Sometimes insightful business examples are found in the extreme parts of our imagination — outside of reality. Movies and books give us these ideas and potential opportunities in great abundance. For example, In the 2021 sci-fi movie, Finch, Tom Hanks (as the title character) lives alone in a mostly uninhabited world — decimated by an environmental event. Finch has a dog and a small robot helper. He adapts to the new world.

As Finch learns to survive in an unpredictable environment, he works on building a larger robot with a fixed purpose. (I won’t spoil the purpose.) To build the robot’s knowledge, he scans the information from thousands of books. He helps the robot to consume vast amounts of data that will ultimately come in handy. As it turns out, Artificial intelligence, even in the movies, is a hungry animal — it requires feeding. But all of the feeding will help the robot to accomplish its necessary purpose.

As radically different as Finch’s world is from ours, there are challenges we will increasingly share in the coming years. One of those is talent – specifically for insurers. It is estimated that up to 40% of today’s insurer employees will be retiring by 2030, creating a significant talent gap – one that is beyond just people, one that needs to have a deeper understanding of insurance from the products to the business processes of quoting, issuing, servicing, billing, claims and more.

When insurers look at the complexity of their work and the enormity of their task at hand, and all that risk, there is no longer any question that “only AI” can adequately make the coming situation tenable.

AI will have to find its purpose in insurance.

In the coming days, starting right now, insurers need to explore and expand upon all of AI’s various purposes and utilize all of its accompanying technologies if they are to remain viable and profitable. Insurers will be called upon to feed hungry AI capabilities, the data that it need to work well.

What does the customer think about AI and data use?

There was a day in the not-so-distant past when most insurance data gathering happened outside of any acknowledgment permissions, or understanding from the insured. Insurers pulled reports and data that were freely available. Where more information was needed, there were questionnaires and blood tests, or for property, site inspections, and records requests. These were sufficient to improve underwriting or claims. Data was largely in the background.

But the good news for insurers and their desire to use AI is that data is important enough now to have a face of its own — customers think about it and most customers understand how it improves risk and pricing. Public opinion about data use is mostly improving, due in part to a generational shift among customers and the increased cost of insurance. This is happening at the same time that excellent real-time data is becoming increasingly available, and customers are growing interested in allowing insurers to use it — if it means a price break or an improvement in service. The time to expand AI’s purpose and take advantage of the technologies that will enhance products and services is now.

Majesco’s recent Thought Leadership report, From Trust to Technology: The Tipping Point for Insurance Customers., takes a close look at customer views about insurance technologies, data, and AI to help insurers capitalize on trends and understand where the opportunities lie. In today’s article, we’ll share some of those findings and point out areas where data is ready and growing in use.

AI, GenAI, and digital technologies and demographics

The relationship between generations and technology is complex, influenced by a variety of factors including technology advancements, society and peer norms, attitudes and expectations, and perceived value of the technology. Each of these technologies were to varying degrees embraced in both personal and professional lives.

Understanding the unique perspectives and acceptance of these technologies is crucial for insurers as they continue to create digital experiences and engage their customers. In our survey, we asked about some of these technologies that have real potential value for both insurers and their customers.

AI in Demand – AI’s use in insurance is underutilized

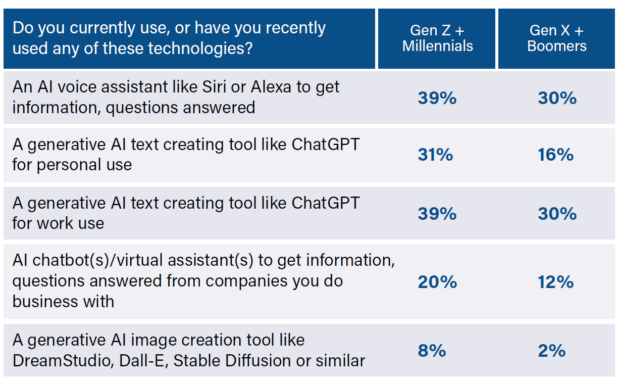

With AI being one of the hottest topics in the news and across most industries, it is not surprising that a sizable proportion of both generational segments are familiar with Artificial Intelligence (AI) through their use of voice assistants like Siri and Alexa. In addition, Gen Z and Millennials’ experience – nearly double or more that of the older generation – also extends into generative AI text tools for personal and work use, and chatbots/virtual assistants for interacting with companies as noted in Table 1.

Table 1: Gen X and Boomer customers’ experience with AI and GenAI tools

However, when using these technologies to engage with insurers, there is a clear missed opportunity.

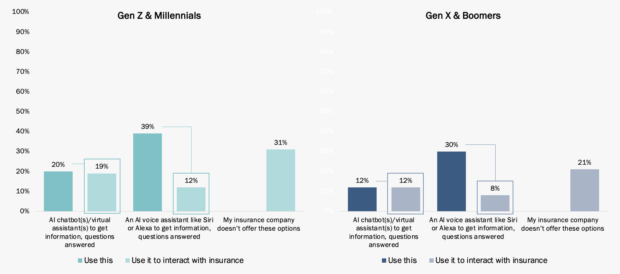

The usage levels for insurance by Gen Z and Millennials net out to just 3.8% for AI chatbots and 4.7% for AI voice assistants and just 1.4% and 2.4%, respectively, for Gen X and Boomers as seen in Figure 1. Thirty-one percent of Gen Z and Millennials and 21% of Gen X and Boomers indicate their insurer doesn’t offer these options, suggesting that they tried to find these options but were not available – a missed opportunity by insurers.

Figure 1: Customers’ use of AI-assisted devices

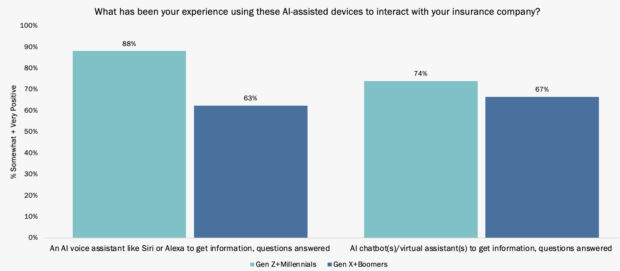

This is unfortunate, as the customers who used these AI-enabled tools were very satisfied with the experience: 88% of Gen Z and Millennials for AI voice assistants and 74% for an AI chatbot experience. (See Figure 2) Well over half of Gen X and Boomers had positive experiences as well (63%, 67%). Given the positive experiences, this indicates an opportunity to gain trust and loyalty with customers by offering them these experiences.

Figure 2: Customers’ satisfaction with their experience using AI-enabled tools

AI and GenAI purposes brought to life across the business operation

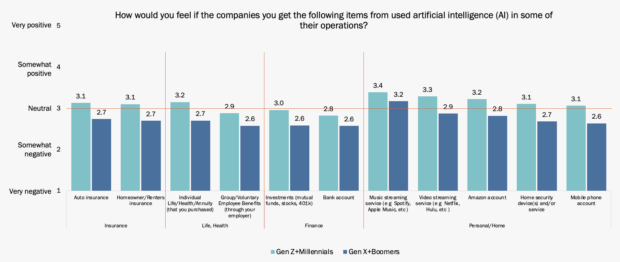

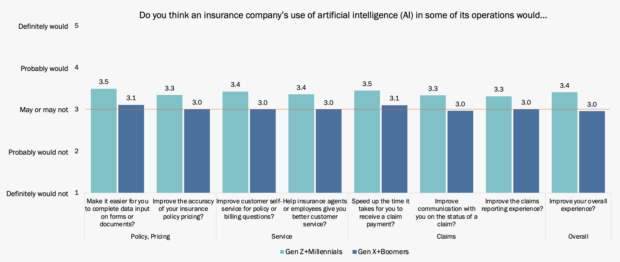

Insurers are rapidly experimenting with and expanding the use of Artificial Intelligence and GenAI beyond customer-facing service use cases to other parts of their operations. Gen Z and Millennial consumers are more comfortable with using artificial intelligence in their operations as compared to Gen X and Boomers as seen in Figure 3. For both generational segments, the perceived benefit is highest with Personal/Home items, however, there is strong interest by the younger generation for use in P&C and L&AH insurance.

The relatively consistent levels of comfort by consumers across different types of businesses indicate the growing acceptance and use of artificial intelligence in day-to-day interactions.

Figure 3: Customers’ perceptions of AI use by companies they do business with

Consumers showed positive and consistent feedback for insurers using AI across the value chain as seen in Figure 4, once again highlighting the potential for this technology to enhance insurance engagement and experiences. Gen Z and Millennials are particularly positive with the potential to enhance all aspects of their insurance experience, with the older generation not far behind.

Figure 4: Customers’ perceptions of AI use by insurance companies

Similar to when digital engagement emerged with the Internet and smart phones, insurers once again have a golden opportunity to capitalize on consumers’ enthusiasm and increasing use of AI and GenAI to create even better experiences that can significantly improve loyalty and trust. There is no better time than the present to get out ahead of this by experimenting with and leveraging the technology to make insurance accessible, affordable, and relatable.

Digital payment options

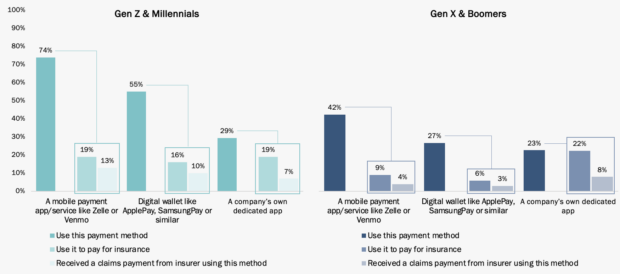

Given that Gen Z and Millennials have become digital leaders, it is not surprising they lead Gen X and Boomers in using mobile payment apps and digital wallets by sizable margins as shown in Figure 5. However, use of a company’s dedicated app is much lower for Gen Z and Millennials (29%), half the usage rate of digital wallets (55%) and 2.5 times lower than mobile payment apps (74%) reflecting a loyalty to specific types of digital payment options they use regularly. Likewise, Gen X and Boomers are similar in the lower use of a company’s app (23%).

While there is a high use of digital payment options overall, the discouraging insight is the disconnect and low use of them for paying insurance premiums or receiving claims payments. Less than 20% of Gen Z and Millennials use digital apps for these purposes and less than 10% of Gen X and Boomers do as well.

Furthermore, while Gen X and Boomers had the highest use of a company’s dedicated app to pay for insurance (22%), this nets out to just 5% of all Gen X and Boomer customers, a paltry usage rate and a potential reason why insurers should look to mainstream digital payment options for their customers, regardless of generation. With mobile payment apps and digital wallets becoming table stakes for simplifying and removing friction in consumers’ financial transactions, insurers need to adopt and promote these options for their customers.

Figure 5: Customers’ use of digital payment methods

Digital Smart / IoT devices are accelerating in use

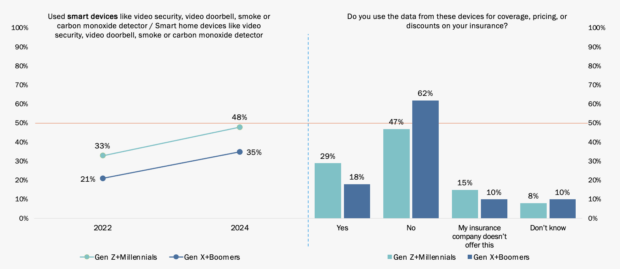

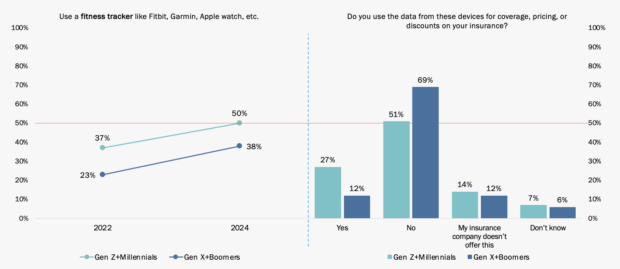

Regarding the usage of smart connected devices, Gen Z and Millennials lead Gen X and Boomers by wide margins, with half of them using fitness trackers and smart home devices as compared to Gen X and Boomers, reflecting their rapid adoption of these technologies. However, as seen in Figures 6 and 7, both generational segments have increased their use of these devices substantially as compared to the results from our 2022 consumer survey, indicating a continued growth in adoption of these devices as they become valuable in their everyday lives, just like mobile phones did. Insurers could contribute to the growth of these devices if they chose to leverage them to provide new products and services.

One of the benefits of these devices is the rich data they provide; data that can be used by AI And GenAI to provide useful insights for insurers about risk, which can translate into more accurate, personalized pricing and new services for customers. Unfortunately, like digital payment options, there are large gaps between consumers’ use of these items and insurers’ use of them.

Gen Z and Millennials (47%) and Gen X and Boomers (62%) who have smart home devices don’t use them for insurance. This trend continues with non-usage of fitness tracker data of 51% and 69%, respectively, for insurance. Why? A key reason is likely due to insurers not offering these options, according to both generations.

Given the high general usage of these devices, insurers once again are missing out on an opportunity to provide products and services that use them, particularly to provide alerts and help manage risk.

Figure 6: Customers’ use of smart devices

Figure 7: Customers’ use of fitness trackers

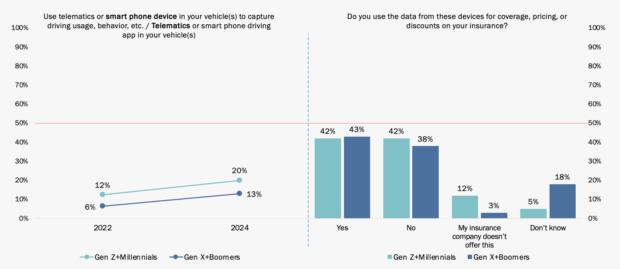

The two-generational segments are more aligned in using telematics or a smart phone driving app in their car, at 20% for Gen Z and Millennials and 13% for Gen X and Boomers. While relatively low, they show strong growth since 2022, as seen in Figure 8.

With several well-known insurers having long-running usage-based insurance (UBI) programs, it is not surprising to see that more consumers who have these devices are using them for insurance pricing, and aligns with the results for auto insurance. For Gen Z and Millennials (17%) and Gen X and Boomers (21%) indicate either their insurer doesn’t offer this, or they do not know – once again a missed opportunity for insurers, particularly given the growth in usage noted previously.

Reinforcing this missed opportunity, our 2024 Strategic Priorities research with insurers revealed that just 27% said they were implementing or had already implemented usage-based insurance products, and just 20% did the same with IoT/telematics-based insurance products.

Figure 8: Customers’ use of telematics or smart phone devices in vehicles

Digital, AI, and GenAI will improve insurance and meet customer expectations

Insurance AI and GenAI coupled with digital solutions are businesses new facilitators. They communicate. They decide. They anticipate and they work with unprecedented levels of intelligence. Majesco is at the forefront of AI and GenAI use in insurance. Majesco Copilot gives AI numerous purposes within the insurance enterprise, providing users with up to 20 times the productivity within some functions. It is currently in use as an automation solution that both assists insurance operations and also fosters insurance communications. Its broadening use will one day assist with every function found in the modern insurance company.

Whether your organization is interested in using auto or home smart devices to improve prevention, fitness trackers to improve health and mortality, or AI service capabilities to reduce the burden of your service organization, Majesco can help you with the steps you need to make it happen. Contact Majesco today. For more information on Majesco’s cutting-edge use of AI and GenAI, visit our website and unleash the power of GenAI in insurance.

By Denise Garth

Nearly 26.2M Workers Are Expected to Miss Work on Super Bowl Monday

Nearly 26.2M Workers Are Expected to Miss Work on Super Bowl Monday  Chubb CEO Greenberg on Personal Insurance Affordability and Data Centers

Chubb CEO Greenberg on Personal Insurance Affordability and Data Centers  Winter Storm Fern to Cost $4B to $6.7B in Insured Losses: KCC, Verisk

Winter Storm Fern to Cost $4B to $6.7B in Insured Losses: KCC, Verisk  Lessons From 25 Years Leading Accident & Health at Crum & Forster

Lessons From 25 Years Leading Accident & Health at Crum & Forster