In an era of digital transformation, the insurance industry faces a growing challenge: managing and leveraging the ever-increasing volume of data that can be used to combat fraud effectively. In this final installment of our series of articles exploring the key survey insights from the Insurance Fraud Management (IFM) Conference 2024, we explore the critical issue of data management and its impact on anti-fraud efforts.

Executive Summary

This article is the fourth in a series examining the pressing issues confronting SIU decision-makers and the transformative potential of emerging technologies.

The Data Management Challenge

The insurance sector is experiencing an unprecedented influx of data from various sources, including telematics, Internet of Things (IoT) devices, social media and traditional claims information. While this wealth of information presents enormous potential for fraud detection within property and casualty claims, it also poses significant challenges. According to our recent survey of insurance industry professionals at the IFM Conference, 11 percent of respondents named data management and analysis as their top challenge.

The sheer volume of available, relevant data can be overwhelming, making it difficult for insurers to process and analyze effectively. Moreover, the diversity of data sources often results in siloed information, inhibiting a comprehensive view of potential fraud patterns. As fraud schemes become increasingly sophisticated, the ability to manage and use this data effectively is crucial for supporting robust anti-fraud operations.

Data Volume’s Impact on Anti-Fraud Efforts

Data plays a pivotal role in detecting and preventing insurance fraud. When properly analyzed, it can reveal patterns, anomalies and connections that might otherwise go unnoticed. However, the challenges presented by managing vast amounts of data can significantly impede these efforts.

- Missed opportunities. Without effective data management, insurers may overlook crucial indicators of fraud hidden within their data sets.

- Delayed responses. The time needed to sift through large volumes of unstructured data can slow down investigations, allowing fraudsters more time to cover their tracks.

- False positives. Poor data quality or incomplete analysis can lead to an increase in false positives, wasting valuable resources and potentially damaging customer relationships.

The impact of these challenges is substantial. With insurance fraud costing more than $308.6 billion annually in the U.S. alone(according to a 2022 study by the Coalition Against Insurance Fraud), the need for more effective data management and fraud detection strategies is clear.

Getting Ahead of the Curve

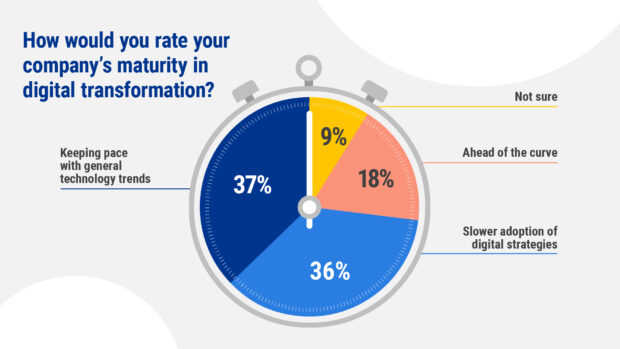

In Verisk’s recent survey, only 18 percent of respondents considered their companies to be ahead of the curve in their digital transformation—a situation that directly impacts their ability to manage data effectively for fraud detection.

These findings reveal a significant gap in digital readiness across the industry. With at least 36 percent of companies admitting to slower adoption of digital strategies, there’s a clear need for many insurers to accelerate their digital transformation efforts to enhance their data management and fraud detection capabilities.

The Role of Technology in Data Management

Adopting cutting-edge fraud detection tools is crucial for insurers looking to stay ahead in the fight against fraud. Technologies such as artificial intelligence, machine learning and predictive analytics can help insurers:

- Process and analyze vast amounts of data quickly and accurately.

- Identify subtle patterns and anomalies that might escape human detection.

- Automate routine tasks, allowing human investigators to focus on complex cases.

- Continuously adapt to new fraud schemes as they emerge.

As the insurance industry continues to grapple with the challenges of data management in fraud detection, embracing innovative technologies and strategies becomes increasingly critical. By leveraging industrywide data, accessing external records efficiently and implementing automated case management systems, insurers can significantly enhance their anti-fraud capabilities.

Continually adapting their data and technology strategies enables insurers to stay one step ahead in the increasingly complex battle against insurance fraud.

Insurance Groundhogs Warming Up to Market Changes

Insurance Groundhogs Warming Up to Market Changes  Chubb CEO Greenberg on Personal Insurance Affordability and Data Centers

Chubb CEO Greenberg on Personal Insurance Affordability and Data Centers  Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford

Earnings Wrap: With AI-First Mindset, ‘Sky Is the Limit’ at The Hartford  Allianz Built an AI Agent to Train Claims Professionals in Virtual Reality

Allianz Built an AI Agent to Train Claims Professionals in Virtual Reality