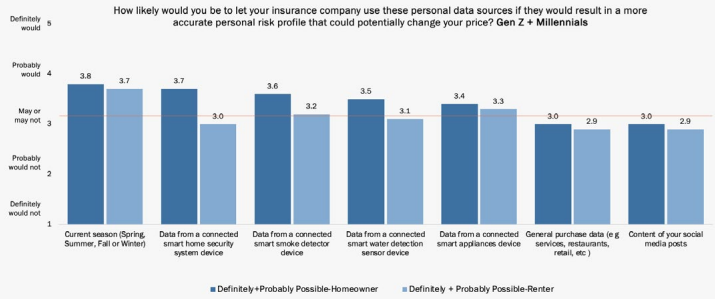

For homeowner and renter insurance, Gen Z and Millennials nearly mirror their auto insurance responses for using their personal data sources for a more accurate risk profile and potential lower rates as shown in Figure 4. Season-based rates are most popular, with a range of smart home devices coming in very close, once again creating an opportunity for insurers to offer products to help customers manage their risk and price.

Figure 4: Gen Z & Millennial customers’ likelihood to use personal data sources for homeowner or renter insurance pricing

In comparing the results between our 2022 with 2024 surveys, interest in these data sources to help manage risk and potentially lower prices increased and remained remarkably strong and consistent as shown in Figure 5. Three auto insurance data sources with noticeable increases, reinforces the J.D. Power survey results on the rise in usage-based programs and interest.

Figure 5: Gen Z & Millennial customers’ likelihood to use personal data sources for P&C insurance pricing, 2022 vs. 2024

L&AH Insurance Products

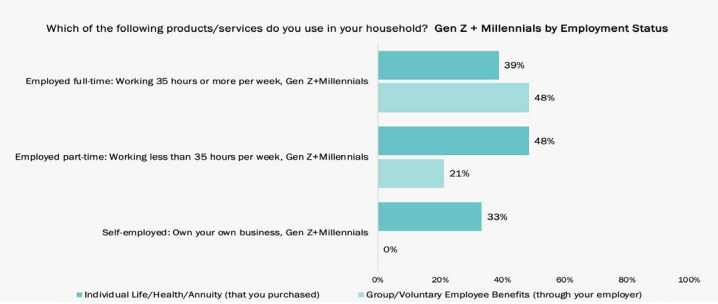

The survey results reflect significant opportunities for individual, group, voluntary, and worksite benefits for Gen Z and Millennials. As highlighted in Figure 6, only 39% of those working full-time have individual life, health, or annuity and only 48% have employee benefits, highlighting a significant protection gap for this generation.

Even more concerning, while 48% of part-time workers have individual only 21% have benefits, exacerbating a protection gap. Given that this generation moves regularly between jobs, the need to reach them with individual or worksite products they can take with them between jobs, whether full-time or part-time, is crucially important, creating a great market opportunity for insurers.

Figure 6: Gen Z and Millennial individual and group/voluntary protection gaps

Among those with individual or group and voluntary products, only 30% and 24%, respectively said the cost of their coverages has increased somewhat or significantly. While these percentages are relatively low as compared to P&C product responses, they exacerbate the financial challenges this generation faces and are likely why there is such low ownership of many of the other benefits products beyond medical, vision and dental.

Table 4: Reported changes in L&AH insurance costs by Gen Z & Millennial customers

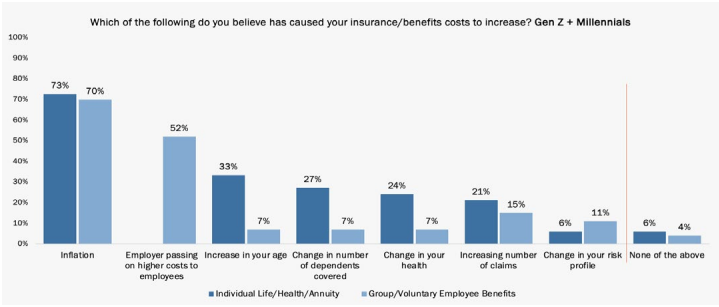

Like P&C products, inflation is the most-cited reason for the increase in L&AH insurance costs as seen in Figure 7. Employers passing on higher benefits costs is another major driver of benefits (52%) cost increases. Contrary to this, individual cost increases were primarily focused on age, number of dependents, health, and rising claims – all relatively about the same in perception.

Figure 7: Gen Z & Millennial customers’ perceived causes of increases in cost of L&AH insurance

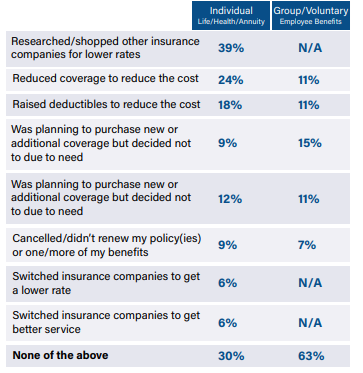

Only a handful of options to look for individual lower prices were undertaken by this generation as seen in Table 5. The three most significant actions were researching/shopping other insurance companies (39%), reducing coverage (24%), and raising deductibles (18%). Given the nature of benefits packages defined by employers, very little action was taken.

However, for those with benefits, 11% reduced coverage and raised deductibles to manage their costs – likely for more health-related benefits – while 15% decided not to add more coverage due to cost. This highlights the challenge for group and benefit insurers to enroll this generation into more products beyond their health-related products (i.e. medical, vision and dental) due to cost.

Table 5: L&AH insurance-related actions done this year by Gen Z & Millennial customers

L&AH customers are seeking a partnership in lowering costs, but increasingly wary of data sharing.

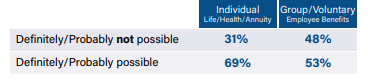

There is a significant belief that this generation can reduce their risk and have lower costs for individual (69%) and benefits (53%) as seen in Table 6.

Table 6: Gen Z and Millennial customers’ belief there are things they can do to reduce risk and chances of having a claim, which could lead to a lower price for their L&AH insurance

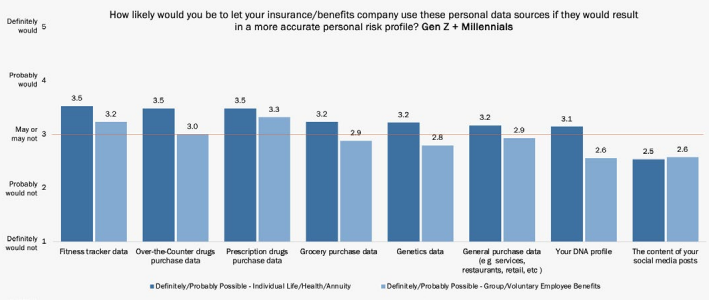

Among those who strongly felt this way, they are more open to using their personal data sources to develop a more accurate personal risk profile that could change their rates as seen in Figure 8.

The strongest interest for both customer groups is for fitness tracker data, and over-the-counter drugs and prescription drugs purchase data, all rated at 3.5. However, they are split in their views on using DNA profiles, with individual customers rating it 19% higher.

Figure 8: Gen Z & Millennial customers’ likelihood to use personal data sources for L&AH insurance pricing

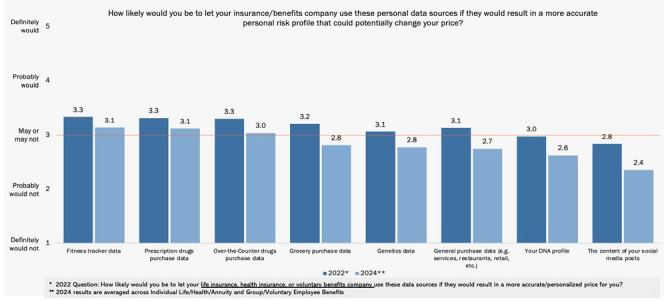

In comparing the 2022 and 2024 results, the likelihood of using personal data sources has declined slightly across the board, highlighted by a 17% decline for content of your social media posts, a 12% decline for grocery purchase data, general purchase data, and DNA profile, and 9% decline for genetics data. If L&AH insurers want to capitalize on some willingness to share data, they should also work to build “trust” into their communication messaging.

Insurers should also look to how group and voluntary benefits transformation can help reach more Gen Z and Millennials. For more on this topic, read the recent Majesco and Capgemini point of view report, Don’t Pull Back…Put the Pedal to the Metal for L&AH Transformation.

Figure 9: Gen Z & Millennial customers’ likelihood to use personal data sources for L&AH insurance pricing, 2022 vs. 2024

The necessity of data and AI use

Are insurers waking up to the Gen Z and Millennial customers and how necessary data and analytics are to capturing them and keeping them satisfied?

The great thing about this new generation of buyers is that they have delineated goals and buying patterns. From the perspective of buyer personas, they give us the signs and signals that will help us re-create products and processes to fit their needs. They are very risk-conscious, and in some ways, they might perceive themselves to be more at risk and in need of coverage than older generations. For insurers to meet those needs AND build trust, insurance systems will need to be able to gather and assess many forms of data from nearly all spheres of life.

Rapid decisions and smart systems will be required. Without AI and GenAI capabilities, insurers won’t be able to handle high volumes or provide quality and consistency. Front-line customer-facing service operations as well as customer portals can leverage AI and GenAI to elevate communications and engagement to create a much-enhanced customer experience.

A demographic tipping point is no longer a “nice to know” boardroom conversation starter. It’s a clarion call to modernize and adapt in order to compete.

Are you ready for the next step in capturing Gen Z and Millennial business? Contact Majesco today.

Read more about AI and GenAI in insurance, and find out more about the link between technology and today’s customer in our thought-leadership report, From Trust to Technology: The Tipping Point for Insurance Customers.

By Denise Garth

[i] “Trust Emerges as Top Driver of Customer Satisfaction with Auto Insurance as Prices Continue to Surge, J.D. Power Finds,” J.D. Power, June 11, 2024, https://www.jdpower.com/business/press-releases/2024-us-auto-insurance-study

[ii] Crane, Grace, “Telematics and usage-based insurance on the rise: J.D. Power,” Digital Insurance, August 30, 2023, https://www.dig-in.com/news/telematics-and-usage-based-insurance-on-the-rise-j-d-power

20,000 AI Users at Travelers Prep for Innovation 2.0; Claims Call Centers Cut

20,000 AI Users at Travelers Prep for Innovation 2.0; Claims Call Centers Cut  Experts Say It’s Difficult to Tie AI to Layoffs

Experts Say It’s Difficult to Tie AI to Layoffs  Flood Risk Misconceptions Drive Underinsurance: Chubb

Flood Risk Misconceptions Drive Underinsurance: Chubb  Nearly 26.2M Workers Are Expected to Miss Work on Super Bowl Monday

Nearly 26.2M Workers Are Expected to Miss Work on Super Bowl Monday